Interactive Brokers’ TWS platform and API now support MiFIR reporting

The latest build of Interactive Brokers’ TWS platform allows setting a default decision-maker and execution trader.

There are only a couple of days left before the new Directive 2014/65/EC (MiFID II) and Regulation (EU) No 600/2014 (MiFIR) get into effect, with companies implementing the necessary changes to their systems in order to comply with the new requirements. Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has also taken steps in line with the changes. The latest build of the TWS platform (Build 969) and the API now support MiFIR reporting.

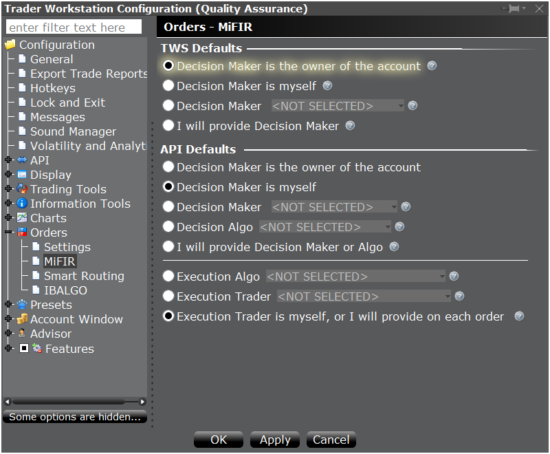

Users can define default TWS and API decision-maker and execution trader values in Global Configuration for MiFIR reporting. To access these settings, in TWS Global Configuration they should go to Orders and then select MiFIR. Users can define default values including: TWS Defaults (Decision Maker is the owner of the account, Decision Maker is myself, etc); API Defaults (Decision Maker, Decision Algo, etc); Execution Defaults (Execution Trader, Execution Algo, etc).

Users can also specify a decision-maker or change the default on a per-order basis from the Mosaic Order Entry panel, the Classic order line, or the Order Ticket.

From Mosaic Order Entry, use the advanced panel to display the decision-maker drop-down. If a default selection is defined in Global Configuration, that value is displayed; if it was not set as a default, the field displays “NOT SELECTED” and users must define a decision-maker for the order to be accepted.

From the Classic TWS order line, use the Decision-Maker field drop-down to make a selection. From the TWS Order Ticket, select or change the decision-maker from the Investment Decision section of the window.

A new transaction reporting system has been implemented that will enable qualifying clients that have direct reporting obligations under the new Regulation to comply with the new MiFIR requirements. The number of reporting fields has grown from 23 under the MiFID I regime to 65 under MIFIR. The new information requirements now include, inter alia:

- Detailed identification of the buyer and the seller for each transaction. In particular, the Regulation requires the provision of Legal Entity Identifiers (LEI) for legal entities and National Identifiers for natural persons (based on their countries of citizenship).

- Identification of the Decision Maker for the buyer and the seller when a third-party exercises discretion:

- A person other than the account holder on an individual or joint account, or a third-party entity.

- A third-party other than the authorised traders on the account for an organisation account (e.g. a Financial Advisor trading for its clients’ subaccounts).

More information on Interactive Brokers and MiFIR can be found here.