Israeli police collaborate with French regulator; 15 FX company directors under criminal investigation

4XP, BForex, Sisma Capital, Tradaxa and Aston Invest involved in a massive scam operation that took an average of €210,000 from each victim The world of Forex and Binary Options scams in Israel is being dragged out by a joint collaboration between the French regulator Autorité des Marchés Financiers (AMF) and the Israeli police in […]

4XP, BForex, Sisma Capital, Tradaxa and Aston Invest involved in a massive scam operation that took an average of €210,000 from each victim

The world of Forex and Binary Options scams in Israel is being dragged out by a joint collaboration between the French regulator Autorité des Marchés Financiers (AMF) and the Israeli police in an investigation that targets at least five companies that are the suspected operators of a fraud that totals approximately €105 million. 50 cases, involving at least 500 identified victims are being treated by the Paris prosecutor. Two resulted in the opening of a judicial inquiry.

As reported today by mainstream Israeli news source Calcalist, alleged scams include websites such as the now defunct 4XP, as well as existing companies BForex, Sisma Capital, Tradaxa and Aston Invest, amounting to a total of 15 reported suspects based in Israel, in an investigation headed by Justice Audi Buresi.

In a joint press conference of the AMF, Parisian prosecutor François Molins said: “I want to emphasize the excellent cooperation between the authorities and the Israeli police”, adding that “These sites are linked to organized crime, with highly structured teams and powerful laundering mechanisms”.

4XP (Forex Place) executives Benny Abramov, Yair Abramov and Shimon Choen, based in Ramat Gan, gave no comments regarding the investigation. Bforex, also based in a small village in the south of Israel called Mitzpe Ramon and with call center operations in Herzliya, but owned by a company with a similar name registered in the UK, is owned by Director Tzachi Rosenbaum, that didn’t provide any comment.

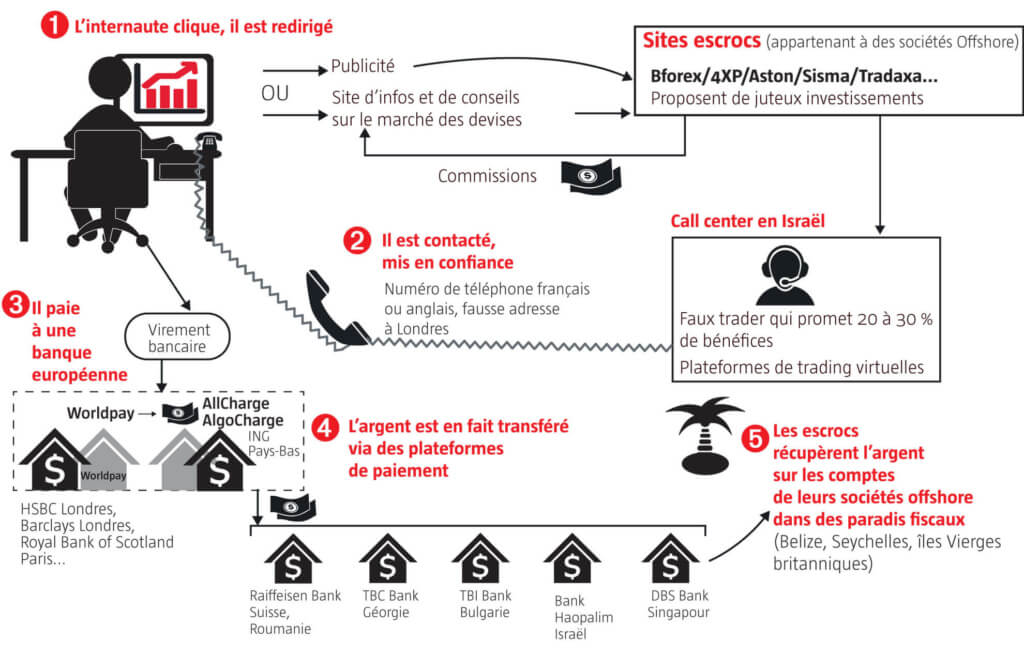

The unregulated brokerages in question have been accused of operating without regulatory approval in any jurisdiction, and soliciting clients either online or by phone, promising annual returns of 20%, 30%, and even 88%, for derivatives trading, most commonly Foreign Exchange, with certain investment products guaranteeing the total amount invested during the first year.

Investigators have alleged that they disguised themselves as representatives of the company’s offices in London or Paris to induce a more credible approach and have them convinced that the money would be transferred to European banks such as ING, RBS or HSBC. Instead, it was moved outside the EU, mostly to Israel, Georgia or Singapore, and offshore tax havens Seychelles, Belize and the British Virgin Islands.

Given that the French prosecutor said that the investigations ongoing regard to 50 cases, 500 victims, and a total sum of €105 million, then the average scam must have been worth €210,000. French economic daily ´Les Echo’ estimates the volume ranges from €100,000 and €500,000 for each victim.

Two employees at 4XP were already charged by the French police, according to the French press. One of them was involved in a hate crime against a Palestinian taxi driver in 2007. The second employee, Jeremias C., was arrested in a suite of a luxury hotel in Paris last November. He was carrying €6,000 in cash in €50 bills, claiming he earned it playing poker. He paid bail of €80,000.

Although the Israeli police and the Israel Securities Authority have provided no comment on the investigation, as the current international memorandum of understanding requires Israel officials to help foreign authorities in cases of Israel-related offenses.