Lucid Markets has CPO registration exemption withdrawn in USA

The change, shown in the BASIC system of the National Futures Association, is effective March 4, 2019.

There has been an update on the US status of Lucid Markets, one of the businesses in the “FXCM family”, which the broker has actively marketed for sale.

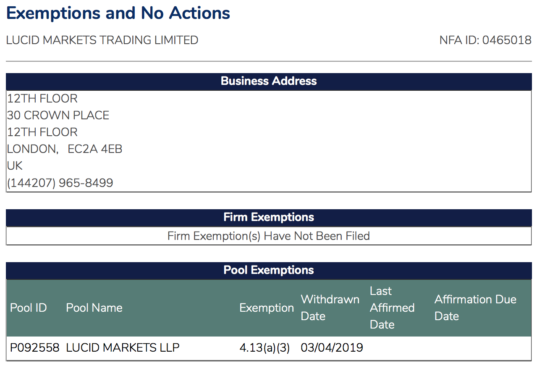

Effective March 4, 2019, Lucid Markets Trading Limited has its Commodity Pool Operator (CPO) registration exemption withdrawn. The change is reflected in the BASIC system of the National Futures Association.

A commodity pool operator (CPO) is an individual or organization that operates a commodity pool and solicits funds for that commodity pool. A commodity pool is an enterprise in which funds contributed by a number of persons are combined for the purpose of trading futures or options on futures, retail off-exchange forex contracts, or swaps, or to invest in another commodity pool.

CPO registration is required unless the CPO qualifies for one of the exemptions from registration outlined in CFTC Regulations 4.5 or 4.13. In the case of Lucid Markets, it had an exemption under 4.13(a)(3). Put simply, this exemption provides relief from CPO registration in cases where the pool trades minimal amount of futures.

The change is barely surprising, given that, in November 2018, Lucid Markets LLP stopped being authorized by the UK Financial Conduct Authority (FCA). The change of company status, effective November 23, 2018, is reflected in the UK Financial Services Register.

In January 2018, the designated members of Lucid Markets LLP, a wholly owned subsidiary of Lucid Markets Trading Limited, announced their intentions to sell the exchange memberships and wind down the LLP in an orderly manner. The reasons for this decision were recent losses and that current projections saw no medium to long-term return to profitability for the LLP. The partners have informed the relevant regulators of the partnership’s intention to exit the market.

According to filings with the UK Companies House made in early October 2018, as a result of the decision to wind down the LLP, Lucid Markets Trading Limited will be subsequently wound down and dissolved once the LLP wind down process is complete.

For that matter, let’s note that the status of Lucid Markets Trading Limited on the UK Financial Services Register has been changed to “inactive”.