Iran, Panama, and Russia pose highest financial crime risk, according to UK financial services industry

UK financial services firms refused to provide services for 1.15 million prospective customers for financial crime-related reasons in 2017.

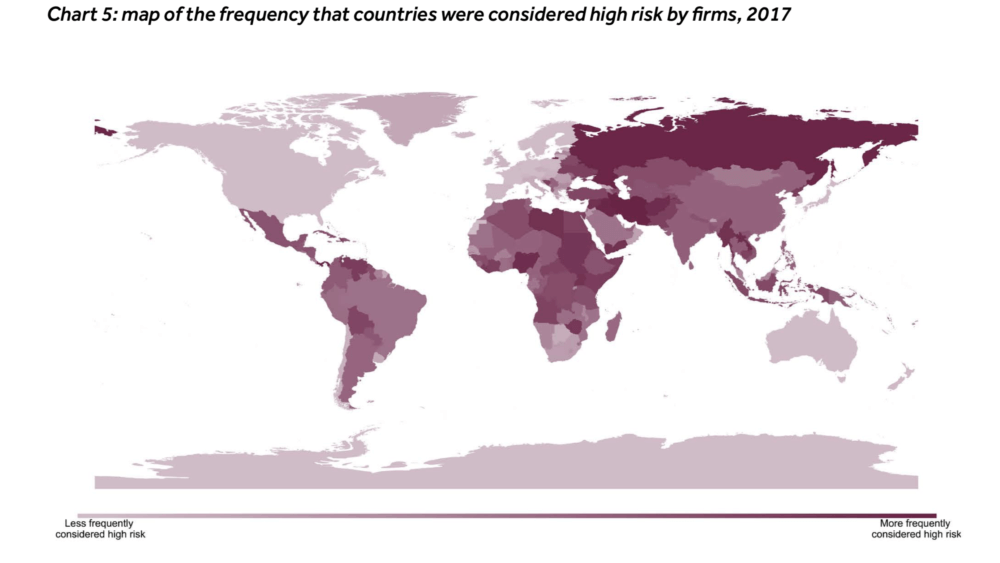

Iran, Panama and Russia are the jurisdictions assessed by UK-based financial services firms to have highest financial crime risk. The data come from the first FCA annual financial crime survey of over 2,000 UK firms, across the financial sector.

The firms, which submitted their returns covering 2017 on their accounting reference date, had a total of 549 million customer relationships, of which 427 million (or 78%) are in the UK. A further 113 million (or 21%) of the total number of relationships are in the rest of the European Economic Area.

The respondents identified 120,000 ‘politically exposed persons’ among their customer bases. There were also 11,000 non-EEA correspondent banking relationships. The law requires firms to treat these customers as high risk. On top of that, firms had 1.6 million other ‘high-risk customers’. This covers customers or clients the firm categorised as being high-risk for reasons other than the customer being a politically exposed person or a non-EEA correspondent bank.

The FCA asked firms to list which jurisdictions they had assessed and considered to be a high financial crime risk. The Top 3 includes Iran, Panama, and Russia. Least risky are Norway, Sweden and the United States.

The FCA estimates the financial services industry is spending over £650 million annually in dedicated staff time to combat fraud, laundering and other financial crimes. The total amount, however, is likely to be much higher than this estimate, as the figure does not include other costs such as those related to information technology systems, or time taken by the rest of a firm’s staff on preventing financial crime.

Staff at all levels, and automated systems, escalated 923,000 suspicious cases internally. Following investigation, 363,000 of these cases were reported to the National Crime Agency by firms’ MLROs. Furthermore, more than 2,100 terrorism-related suspicious activity reports were made to the authorities by firms the FCA regulates.

Concerns related to financial crime led to firms turning away some prospective customers. Firms refused to provide services for a total of 1.15 million prospective customers for financial crime-related reasons in the year the FCA data covers. In addition, 375,000 existing customers were turned away because of these concerns. Worries about financial crime led to nearly 800 introducer relationships being terminated, including over 100 with Appointed Representatives.

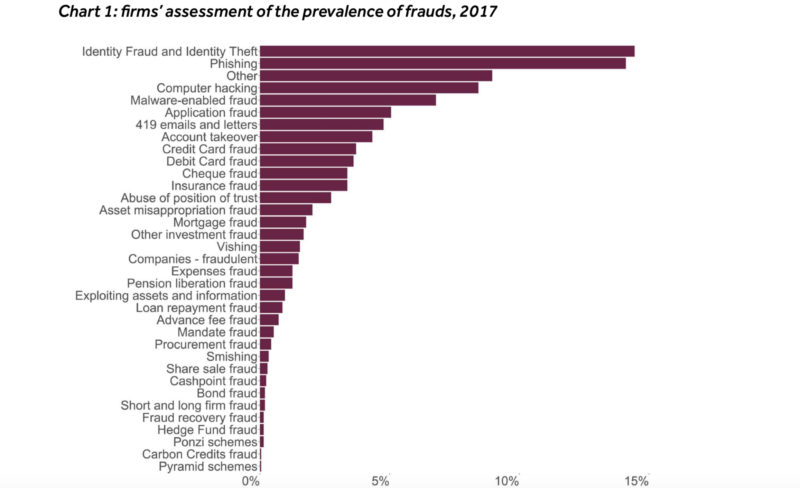

Cyber-crime is shown to be a key concern, with many of the frauds that were most frequently mentioned (such as identity theft and phishing) enabled by information technology. Some long-established crimes, such as account takeover, insurance fraud, card fraud and even cheque fraud, were also highly cited threats.