Interactive Brokers’ TWS enables traders to build complex strategies via predefined strategies list

The broker has added a new Predefined Strategies pick list in the Strategy Builder.

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) keeps adding new features and capabilities to its TWS trading platform. The latest novelty aims to make it easier to build strategies.

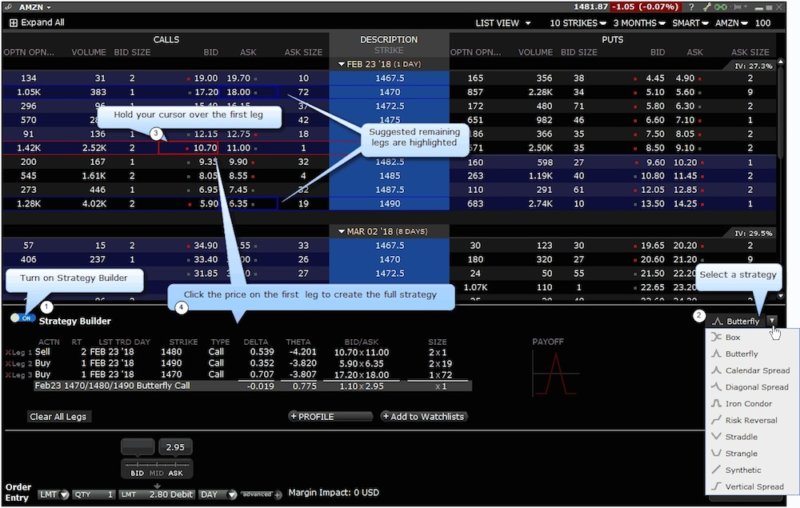

The Strategy Builder tool allows traders to easily build complex, multi-leg strategies from an option chain by simply clicking the Bid or Ask price of a call or put to add the leg to one’s strategy. The company has made this process even easier with new Predefined Strategies pick list in the Strategy Builder.

When a trader selects a strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. One simply has to click the first leg and see the fully-editable strategy come together in the Strategy Builder.

In order to create a predefined strategy, a trader has to open an option chain (select a symbol and use the right-click menu to choose Trading Tools and then Option Chain). Toggling on the Strategy Builder tool at the bottom of the chain will result in displaying the predefined strategies. Then one has to select a strategy, and hold the cursor over the Bid or Ask price of the put or call for the first leg in the option chain. The other legs that will be included are highlighted. Clicking the price will lead to adding the highlighted legs to the Strategy Builder.

Alternatively, keeping the cursor over the price for leg 1, and using the mouse scroll button can be used to widen or narrow the spread between the strategies other legs. When ready, one can click the price to add the highlighted legs to the Strategy Builder.

One can use the Order Entry panel below the Strategy Builder to trade the strategy.

When needed, the Option Chain view will change to List View – this works for strategies that use different expirations.

To use a different strategy, traders should simply choose a new strategy and then click the bid or ask for a put or call. The old strategy is cleared and the new one takes its place.

Other improvements in the latest (beta) version of the TWS platform include an enhanced Performance Profile, which traders can access from within Strategy Builder. It will reload as legs are added/removed from the strategy or ratios are changed. The broker has also made available additional data points in the Performance Profile, such as Min Invest, Break Even, Margin Impact, and Commission.