KVB Kunlun reports rise in profits in 2018

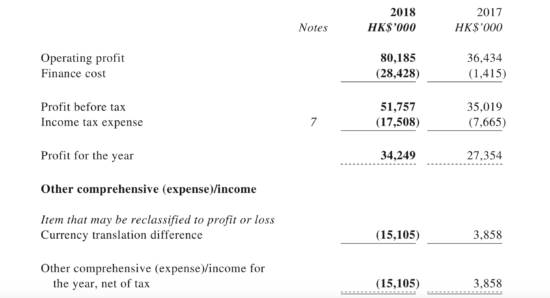

The brokerage marked a net profit of HK$34.2 million for 2018, up from HK$27.4 million registered in 2017.

Hong Kong-focused retail Forex broker KVB Kunlun Financial Group Ltd (HKG:6877) has earlier today posted its financial results for the year to end-December 2018.

Given the robust metrics the company reported for the first half of 2018, it is barely surprising that the full-year profit results are also solid.

KVB Kunlun marked a net profit of about HK$34.2 million during the year ended December 31, 2018 compared with the net profit of about HK$27.4 million for the year ended December 31, 2017. The net profit margin for 2018 was approximately 7.3% (2017: 5.3%).

On the downside, however, the total income decreased by 8.5% to HK$471.1 million in 2018, down from HK$514.9 million for 2017.

The leveraged foreign exchange and other trading income fell 6.1% to HK$372.9 million. This was mainly due to the decreased trading volume in 2018 as compared to the preceding year.

The top three most traded FX pairs in the year under review were USD/JPY, EUR/USD and GBP/USD. For CFDs and commodity products, gold was the most popular product traded by KVB Kunlun’s customers, followed by the crude oil.

The cash dealing income of the Group increased to HK$3.3 million from HK$1.1 million. The increase was mainly attributable to higher market volatility and successful dealing strategy.

KVB Kunlun’s fees and commission income fell to HK$108.8 million. The decline was mainly due to the decrease in commission earning as a result of lower trading volume.

The Group recorded other income of HK$38.4 million for the year ended December 31, 2018 as compared to other income of HK$8 million for the year ended December 31, 2017.

The retail margin FX trading market is highly competitive, the broker noted. The range of competitors includes international multi-product trading firms, other online trading firms, and financial institutions. KVB Kunlun expects the market to remain very competitive in the foreseeable future.