London Stock Exchange consults on shorter trading hours

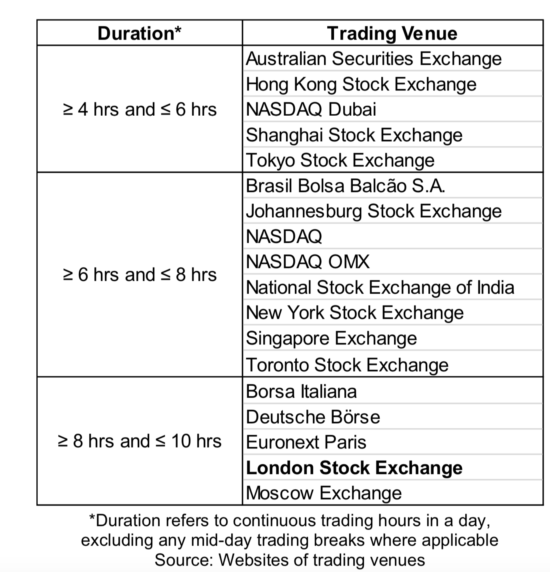

Equity markets in Europe are open for 8.5 hours, whereas most other global financial centres are open between 5-6.5 hours.

London Stock Exchange today launched a consultation with market participants on a potential adjustment to trading hours.

The Exchange notes that the Association for Financial Markets in Europe (AFME), representing banks and brokers in Europe, and the Investment Association (IA), recently published a proposal for European exchanges to review trading hours with the goal of benefiting market structure and improving wellbeing, culture and diversity across their member firms.

There is a general sentiment that a coordinated approach by European exchanges would be required in order for a change to be effective.

LSE therefore seeks feedback on the following potential proposals for Equity trading hours:

- A. 08:30 – 15:30 London time or

- B. 08:30 – 16:00 London time or

- C. 09:00 – 16:00 London time or

- D. 09:00 – 16:30 London time or

- E. Maintain the current time of 08:00 – 16:30 London time.

LSE notes that equity markets in Europe are open for 8.5 hours, whereas most other global financial centres are open between 5-6.5 hours. The Exchange would like to know if market participants consider that the longer hours in Europe a benefit to liquidity. Alternatively, market participants may consider the concentration of trading hours to increase turnover and liquidity.

Further, Europe has the geographic advantage of “bridging” between Asian and North American markets. A question related to this is: “Would a reduction of trading hours reduce the interest of non-European investors in trading European equities?”

The Exchange would also like to know what would be the anticipated impact for corporate issuers on European markets of adjusted trading hours and what would the implications be for equity options and futures markets if equity trading hours were shortened.

The list of potential impacts from adjustments to trading hours includes:

- Reduced overlap with US trading hours if the market close is earlier, or reduced overlap with Asian trading hours if the market opens later, with potential negative impact for Asian or US trading participants;

- Given major trading desks are pan-European, all main European trading venues would need to be aligned to maximise benefits;

- Changes to regulatory reporting times would require regulatory approval and also commitments regarding trading on Systemic Internalisers (SIs) and OTC.

The consultation document would be of interest to Trading, Technology, Operations and Compliance staff at Member Firms; Investment Firms; and all other relevant Stakeholders including Regulators, Issuers and Individual Investors.

LSE requests that interested parties provide a single, combined response per entity to the questions raised in the consultation document no later than January 31, 2020.