Interactive Brokers’ TWS platform enables traders to use algos to close multiple positions

When traders want to close all or a portion of positions on multiple assets with either a Limit or Market order, they can now use an algo to manage the close-position orders.

Online trading major Interactive Brokers Group, Inc. (IEX:IBKR) continues to expand the functionalities of the TWS platform. The latest (beta) version of the solution enables traders to use algos to close multiple positions.

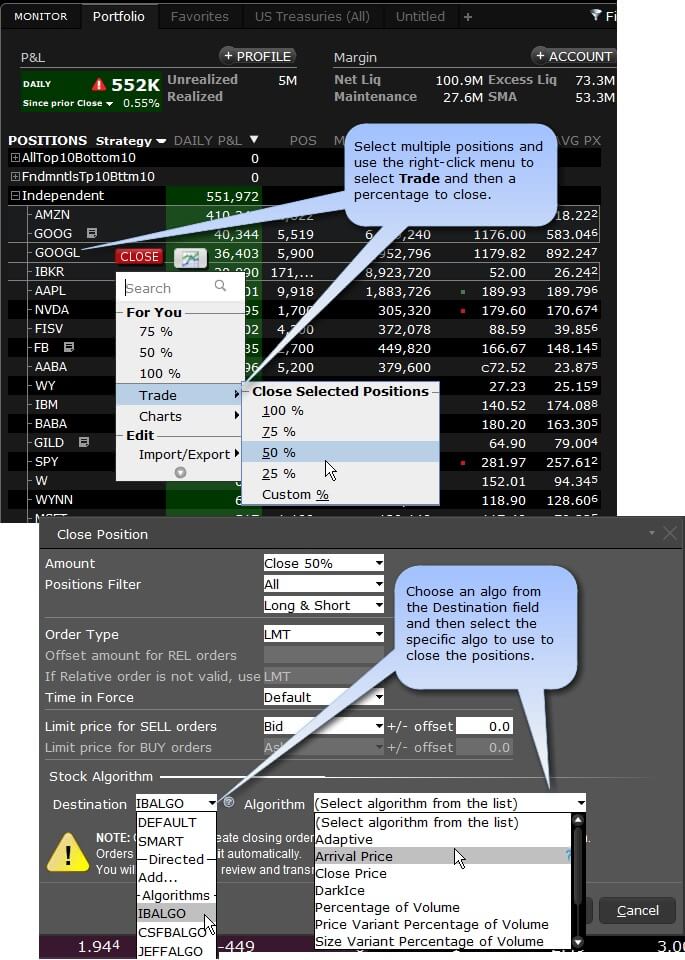

When traders want to close all or a portion of positions on multiple assets with either a Limit or Market order, they can now use an algo to manage the close-position orders. They simply have to select positions from their portfolio and, by using the right-click menu, to select Trade, then the percentage of positions to close.

In the Close Positions dialog, one has to complete the fields for closing orders, and choose either LMT or MKT order to enable algos. The context-sensitive Algorithm section presents available algo strategies based on asset type and, when relevant, on the specific instrument. Traders then have to go to the Destination drop-down to choose an algo destination, then use the Algorithm drop-down to choose a specific algo strategy. The order will be completed by specifying required values for the chosen algo.

The latest (beta) version of TWS also offers traders an auto-synchronized Watchlist Library.

The new Watchlist Library provides effortless synchronization of traders’ Watchlists across all platforms, ensuring that they get the latest version regardless of whether they are logging into mobile, desktop, or Client Portal. There is no need to decide which lists to import or sync, as all of a trader’s lists are always available no matter where a trader is.

On top of that, the brokerage has made it easier for traders to get started by offering them a library of Watchlists to jump-start their trading. In cases where traders have added a product on desktop that is not yet supported on mobile or Client Portal, it’s preserved and displayed correctly in all versions.

The broker has also recently added several updates to the Futures Term Structure tool. For starters, the “Today Last Price” series have been added in the term structure plot. This displayed by default. The company also now offers the “Today Mark Price” series which is not shown by default but can be selected. Note that historical series are always based on the close price.

Further, the underlying/index price (when available) has been added as the first node in the series. Optionally, traders can also add values markers at the underlying/index price (when available) by selecting “Underlying” in the right-click context menu.

Traders can now choose to display Price Change or Percentage Price Change (or “return”) in the lower section of the window. They have to use the Config panel from the gear icon to choose.