Lucid Markets LLP applies to cancel FCA authorization

The change in the authorization status of Lucid Markets LLP happens after earlier this year members of the partnership announced their intentions to sell the exchange memberships and wind down the LLP.

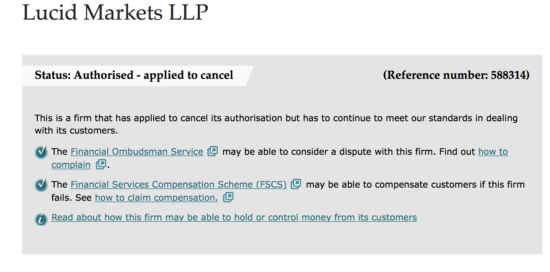

Further to FinanceFeeds’ report from earlier in 2018 about plans by Lucid Markets LLP to close, the company has changed its authorization status, as per information available on the UK Financial Services Register.

The status of the company now says “authorized – applied to cancel”. The status was changed on November 1, 2018.

On January 29, 2018, the designated members of Lucid Markets LLP, a wholly owned subsidiary of Lucid Markets Trading Limited, announced their intentions to sell the exchange memberships and wind down the LLP in an orderly manner. The reasons for this decision were recent losses and that current projections saw no medium to long-term return to profitability for the LLP. The partners have informed the relevant regulators of the partnership’s intention to exit the market.

According to filings with the UK Companies House made in early October this year, as a result of the decision to wind down the LLP, Lucid Markets Trading Limited will be subsequently wound down and dissolved once the LLP wind down process is complete.

Lucid Markets was among the businesses in the “FXCM family”, which the broker has actively marketed for sale. In May last year, FXCM announced the sale of its stake in FastMatch to Euronext. Euronext subsequently increased its holding in FastMatch to approximately 97.3%. This happened after Euronext purchased the remaining shares owned by Dmitri Galinov, co-founding CEO of FastMatch.

Talking of FXCM disposing of non-core assets, let’s mention a SEC filing which has shown that in August 2017, V3 Markets, LLC (V3), another of the businesses that FXCM has actively marketed for sale, sold certain intellectual property and fixed assets. An unnamed buyer paid $0.3 million in cash. Also, as part of the transaction, the buyer agreed to reimburse V3 for certain liabilities and contract costs incurred by V3 for a prescribed period of time before and after closing amounting to $0.2 million. In conjunction with the sale, V3 ceased its remaining operations.