JP Morgan Chase CEO buys $26.5 million worth of shares: Shrewd or speculatory?

Many large banks have experienced tremendous collapse in the price of their shares over the last few weeks, a direction which continued unabated after a two-day ‘dead-cat bounce’ earlier this week. Some of the institutions concerned represent the largest percentage of global FX order flow and are prominent among Britain’s interbank sector in Canary Wharf. […]

Many large banks have experienced tremendous collapse in the price of their shares over the last few weeks, a direction which continued unabated after a two-day ‘dead-cat bounce’ earlier this week.

Some of the institutions concerned represent the largest percentage of global FX order flow and are prominent among Britain’s interbank sector in Canary Wharf.

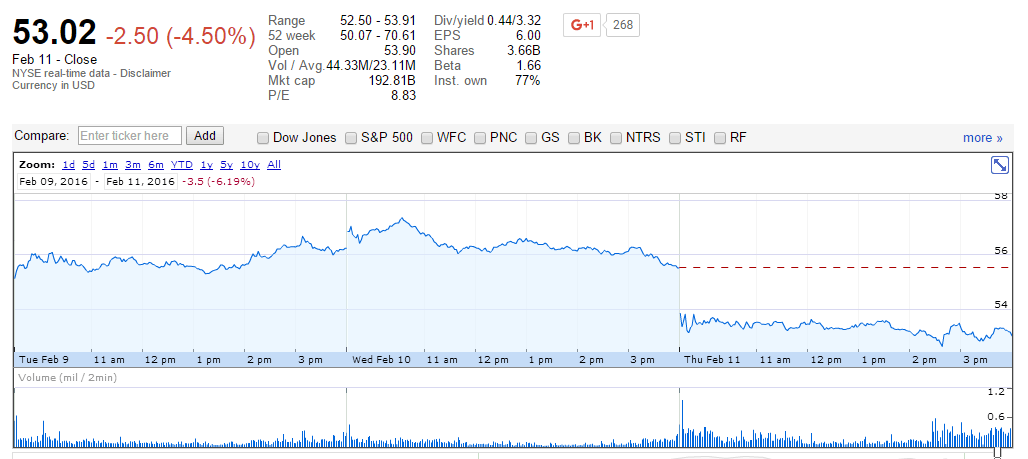

Today, an interesting occurrence has bolstered the share price of JPMorgan Chase & Co. (NYSE:JPM), albeit very slightly after a massive downward spiral recently.

This occurrence comes in the form of a share purchase by the bank’s CEO Jamie Dimon, who purchased 500,000 shares in the company, with a total value of $26.5 million at the time of purchase.

As share prices across the board are continuing to dive, prominent interbank FX dealers such as Credit Suisse have cut the bonuses of staff by up to 36%, an initiative which has reached the very senior management, with Tidjane Thiam, the bank’s CEO, having stated earlier this week that he was preparing to take a larger hit than other Credit Suisse employees with regard to the reduction of his own bonus.

Deutsche Bank, the world’s second largest interbank FX dealer in terms of market share, is one of the most severely affected, having plunged so considerably that German government officials have publicly spoken out. Wolfgang Schaeuble, Germany’s finance minister, stated this week that he has “no concerns over Deutsche Bank” in answer to investor concerns over the bank’s capital position.

JPMorgan Chase is the world’s fourth largest interbank FX dealer by volume, retaining this position since 2014.

At the beginning of this year, the firm’s share prices began to head south dramatically, standing today at $53.02, 4.5% down from yesterday. Mr. Dimon’s purchase may have had a slight influence with regard to stemming the downward direction, however the question remains as to whether this was a strategic move on his part to buy shares at what could be a critical low point where they may not go any lower, therefore a safe investment, or whether this is purely speculative and it could be not quite the good time to buy bank shares as it seems.

Photograph: Downtown Manhattan. Copyright FinanceFeeds