Lucid Markets confirms it is for sale, still no clarity on potential deal

Lucid Markets is being “actively marketed for sale in 2017” but there is no information on a particular deal, whereas the company continues to provide liquidity to the FX market.

Last week, FXCM UK published its annual report for 2016, with all eyes being on any consequences on the UK business of FXCM Group following the February settlements with US regulators. While FXCM UK provided somewhat of a bullish stance saying that it faces no action from the UK Financial Conduct Authority (FCA) over its business practices, other companies belonging to the FXCM Group were less upbeat in their reports.

Lucid Markets LLP has been marked for sale since 2015 and has reiterated this in its annual report for 2016 that has just become available on the UK Companies House website. Lucid Markets LLP is an electronic market maker and trader in the institutional foreign exchange spot and futures markets. Its immediate parent is Lucid Markets Trading (LMT), also incorporated in England and Wales. LMT is 50.1% owned by FXCM UK Merger Limited, which in turn is 100% owned by FXCM Group, incorporated in Delaware. Global Brokerage Inc (NASDAQ:GLBR), formerly known as FXCM Inc, is the ultimate controlling undertaking and operates and controls all of the businesses and affairs of the FXCM Group and its subsidiaries.

During 2016, Lucid Markets continued to provide liquidity to the Forex market but registered annual profit, excluding amortization, of $11.99 million, down 43% from $21.2 million in 2015. This reflects a 29% year-on-year drop in turnover to $26.3 million. This drop is attributable to decrease in currency volatility.

Lucid Markets LLP has only two designated members as per the latest report: Catalina Algorithmic Investments Limited and Lucid Markets Trading Limited.

With regards to the future, the report does not say much. Lucid confirms that it is actively marketed for sale in 2017, as FXCM is trying to dispose of certain retail and institutional assets. The report does not provide any information on a particular deal or a bidder.

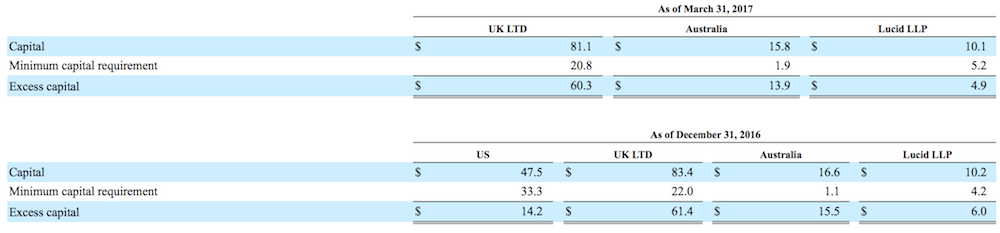

Lucid’s report states that the company has adequate resources to ensure that it will be able to meet its ongoing obligations for at least 12 months from the date of signing the statutory accounts and will have enough capital to meet all of its regulatory requirements.

This broadly reflects what Global Brokerage said in its financial report for the first quarter of 2017.

Global Brokerage has insisted that it plans to sell its remaining interests in institutional businesses, which include Lucid, V3 and FastMatch, and continues to actively market these businesses.

The question that remains open is how much longer FXCM will continue to shop around for the best offer for its institutional businesses. The problem is acute given that FXCM is running out of time to gather cash to repay its Leucadia loan, with the risk of default being present due to low market capitalization of Global Brokerage Inc and the possibility of the company being delisted from NASDAQ.