London Stock Exchange Group reports solid metrics for Q1 2019

Post Trade – LCH marked an income increase of 17% to £182 million, while Information Services saw revenues grow 6% to £214 million.

London Stock Exchange Group Plc (LON:LSE), or LSEG, has earlier today provided an update on its key performance metrics for the quarter to end-March 2019.

In the face of what LSEG dubbed “challenging market backdrop”, the Group managed to deliver solid results during the three-month period.

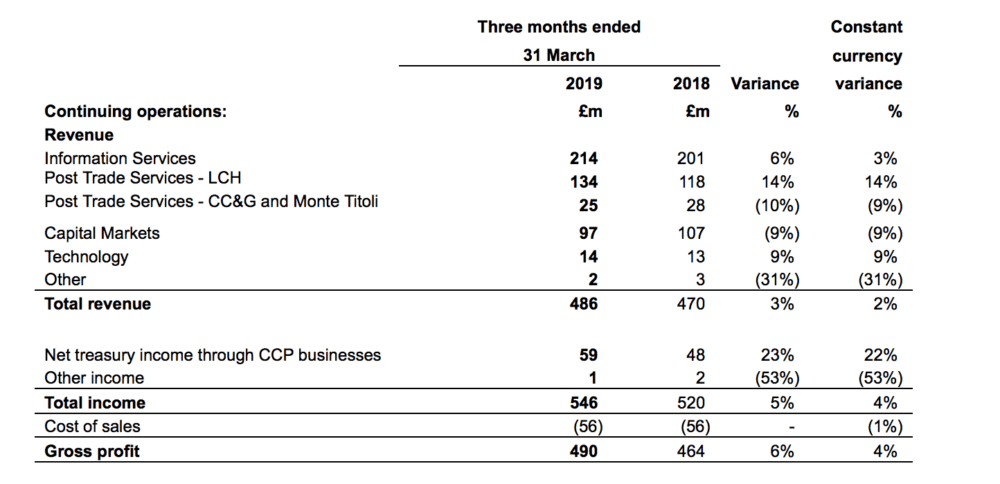

Total income was up 5% year-on-year in the first quarter of 2019 to £546 million.

The Information Services segment saw revenues grow 6% to £214 million – with 7% growth at FTSE Russell. Growth in index subscriptions remained strong while FTSE Russell asset-based revenues reduced due to reduction in AuM at the end of 2018 (which impacted on revenue in the first part of Q1 2019).

It is useful to mention at this point that, earlier this year, LSEG announced changes at the top of its Information Services Division. In January, LSEG announced the appointment of Waqas Samad as Group Director of the Information Services Division (ISD) and a member of the LSEG Executive Committee. Waqas Samad, whose appointment became effective immediately, will report to David Schwimmer, CEO, LSEG.

Post Trade – LCH marked a 17% increase in income to £182 million, with 16% revenue growth in OTC following record volumes at SwapClear and no discernible change to customers’ use of the service as equivalence secured in event of hard Brexit. LCH benefited from an updated SwapClear agreement with partner banks, with effect from the start of the year, estimated to deliver c.£30 million savings to cost of sales in 2019.

Post Trade – Italy, however, registered a 4% drop in income to £36 million as equity markets experienced a slow first quarter. After adjusting for the treatment of T2S costs, gross profit increased 3%.

Capital Markets saw revenues decline 9% to £97 million, mostly reflecting lower equity trading volumes.

Technology Services marked revenues growth of 9% to £14 million.

David Schwimmer, CEO said:

“We continue to execute our strategy across our core businesses of Information Services, Post Trade and Capital Markets. In Post Trade, we acquired a stake in Euroclear, which shares our open access approach, and we updated our SwapClear agreement, which will deliver significant savings as we further develop the service.

“We are investing in and growing our Information Services business, including developing our multi-asset and data and analytics offering. While equity markets were slower due to macroeconomic uncertainty, we have seen an improved listing environment in Q2.

The Group’s financial position remains strong and is broadly unchanged from that reported for 31 December 2018. As at 31 March 2019, having funded the purchase of a 4.9% stake in Euroclear, the Group had committed facility headroom of over £750 million available for general corporate purposes.