KVB Kunlun’s proposed name change secures unanimous support at EGM

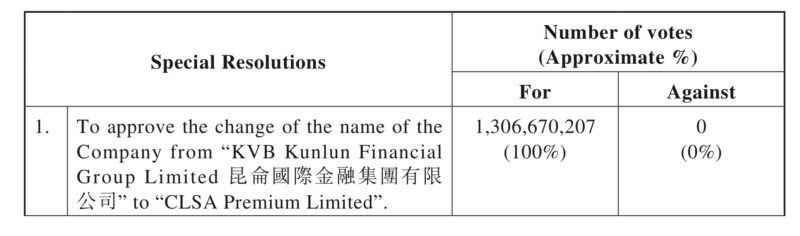

A total of 1,306,670,207 votes were cast in favor of the proposal to change the company’s name to CLSA Premium Limited.

About a month after Hong Kong-focused retail Forex broker KVB Kunlun Financial Group Ltd (HKG:6877) unveiled its plans to change its name, an Extraordinary General Meeting (EGM) was held with the proposed change put to vote.

Today, KVB Kunlun’s Board announces that the special resolutions were duly passed by the shareholders by way of poll at the EGM held on October 29, 2019.

A total of 1,306,670,207 votes (100%) were cast in favor of the proposal to change the company’s name to CLSA Premium Limited. The proposal to amend the Memorandum of Association and the Articles of Association of the Company in line with the name change also received unanimous support.

The proposed name change will become effective from the date on which the certificate of incorporation on change of name is issued by the Registrar of Companies in the Cayman Islands. Thereafter, the company will carry out all necessary filing procedures with the Companies Registry in Hong Kong pursuant to Part 16 of the Companies Ordinance (Chapter 622 of the Laws of Hong Kong) upon the proposed name change getting into effect.

Back in September, explaining the rationale for the planned name change, the Board said the new name will better reflect the fact that KVB Kunlun is part of the substantial shareholder’s group of entities, including CLSA group. Furthermore, the Board believes that the new name will provide the company with a fresh corporate image and identity, which will benefit the Group’s future business development and is in the interest of the company and its shareholders.

In addition, given that there are unaffiliated entities that are using a similar name and conducting similar business as the company, changing the name would remove any confusion that may cause to the public. The rebranding will be part of the company’s new plan and vision to better utilize and capitalize on the business know-how and potential synergies with CLSA group and its affiliates.