Investors pour $126 million into Bitcoin funds last week

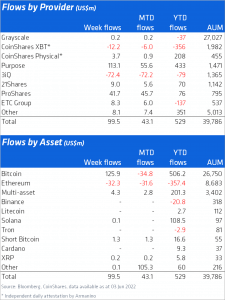

CoinShares’ weekly survey of cryptocurrency fund flows shows that total investment inflows into digital assets hit $100 million last week.

The asset manager writes that despite crypto prices range trading, Bitcoin saw inflows totaling $126 million last week, bringing total inflows year-to-date to just past the half a billion mark at $506 million.

However, BTC inflows are lagging relative to last year, where Bitcoin saw inflows totaling $3 billion in the first quarter, a particularly euphoric period for the crypto industry. Short Bitcoin saw inflows of $1.3 million last week, the report notes.

The renewed inflows suggest the recent headwinds for digital assets, such as the significant price weakness, were seen as buying opportunities for investors.

Year-to-date net flows have now hit $529 million while total assets under management (AuM) have recovered to $39.78 billion. Regionally, flows have been almost one-sided, with 88% of inflows derived from the Americas, while Europe remains hesitant, seeing only $11 million of inflows.

Europe’s largest digital asset investment firm said Ethereum investment products continues to suffer, with another week of outflows totaling $32 million. The second largest cryptocurrency in terms of market capitalisation has endured 9 straight weeks of outflows implying negative investor sentiment, with YTD outflow of $357 million. This contrasts to the first quarter 2021 where we saw inflows totaling $705 million.

However, since Ethereum outflows began in December 2021, they only represent just under 7% of total AuM.

Altcoin investments flat

Breaking down the latest statistics, Coinshares said minor outflows were seen in most altcoins’ investment products, highlighting investors are flocking to the relative safety of Bitcoin.

Revenue at CoinShares fell in the first quarter from the previous one, weighed down by a decline in institutional investors’ interest in cryptocurrency trading. The company’s combined revenue, gains and other income was reported at £27.96 million, down from Q1 2021’s £39.91 million. Adjusted EBITDA also halved to £18.7 million from £34.2 million in the three months through March 2021.

In the fourth quarter, CoinShares notched its highest quarterly earnings after surging crypto markets drove significant growth in its assets under management. However, due to lower demand for digital asset investment products, ETP assets under management (AUM) dropped to £3.07 billion from £3.4 billion as of 31 March 2022.

As the market environment has changed in the past three months, with cryptocurrencies under pressure, the institutional-favorite platform has experienced difficulties gaining confidence from investors.