Latest CQG desktop version adds icebergs to Order Ticket

Also, overbought and oversold parameters have been added to RSI study.

Provider of high-performance trading, market data, and technical analysis tools CQG has rolled out the latest version of CQG Desktop (3.6), including enhancements to trading features and charts.

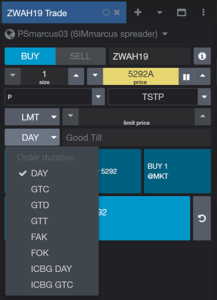

In terms of trading, the improvements concern icebergs. They have been added to the Order Ticket. CQG offers a suite of Smart Orders that includes iceberg orders. Iceberg orders are now available in the duration dropdown in the Order Ticket. These orders are available for strategies (spread and aggregation) also.

An iceberg order is a limit day or GTC order that has both a total quantity and a display quantity that is shown publicly on the order book.

An iceberg order is a limit day or GTC order that has both a total quantity and a display quantity that is shown publicly on the order book.

In terms of charts, overbought and oversold parameters have been added to RSI study.

The latest version of the platform also improves workflow for creating a new list when opening a quotes widget. It also introduces ability to customize abbreviations for pages. To do that:

- With the left bar open, go to the … menu > Rename page…

- A field has been added to customize the abbreviation of pages when the toolbar is closed.

The previous release (3.5) of the solution introduced a new widget for commercial grain hedgers. The new widget, called “Hedge to Arrive” aims to modernize hedge management workflow for commercial customers. Producers can enter orders under their account and orders will be submitted to the exchange through the hedge account. The hedge desk can view and manage orders by producer and hedge accounts.

CQG announced the rollout of the latest pilot release in August this year. The list of new features and enhancements in the CQG Midyear Release includes:

- Estimated Place in Queue

CQG’s professional trading customers need to know where their order sits amongst the rest of the orders working at the exchange. CQG’s powerful algorithms calculate an estimated place in queue, giving them an edge in the market.

- Fenics Exchange

CQG has connected to the Fenics exchange, making their highly anticipated US Treasury products available to customers. Fenics offers the tightest tick size available in US Treasuries, 1/16th of 1/32nd.

- Server-side Bracket Orders

Bracket Orders give CQG customers an added level of security, allowing them to set profit and loss targets around an order to ensure customers get the price they need. Bracket orders now reside on CQG’s co-located servers making this order type even more powerful. The brackets will continue to work even if one’s platform is not running.

- CQG & Microsoft Excel Integration

The full integration with Microsoft Excel allows traders to push data and actions from Excel back into CQG. Access any data set for analysis in CQG, build custom studies based on external data sets, create automated trading strategies, and much more.

- Additional Modification of Parked Orders

‘Park Until’ order types can be modified to Park indefinitely without the need to activate the order or cancel it.