LIVE from Devexperts workshop on Financial Charting

The workshop is over. Below you can read our live coverage of the event, both the workshop and the Q&A session.

Devexperts has scheduled a workshop on financial charting at 4 p.m. London time. If you haven’t registered yet, you still can via this link.

The event, hosted by Ben Clark, Devexperts trading infrastructure guru, is mostly targeted to FX, Crypto, Stock brokers, IBs, financial news media, market data vendors, and trading schools.

How charting can give a competitive edge

“How financial firms gain a competitive edge by providing charting to their traders” will cover Devexperts’ charting solution and its tools that enhance engagement and user loyalty and how it all works.

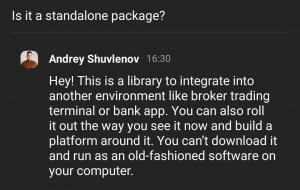

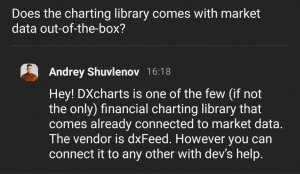

Devexperts will be presenting DXcharts, a mobile-friendly technology that can be integrated in a single day and remains responsive and nimble even with thousands of candles, hundreds of drawings, and dozens of indicators, which was proven by performance and stability tests.

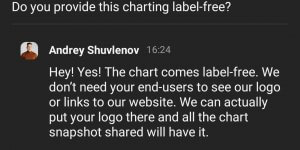

Devexperts offers the charting widget at a very appealing price for startups (reach out to Devexperts to find out the terms) and ensures that it doesn’t add any external links or logos.

The DXcharts library is said to combine the best practices from OTC and brokerage platforms, and it allows users to juggle the chart layouts as they wish, synchronizing them by instrument, chart type, timeframe and range, studies, and appearance.

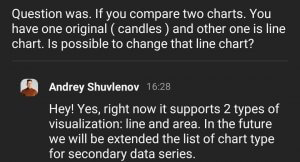

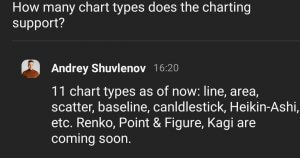

The solution features instrument comparison, custom aggregations, chart events, various chart types, an extensive indicator library, and drawing tools.

DXcharts has been chosen as the charting solution by many trading platforms, including Prime XBT, CEX.io, Gedik Yatırım, DXfina, Işık Menkul, and more.

FinanceFeeds will be providing live coverage at 4 p.m. London. You can still register here.

See you soon!

The DXcharts workshop begins

16:05 – Ben Clark started out by announcing he would go through approximately ten different features available on their charting platform, DXcharts. These futures are believed to be the most desired by retail traders, who are willing to pay for them.

Boasting a “bunch” of candlestick types, DXcharts allows users to customize aggregations within the charts as well as to change the timeframe of each candle.

16:10 – The workshop host tried out a variety of setting on the charting platform and enumerated a few of the events available on the chart demo, including dividends, splits, earnings, and conference calls. These mostly affect Stock trading, but DXcharts also caters to the needs of FX and Crypto traders.

16:15 – Ben Clarke explored the Scale feature – including price scale settings – and several of the platform’s Drawings capabilities – including the Magnet Mode – and Studies – which are highly customizable and allows users to tweak the source code of all kinds of indicators. dxScript is the programming language.

16:30 – As the workshop approached its end, Ben Clark showed two more functionalities: the ability to sinchronize charts and to share on socials, either by download, copy, or create a link which can be tweeted or sent to Telegram, Discord, or other social media.

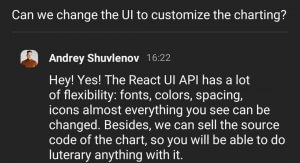

Q&A with Andrey Shuvlenov

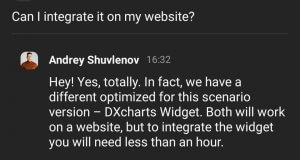

16:40 – Andrew Shuvlenov, Product Manager of DXcharts at Devexperts, took over the webinar for the Q&A session. Below, the snapshots of a few answers he provided to attendees.

Ben Clark ended the webinar by reminding everyone that they are available for further questions and a more detailed analysis of the DXcharts charting solution.