London share in global FX volume drops as turnover hits $7.5T

Global FX trading has jumped by 14 percent between two consecutive triennial surveys, the Bank for International Settlements said, with a strong uptick in swaps trading accounting for most of that increase.

The daily FX transaction volume in April 2022 totalled $7.7 billion, shows the study from the BIS, which is known as the central banks’ bank. That compares to $6.6 billion per day in 2019.

“The 14% growth since the April 2019 Survey was the lowest triennial growth rate in all but two Surveys since 2004. This was despite data collection coinciding with heightened FX volatility due to changing expectations about the path of future interest rates in major advanced economies, rising commodity prices and geopolitical tensions following the Russian invasion of Ukraine. At the same time, Covid-19 restrictions in place in several reporting jurisdictions, including in China and Hong Kong SAR, may have suppressed turnover,” the report notes.

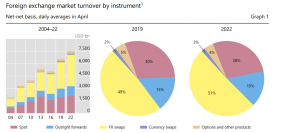

The increase in total FX turnover is mainly due to the rise in FX swaps, which is primarily used by market participants for liquidity management and hedging currency risks. This figure printed $3.8 trillion in 2022, adding over $600 billion or 19 percent up from $3.2 trillion in the previous report.

This overshadowed a 10 percent increase in spot trading, for which the average daily volume climbed by $100 billion to $2.1 trillion between 2019 and 2022. As such, the share of spot trades in global FX activity fell to 28 percent in 2022, down from $1.98 trillion or 30 percent in 2019. By contrast, FX swaps continued to gain in market share, accounting for 51 percent of total FX market turnover in April 2022.

In the most comprehensive report into the 24 hour-a-day FX market, which draws many conclusions that are broadly applicable in the global markets, the BIS says in terms of geographical distribution of turnover “FX trading continues to be concentrated in the largest financial centres.”

London retains role at the heart of the global Forex

Indeed, FX market activity (including spot, outright forward, foreign exchange swap, and option transactions) became increasingly concentrated in those major hubs, with the top five centers of London, New York, Tokyo, Hong Kong, and Singapore rising to 78 percent.

Elsewhere in its report, BIS notes that the ranking of these trading hubs remained unchanged compared to 2019. But within that, there were notable shifts. London remains the global FX trading capital by some distance, though its market share dropped five percent to 38 percent in April 2022.

Asia’s main centers – namely Hong Kong, Singapore, and Tokyo – saw their combined share of trading remain relatively stable after it rose slightly to 21 percent of the global total from 20 percent. However, the growth of activity among the Asian centres diverged. Turnover in Singapore rose to 9% of global turnover in 2022, from 8% in 2019, while that in Hong Kong SAR declined to 7% from 8% and that in Japan to 4% from 5%.

Dollar, Euro, Yen retain top ranks

In terms of specific currencies across the spot market, the US dollar strengthened its position as the world’s most dominant currency. The buck retained its dominant currency status on the side of 88 percent of all FX transactions, virtually unchanged from the prior survey.

Meanwhile, the euro’s role in world FX trading has decreased from three years ago. The single currency’s share fell to 30 percent from 33 percent, the BIS said. It was 39 percent in the same month a decade ago.

Meanwhile, the Japanese yen’s share was unchanged 17 percent, and it remained the third most actively traded currency. The sterling retained a 13 percent market share.

As in previous surveys, China’s renminbi also saw its market share advance to 7 percent. With $526 billion in turnover, the Chinese offshore currency remained the fifth most traded currency, up from eighth place three years ago and ranking just after the UK pound.