KP International and Forex Financial Services top AFCA’s complaints list

AFCA received most complaints about KP International, Forex Financial Services and Commonwealth Securities Limited among all derivatives & securities services providers between July and December 2019.

The Australian Financial Complaints Authority (AFCA) has updated its Datacube which provides information about complaints received regarding members of the dispute resolution body.

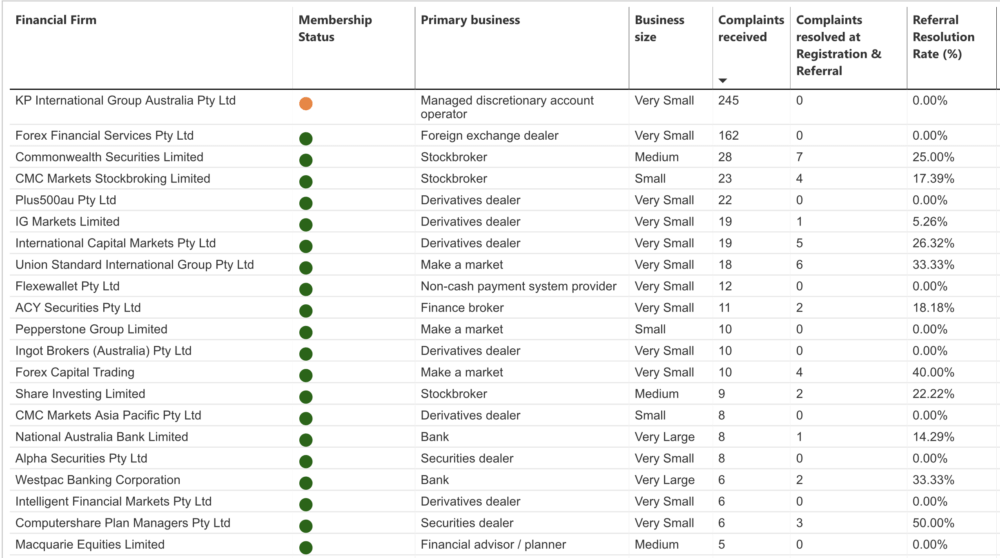

The data for the Derivatives/Hedging & Securities segment shows that, during the period from July 1, 2019 to December 31, 2019, the bulk of complaints was about two firms – KP International Group Australia and Forex Financial Services. AFCA received 245 complaints about KP International in the July-December 2019 period, whereas the number of complaints about Forex Financial Services was 162.

The names of these two entities are probably familiar to FinanceFeeds’ readers, as Forex Financial Services topped the list of Forex dealers that got most complaints in the preceding reporting period (from November 1, 2018 to June 30, 2019).

Regarding KP International, let’s recall that ASIC cancelled the AFS license of KP International effective November 22, 2019.

The Australian Financial Complaints Authority (AFCA) has notified ASIC that it has received numerous complaints from people located offshore regarding a company purporting to be KP International Group Australia Pty Ltd. The complaints have been launched by consumers who have been unable to withdraw funds from their trading accounts.

AFCA explains that it is only able to consider complaints about financial firms that are its members. Although KP International Group Australia Pty Ltd is currently an AFCA member, it is unclear if the entity used by customers is also an AFCA member.

In the period from July 1, 2019 to December 31, 2019, Forex Financial Services continues to be at the lead among FX dealers about whom clients submitted most complaints.

Union Standard International Group topped the list among market makers, whereas Plus500au got most complaints among derivatives dealers.