Live and exclusive from Chicago: Newly established Seed CX launches hemp as all new exchange-traded commodity

The trading of raw materials and commodities in Chicago dates back as far as pre-constitutional America, and whilst the technology upon which commodities are traded is cutting edge, the materials themselves are indeed as old as the Mid Western landscape itself. Here in Chicago, the birthplace of America’s exchange-traded commodities and futures industry, industry executives […]

The trading of raw materials and commodities in Chicago dates back as far as pre-constitutional America, and whilst the technology upon which commodities are traded is cutting edge, the materials themselves are indeed as old as the Mid Western landscape itself.

Here in Chicago, the birthplace of America’s exchange-traded commodities and futures industry, industry executives from the most leading edge institutional exchanges and electronic derivatives marketplaces gathered for a day of showcasing the latest innovations at the FinTech Exchange 2016 conference hosted by Barchart.

What is clear is that whilst many technological tours de force in the institutional and exchange sector are leading the way in terms of technology for executing and connecting global markets, there is one particular company that is taking on a different advancement – the addition of an entirely new commodity to the world markets, traded through a electronic platform.

That material is hemp, which is the commonly used term – as well as the legally defined one – for industrial varieties of the cannabis plant and its products, which include fiber, oil, and seed.

The raw material, however has tremendous value as an industrial input because hemp is refined into products such as hemp seed foods, hemp oil, wax, resin, rope, cloth, pulp, paper, and fuel.

At this year’s FinTech Exchange 2016 event hosted by Barchart, Brian Liston, Co-Founder and President of Seed CX detailed the whole ethos of the newly established company to FinanceFeeds CEO Andrew Saks-McLeod here in Chicago’s electronic trading heartlands.

All new electronic venue, all new commodity!

“Seed SEF is new, and is nearing CFTC approval which of course is a big step for us” explained Mr. Liston.

“We see the business at its core as a derivatives platform as well as an exchange. We have a matching engine and a front end and ISVs will be connecting to us” he said.

Mr. Liston detailed the type of trading environment that Seed provides, and what the participants are looking for: “Some hemp market participants are new to hedging and new to trading, therefore we want to provide them a fully fledged service of economic information, cash market access, and access to a derivatives markets” he said.

Proprietary hemp trading platform

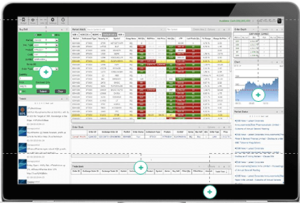

“The platform that we use for trading hemp was provided by GMEX Group. The platform itself has remained 80% standard, and then 20% of its functionality was customized. For example surveillance functions that differ between US and UK had to be taken into account. We also changed some of the visual elements of the trading screens ” said Mr. Liston.

Seed funding for Seed CX

“We just closed our first round in January” enthused Mr. Liston. “We attracted a broad swath of investors from both the financial and hemp industries, including potential hedgers and experienced trading groups, ” explained Mr. Liston

What is the industrial hemp industry, and what can be commoditized?

As this is one of Chicago’s interesting innovations, it is important to define what is so important about hemp as a tradable commodity, and take a look at the basis of the industrial hemp industry.

The United States government redefined the classification of hemp in 2014, with the classification being based on the chemical composition of the product. Within cannabis there are now two categories, hemp and marijuana.

Mr. Liston explained how this is defined and measured. “If you have 0.3% THC or less on a dry weight basis then it is classified as hemp which is legal for cultivation under the 2014 Farm Bill” he said.

A very desirable trading instrument gives access to trading firms

“The ability to trade hemp has a certain appeal, which allows access to trading firms and groups that otherwise would be more hesitant to get involved in a new commodity, but it is important for us to define what is hemp and what is not” said Mr. Liston.

“We are going through the CFTC to become a federally recognized entity to allow people to trade industrial hemp” he said.

“If you talk to people in the hemp industry, they are very evangelical about the benefits of industrial hemp, but for big industry to adopt the product as a legitimate resource, you need consistent supply, easy access and grading standards that are adopted by the industry. That is what we are trying to help provide” explained Mr. Liston.

Taking hemp into a much more commoditized environment

When you talk to people in the industry, they are so passionate, but if you talk to those outside the industry like corn farmers, feed farmers, they want to know the price and this is something that is very difficult at the moment.

When raising funds, investors asked certain questions. Farmers were a very good source because they are more connected than most because their business depends on weather, commodity prices, environmental factors, global markets and raw materials prices.

Who will trade hemp?

“Our operations are registered as a SEF with the CFTC; that is, our contracts are classified as swaps. In terms of customer base” explained Mr. Liston “. only ECPs can trade, which are large hedgers (at least $1 million in net worth) or large traders with $10 million in assets.”

“The earliest adopters of our hemp derivatives are likely trading firms and hedge funds that are interested in new products and/or longer term trading strategies.”

Seed is now expanding its business horizon, the core business thus far being its derivatives matching platform. The company is now looking to provide access to the cash market.

An interesting development indeed, especially bearing in mind the rich heritage in which Chicago is steeped as an historic commodities and raw materials center.

The American raw materials, including hemp, that built Britain, and played a special part in American independence

As far back as the colonial period hemp was a very highly sought after commodity.

In the colonial period, North America was a resource-rich land of plenty, the colonials shipped raw materials from what is now the United States, to Europe to build everything that was needed to power the continent during the industrial revolution.

Indeed, iron for ship building, corn for animal feed (animals were transport in England in those days) and fuels for powering the factories and mills, however hemp was also a colonial export which made its way across the Atlantic in the days before the constitution. It was an important resource for the British Royal Navy as it was used to make rope and sails.

When America moved from the colonial era to become an independent nation, it designed and created the iconic American flag, the very first of which was made of hemp fiber. If there was ever a testament to the importance of a commodity in American history – this is it!

Featured image by Adrian Cable, CC BY-SA 2.0.