Investment-related complaints account for less than 1% of total in 2016 – CSN data

Complaints related to stocks/commodity futures trading account for meager 0.03% of the total last year, data from the Consumer Sentinel Network shows.

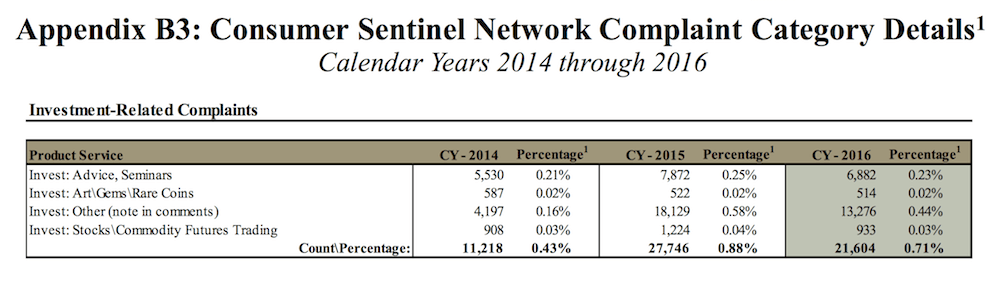

Investment-related complaints accounted for humble 0.71% of the total of 3,050,374 complaints reported to the United States Federal Trade Commission’s Consumer Sentinel Network in 2016. The data comes from the agency’s new Data Book, covering the last calendar year (January 2016 – December 2016).

Investment-related complaints refer to (inter alia) investment opportunities in day trading; gold and gems; art; rare coins; other investment products; as well as complaints about companies that offer advice or seminars on investments; etc. Consumers filed 21,604 complaints related to investment products and services last year. Out of these, only 933 related to stocks/commodity futures trading, a fall from such 1,224 complaints submitted in 2015.

Looking at the overall data, let’s note that nearly 1.3 million complaints were fraud-related. Consumers reported paying more than $744 million in those fraud complaints, with the median amount paid being $450.

In total, the CSN received over 3 million complaints (excluding do-not-call) during calendar year 2016: 42% fraud complaints; 13% identity theft complaints; and 45% other types of complaints.

The small percentage of investment-related complaints as displayed by the CSN report echoes similar numbers reported in other jurisdictions. In France, for instance, the Activities Report for 2016 issued by the General Directorate for Competition Policy, Consumer Affairs and Fraud Control (DGCCRF) has shown that the agency received 69,153 claims against various businesses in 2016, with a meager 3% of these concerning banking and finance. Nearly all other industries were targeted by more complaints. The French are complaining about food quality, electrical appliances, cars, property, but finance-related complaints are rare.

Talking of complaints data for 2016, let’s also mention that the UK Financial Conduct Authority (FCA) has recently published some fresh data from its Consumer Contact Center, with the report showing that binary options were the kind of investment products that registered the highest growth in enquiries for the period from December 1, 2015 to November 30, 2016. Over 13,100 enquiries (14% of total) related to investment products and binary options accounted for 17% of enquiries within investment products. Other product types where the Contact Center that accounted for a lot of the enquiries are shares (14%), Forex (13%) and bonds (10%).