Latest CQG desktop version offers new price formatting options for fractions and decimals

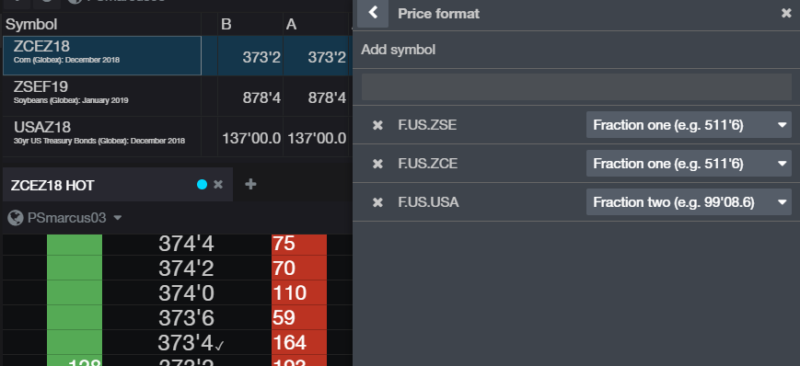

Ag and fixed income customers can now easily display pricing with separators for fractions, making prices easier to read.

Provider of high-performance trading, market data, and technical analysis tools CQG has rolled out the latest version of CQG Desktop (3.7), which offers a raft of improvements, including pricing display.

Ag and fixed income customers can now easily display pricing with separators for fractions, making prices easier to read. To do that, traders have to go to Preferences (gear icon in the lower left), then select “Interface section” and then “Price format”. Afterwards, they have to type in a symbol name in the search field to add it to the customization list and select a preferred format.

There are other enhancements in CQG Desktop (3.7). The list includes:

Spreadsheet Trader

- New Hit/Lift/Sweep columns for aggressive orders

- Separate preference for liquidate vs cancel

- Full description of product in QSS and in autosuggest

- Open Interest no longer abbreviated

Orders and positions grids

- Buy/sell coloring for buys and sells and up/down coloring for OTE, P&L, and balance information

- Column headers show totals for buys/sells in Orders and Positions widgets

Options

- Added columns for best bid/ask volume

The preceding version (3.6) of CQG desktop offered a raft of improvements with regard to trading. For instance, icebergs have been added to the Order Ticket. CQG offers a suite of Smart Orders that includes iceberg orders. Iceberg orders became available in the duration dropdown in the Order Ticket. These orders are available for strategies (spread and aggregation) also.

Let’s note that an iceberg order is a limit day or GTC order that has both a total quantity and a display quantity that is shown publicly on the order book.

Version 3.6 also brought improvements to charts, as overbought and oversold parameters have been added to RSI study.