Libertex launches new account type for committed investors: meet Libertex Invest

The number of new entrants into the equities market is soaring, but rather than aiming for short-term results, the new breed of market players is more interested in the long term, low-risk capital growth

Libertex, a leading international firm offering tradeable CFDs for over 24 years, is now launching a new account type tailored specifically to the needs of today’s investors. Libertex Invest aims to provide investors with unmatched terms that offer an advantage to conservative but consistent activity in the financial markets, providing a range of benefits over the one-size-fits-all approach that still dominates the online trading industry at large.

What is Libertex Invest?

Libertex Invest is a brand-new account type offered on the multi-award-winning Libertex trading platform designed especially for investors. Unlike Libertex’s standard trading accounts, this new option is geared towards people who are looking to make regular purchases of stocks over an extended period of time, with a view to building and maintaining a long-term portfolio. Now, at this point, you could be forgiven for wondering what makes Libertex Invest any better than a standard client account. However, here’s the best part: ZERO commission! No, you didn’t read that wrong; Libertex Invest clients won’t have any commission or account management fees eating away at their potential profits or dividends, which means they can reinvest them instead of giving them back to their broker.

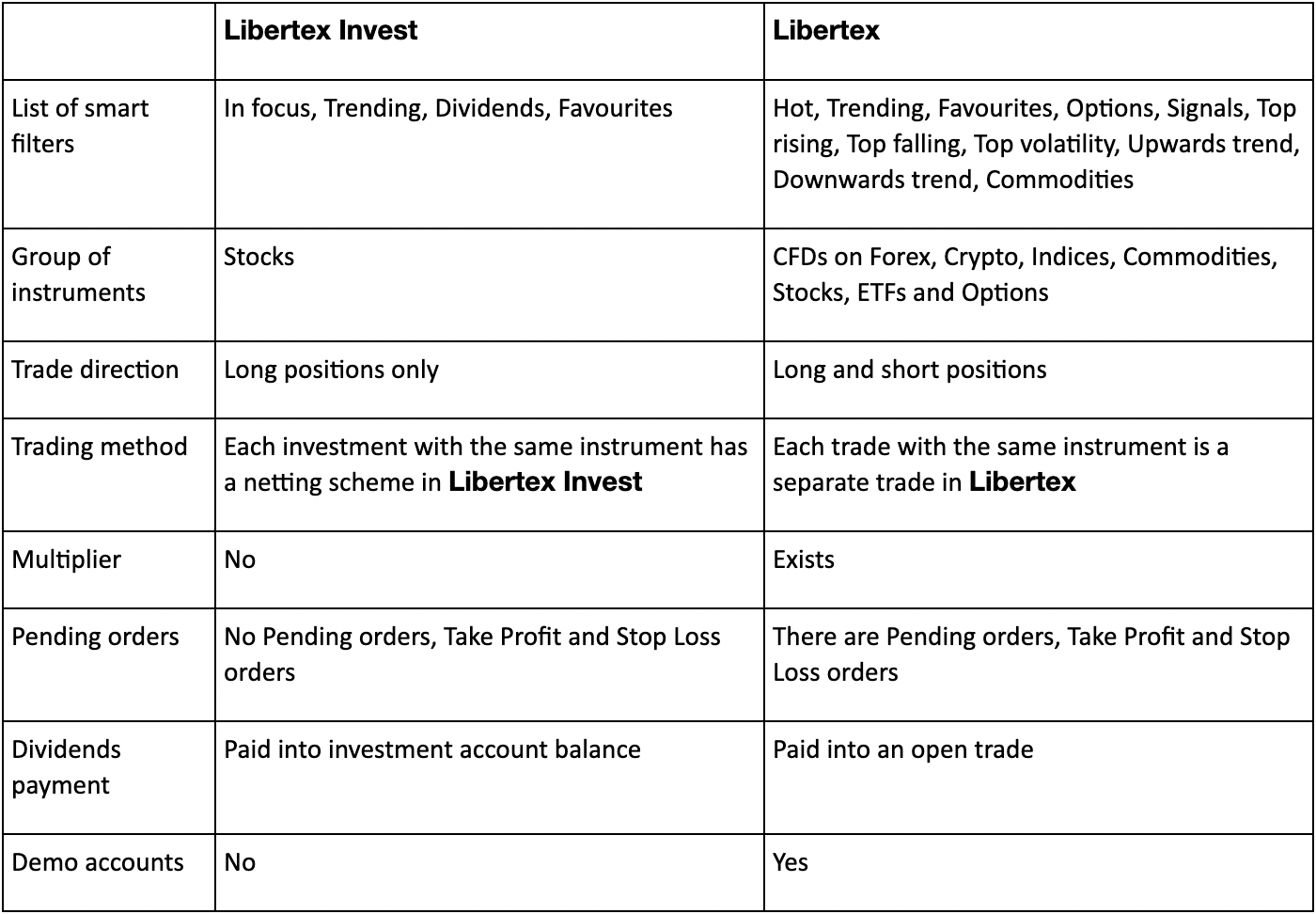

How is Libertex Invest different from a standard Libertex trading account?

Obviously, the biggest difference is the zero commission offered on all trades. For a full comparison of both Libertex account types, consult the table below:

Real advantages for real investors

Thanks to Libertex, the days of responsible savers being punished with high commission and account inactivity fees are now over. With a Libertex Invest account, you are no longer paying huge amounts to your broker. You invest as much as you want each month and because Libertex Invest only offers real stocks with no multiplier, you have much greater control over your capital risk. It’s how money management should work – fast and free. Also, apart from there being no overt fees and charges, Libertex Invest ensures no SWAPS, margin calls or stop outs drain your cash. What’s more, your dividends are credited directly to your investment account balance right on time, so you decide what happens to them and no one else. So, don’t let fees and commissions eat away your budget; put it to better use instead with a Libertex Invest account.

Libertex CMO, Marios Chailis, comments: “We are very excited to present our new investment product, Libertex Invest, which offers extremely attractive trading conditions with stocks of global companies available for sale and purchase starting from just $10. Best of all, Libertex Invest is available through the same intuitive and extremely user-friendly platform that our loyal clients already know and love.”

Libertex Invest enables you to buy shares in top companies such as Google, Apple, Tesla and others at your own convenience. The full range of stock options spans the tech, automotive, industrial, healthcare, entertainment, medical cannabis and food sectors, among others. This of course allows you to build a diverse investment portfolio that minimises risk.

So, whether you’re a new client or one of the Libertex faithful, why not take advantage of this exciting opportunity for commission-free investments? Besides, as any die-hard investor will agree, it is wiser to keep some investments in a stable, lower-risk portfolio and most importantly to never forget that as It always feels like the best time to invest in companies such as these was yesterday, the next best time is the present.

With that in mind, either go to libertex.com or sign into the platform and register your own Libertex Invest account today. Expand your portfolio, invest in stocks commission-free with Libertex and… “Trade For More”!

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Jurisdictional limitations: Libertex Invest is only available in EEA countries.