Lightyear integrates Quartr’s stock market data API on its low cost European brokerage

“We are excited to partner with Quartr and bring earnings calls, as well as reports and transcripts into the Lightyear app, for our customers all across Europe”.

Quartr continues to move forward on its mission to bring the financial community closer together by signing an API deal with Lightyear, an online broker based in London with customers in 20 countries all across Europe.

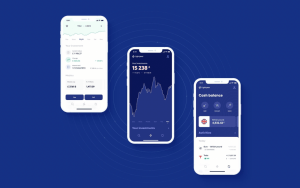

The integration enables Lightyear’s customers to find crucial information such as earnings calls, accompanying documents, reports, and slide decks directly through its online brokerage platform, which gives investors a strong foundation to make informed investment decisions.

“Our API will create a lot of value for both investors and online brokers worldwide”

Sami Osman, CEO & Co-founder of Quartr, said: “We are very pleased to announce this Europe-focused partnership with Lightyear just a week after signing a deal with Sweden’s largest online broker. We are convinced that our API will create a lot of value for both investors and online brokers worldwide, and not least for public companies as this enables them to get their equity stories told to a much wider audience”.

Mihkel Aamer, CTO & Co-founder of Lightyear, commented: “Easy access to stock market data is crucial for new and experienced investors alike — to build out their investment strategies and successfully carry them out over the years. Historically, earnings calls and the discussions within them have not been easily accessible for retail investors; yet keeping up with companies’ quarterly results is a key part of staying up to date with your portfolio performance. We are excited to partner with Quartr and bring earnings calls, as well as reports and transcripts into the Lightyear app, for our customers all across Europe”.

No trading, account, or custody fees. 0.35% fee for FX

The European investment platform founded by ex-Wise duo Martin Sokk and Mihkel Aamer has recently partnered with LHV to adopt SEPA and SEPA Instant payments, as well as EUR safeguarding accounts, which separate client funds from the company’s.

Lightyear offers low-cost access to global markets for residents in the European Union, which means lowering transaction and custody fees as well as hidden FX fees for international markets for customers. The broker raised $25 million in a Series A funding round led by Lightspeed Venture Partners and Sir Richard Branson to fuel its expansion into 19 new European countries.

The neobroker is quickly growing across the old continent by charging no trading, account, or custody fees and charging a 0.35% fee for FX.

In October, Lightyear added global ETFs and a wide range of instruments from UK and European exchanges to its product offering in a milestone for the European investment platform. The new product offering will include a huge selection of popular local and global stocks listed on exchanges all over Europe including the London Stock Exchange, Euronext and the DAX.

The rollout of ETFs also marks the company’s expansion into fund-based products, which are widely considered a good way to diversify a portfolio and a good entry point for newer investors, combining the benefits of diversified mutual funds with real-time pricing, but without high barriers to entry or minimum investment amounts.