Japanese fintech firm Alpaca makes VOL SCORE available on EUR/USD model

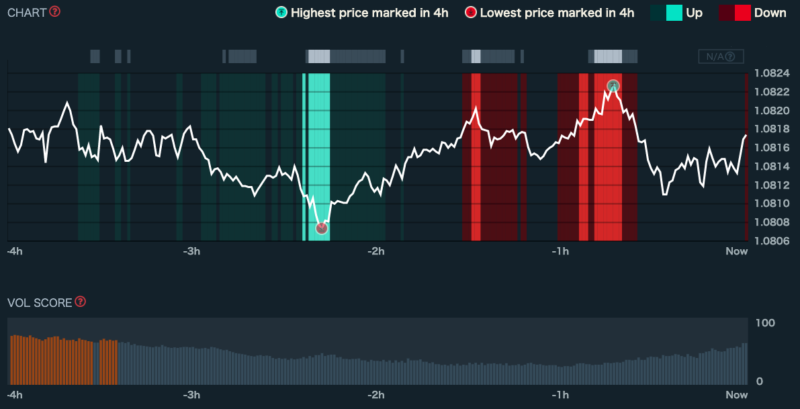

A new feature – “VOL SCORE” – that predicts the most recent increase in volatility is now available on AlpacaForecast.

Japanese fintech expert AlpacaJapanCo has made the “VOL SCORE” feature available on the EUR/USD model.

The feature, which predicts the most recent increase in volatility, is finally available on AlpacaForecast. It continuously generates a probability distribution of price change within the forecast period at all times, and “VOL SCORE” displays a scaled value of 0–100 based the probability of significant price change calculated by the model.

At this stage, the feature is available only on the EUR/USD model has been released, but the other currency pair models will be available gradually. The company hopes AlpacaForecast with this new function will be utilised more widely in various use cases.

As FinanceFeeds reported back in February, Alpaca launched its new AUD/JPY prediction model and the signals were made available on AlpacaForecastCloud.

AlpacaJapanCo., Ltd. announced the release of its AlpacaForecast Cloud for B2B solution back in November 2019. The service is also available via web-browser/smartphone. A free plan is also offered.

The “AlpacaForecast Cloud” is a web application that utilizes Alpaca’s large-scale data processing technology and deep learning technology and shows real-time forecasts for major currency markets. The company developed this web service to provide the most advanced AI-based market forecasting capability to the global financial community, right to their desks.

Alpaca is able to customize API connections directly into one’s platforms for the purpose of trading, hedging, risk management.