Japan’s MONEX Group rides the volatility wave with massive increase in revenues; takes earnings per share out of the negative

Japanese electronic trading giant Monex Group, Inc. (TYO:8698) has today reported its quarterly consolidated statements of income for the second quarter of the fiscal year ending March 2016. Being located in Japan, home to 35% of the world’s retail FX order flow which is conducted predominantly among domestic-market companies only, with very little cross-border activity […]

Japanese electronic trading giant Monex Group, Inc. (TYO:8698) has today reported its quarterly consolidated statements of income for the second quarter of the fiscal year ending March 2016.

Being located in Japan, home to 35% of the world’s retail FX order flow which is conducted predominantly among domestic-market companies only, with very little cross-border activity whatsoever, along with the JPY being a major focus against major currencies such as EUR, USD and GBP has served MONEX Group well this year.

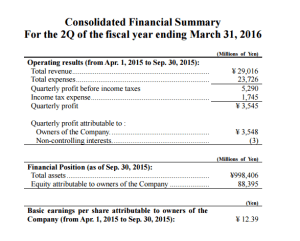

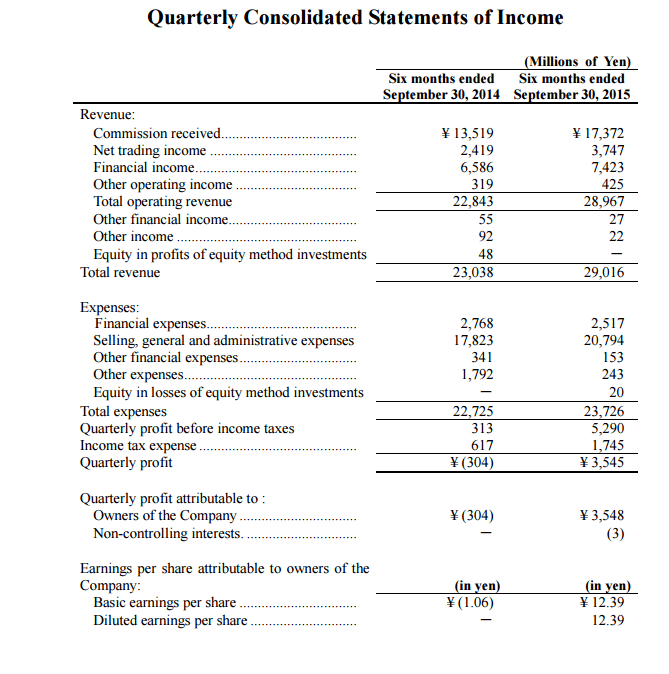

The quarterly gross revenue achieved by MONEX in the six month period between April 1, 2015 and September 30, 2015 was 29.01 billion yen (approximately $240 million dollars), which after expenses and tax generated a profit of 3.5 billion yen (approximately $28.9 million).

MONEX Group, along with other Japanese retail market-focused FX firms, rode a wave of volatility following the Swiss National Bank’s removal of the 1.20 peg on EURCHF in January this year, and, unlike many Western firms, was largely unaffected by exposure to negative client balances because the CHF is not a commonly traded currency among Japanese traders.

Therefore, when the peg was removed, Japan’s traders witnessed the volatility from afar, and nobody caught a cold. Quite the opposite, as CHF trading against other majors went significantly up in volume.

The result of this is higher revenues for Japanese firms, with MONEX having reported a profit for the first six months of this financial year which began just after the Swiss National Bank’s drastic action, of 3.5 billion yen, compared to a loss of 304 million yen during the same period last year.

2014 in general was a year of very low volatility across all markets globally, therefore a clear correlation can be drawn between last year’s loss and this year’s profit for the same period of the year, and the extra market volatility which prevailed.

The company’s cash position has grown slightly, standing at 70.3 billion yen at the end of September 2015, compared to 68.5 billion yen at the end of March this year, however cash segregated as deposits (assets under management) dropped from 525,567 million yen as of March 31 this year, to 522,419 million yen as of September 30, further emphasizing the increased trading activity of active traders.

When considering the total liabilities and equity, the firm remains completely stable, retaining assets with a net value of 998.4 billion yen as of September 30, 2015 compared to a very similar 1 trillion yen in net asset value during as of September 30, 2014.

Shareholders will indeed be happy to note that earnings per share at the end of this accounting period stand at 12.39 yen compared to a negative figure at the same time last year.