Lords Committee turns to academics for opinion on post-Brexit financial supervision

The EU Financial Affairs Sub-Committee will hear evidence on how financial regulation and supervision can evolve following Brexit in order to ensure financial stability and preserve market access.

The UK Parliament has turned to academics for their opinion on how financial supervision will change following Brexit. The EU Financial Affairs Sub-Committee is scheduled to hear Eilís Ferran, Professor of Company and Securities Law, University of Cambridge, and Niamh Moloney, Professor of Law, London School of Economics, with the hearing scheduled for Wednesday, September 13, 2017.

The possible topics of discussion cover the impact Brexit might have on the direction of EU financial governance, the role played by the European Supervisory Authorities (ESAs) in shaping the EU’s financial regulation and how the UK might maintain its influence on the process. Other possible areas of discussion include the main legal obstacles to an agreement on financial services, the options for a transitional arrangement covering financial services, and the regulatory position of FinTech.

The EU Financial Affairs Sub-Committee launched the inquiry into the future of financial regulation and supervision following Brexit in July this year. The focus of the inquiry is how financial regulation and supervision can evolve following Brexit so that financial stability is ensured. The Lords Committee is also examining how to maintain some other form of close relationship between the UK and EU regulatory regimes in order to preserve market access. The inquiry will encompass an assessment of not only the body of regulation, but also the institutional structures that support it.

Brexit, of course, is one of the priority matters for all UK institutions, including financial regulators. Recently, the Financial Conduct Authority has published the results of a survey of companies it regulates. Only 14% of respondents said they feel that the FCA is communicating effectively with them on the process of preparing to exit the European Union.

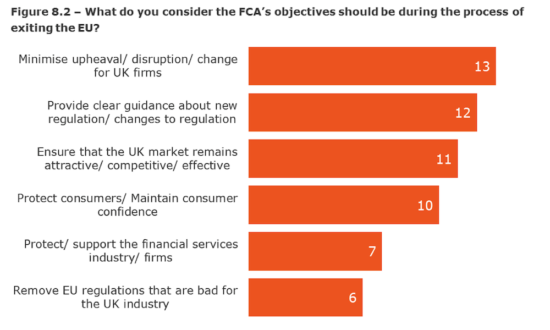

When firms were asked what they consider the FCA’s objectives should be during this process, the most common responses were to “minimise upheaval/ disruption for UK firms”, and to “provide clear guidance about new regulation/ changes to regulation”.

“Protecting consumers” and “protecting the financial industry” did not make it to the top three responses.