KVB Kunlun shares tank: Down 2.2% to just 11 cents per share

The last two years have represented a journey down a very rocky road for Cayman Islands based, Hong Kong-focused electronic brokerage , and today’s dip in the company’s share price represents yet another chapter in the firm’s volatile corporate period. At close of business on Friday, March 4, the price of shares in KVB Kunlun, […]

The last two years have represented a journey down a very rocky road for Cayman Islands based, Hong Kong-focused electronic brokerage , and today’s dip in the company’s share price represents yet another chapter in the firm’s volatile corporate period.

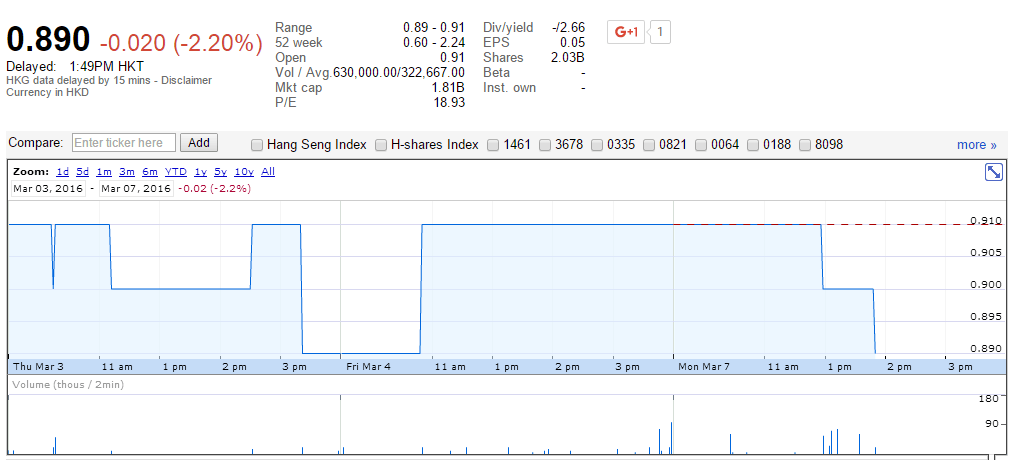

At close of business on Friday, March 4, the price of shares in KVB Kunlun, a publicly listed company on the Hong Kong Stock Exchange, dropped dramatically at approximately 12.00pm from 0.910 HKD per share, to 0.890 HKD per share, revisiting a an equally low value during the afernoon of Thursday, March 3.

The 2.2% drop in share prices puts the stock at an equivalent US dollar value of just 11 cents per share, representing the lowest valuation that the company has experienced for some time.

Volatility has blighted KVB Kunlun’s share prices since the summer of 2014 when the company reported a 45% downturn in revenues in May that year, resulting in a loss of 7.1 million HKD ($915,000) in its half yearly report, which followed the issuance of a pre-emptive warning to shareholders and potential investors by its directors, advising caution when trading KVB Kunlun shares.

Some degree of recovery ensued, with KVB Kunlun reporting a record net profit for the nine months ended September 2014, performance in the third quarter of 2014 having recouped the losses made in the first half of the year.

In February 2015, Chinese financial giant CITIC Securities made an offer to purchase a 60% stake in KVB Kunlun, which by that time had become an M&A target.

CITIC Securities offered paid 780 million HKD for 1.2 billion shares at that time, which equates to just 0.65 HKD per share, which is just 8 US cents per share.

The acquisition by CITIC Securities of 60% of KVB Kunlun which was made in early 2015 had not been without a degree of wrangling either. Some six months later, a further offer from CITIC Securities to buy out the existing public shareholders expired, resulting in a 29% decrease in KVB Kunlun’s share price during the course of June 2015.

The acquisition was completed during the first half of 2015, with CITIC Securities holding a 60% stake in the company, however CITIC did not reissue an offer to buy out the company’s public shareholders.

In October 2015, Ryan Tsui, FinanceFeeds exclusively reported that KVB Kunlun’s Global Sales Director left the company after two years in the position having joined KVB Kunlun from British firm GKFX in August 2013 where he was Managing Director for the Asia Region, based in Hong Kong.

Photograph: Harbour Road, Wan Chai, Hong Kong. Copyright FinanceFeeds