Investors Brace for Non-Farm Payroll Results and Inflation Figures

Investors watch NFP and inflation data, while GBP/USD rises and Dow Jones falls on fears of a banking crisis and higher rates.

Throughout the day, investors will be concentrating largely on the Non-Farm Payroll figure and will be preparing for the next weekly inflation data. Altogether, there will be 4 major announcements over the next week. This afternoon investors will be monitoring February Non-Farm Payroll, which is expected to return to previous figures.

Economists expect the NFP figure to read 225,000, less than half of the previous month but still considerably high. Some economists believe the Unemployment rate may remain at 3.4%, whereas others lean towards 3.5%. However, the Unemployment rate would need to be significantly higher to lower inflation. Some analysts have stated the Unemployment rate would need to be more than 4% for the employment sector to become “more balanced”.

Investors should note that next week’s inflation figures will likely strongly influence the US Dollar and Stocks. Therefore, traders need to remember that investors will start to prepare for the inflation figures later in the day. The Consumer Price Index is expected to read 0.4%, which will keep the yearly inflation at a similar rate. Furthermore, investors are expecting the Producer Price Index to show 0.3%. If the employment and inflation data is higher than expected, investors will likely lean towards the Dollar as interest rates will accelerate.

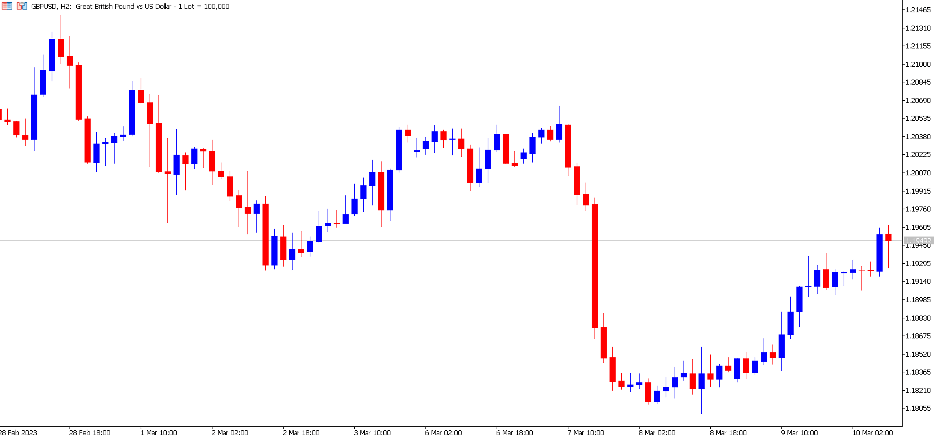

GBP/USD – Investors Brace for Non-Farm Payroll Results and Inflation Figures

The GBP/USD continues to increase as the US Dollar generally weakens over the past 24 hours. The Pound has also been supported by the latest Gross Domestic Product figures released this morning. Even though the Pound has gained 1.35% since yesterday’s US session, investors still should be cautious of a potential downward trend. The exchange rate has still formed 3 significantly lower highs over the past 2-weeks.

When looking at technical analysis, we are still waiting to get a major indication of a longer-term upward trend. However, this is possible if the price maintains momentum and surpasses 1.19628. Nonetheless, the price is currently trading at a resistance level and following a downward trend pattern. Traders await bearish indications from moving averages, crossovers, and price action.

Global stocks over the past week have tumbled and have lost more than 4% since Tuesday’s Fed testimony. Since the reaction, the market has started buying bonds with a significantly higher yield than in previous years. This indicates that safe-haven assets are coming into play and can also affect the US Dollar. Though the US Dollar will only be able to act as a safe haven asset if interest rates remain competitive.

This morning the GBP/USD has been fueled by the UK GDP figure, which read 0.3% instead of the expected 0.1%. The figure is deemed positive for the Pound as it indicates the UK may be able to avoid a formal recession for the time being. The UK’s GDP figure was significantly higher than the previous month, which read -0.5%. Though traders should note that the price action can change if the NFP figure is higher than expected.

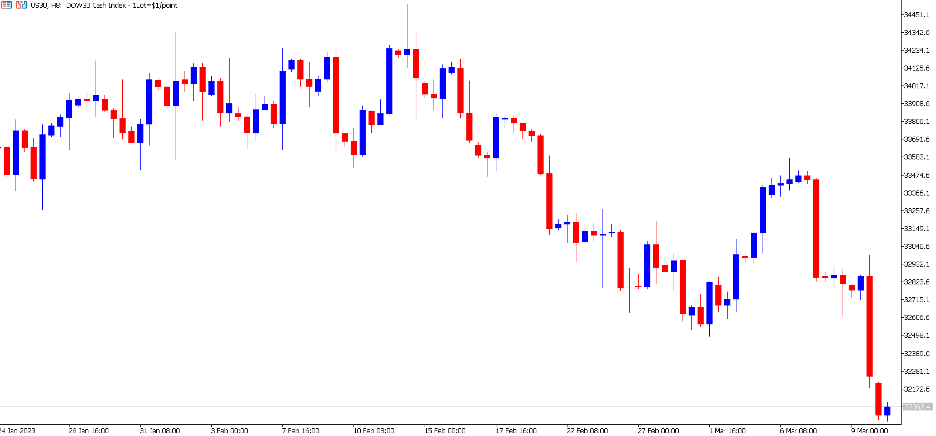

Dow Jones – Stocks Tumble as Investor buy Bonds and Fear Another Crisis

The Dow Jones did not end the day as the worst-performing Index as it did on Tuesday and Wednesday. This time the NASDAQ declined slightly more than the Dow Jones. However, based on weekly data, the US30 is still experiencing the strongest decline. The Dow Jones has declined for 4 consecutive days and shaved 1.70% from its value during yesterday’s session.

2 negative factors mainly influence the stock market. The Federal Reserve raising interest rates and concerns about another banking crisis. SVB Financial Group has been one of the first banking firms to spark concern throughout the market and has seen the stock decline by 60%. The firm has advised that higher interest rates and the poor performance of venture capital to many technology companies have negatively impacted them. The company also launched a $1.75B share sale to raise capital.

In general, the above-sent shockwaves throughout the stock market, and investor sentiment has significantly declined. Investors will now analyse the NFP figure and whether they point towards more rate hikes.

Traders will also continue to monitor technical analysis, which currently points towards a further decline. Though traders will also analyse when the price may become overbought using indicators such as the RSI.

Summary:

- The US Dollar declines back to support levels as traders wait for this afternoon’s NFP release.

- The Pound is supported by a higher-than-expected GDP figure which may keep the UK out of a recession in the short term.

- Global stock markets come under significant pressure due to the fear of another banking crisis.

Interest rates and a lower risk appetite continue to pressure stocks as investors buy bonds again.