Lucid Markets LLP to close due to losses

The members of the partnership have decided to sell their exchange memberships and to wind down the business.

Further to FinanceFeeds’ earlier report about a major reshuffle at the Lucid Markets LLP’s members list, there has been an update from the company. According to the latest filings with the UK Companies House, Lucid Markets LLP is going out of business. The reason for that – heavy losses.

According to the annual report for 2017, the designated members have announced their intention to sell the exchange memberships and wind down the business. The reasons for the decision include recent losses and projections for no medium-term to long-term return to profitability for the Lucid group of companies, including Lucid Markets LLP.

The relevant regulators have been informed of Lucid Markets LLP’s intentions to exit the market.

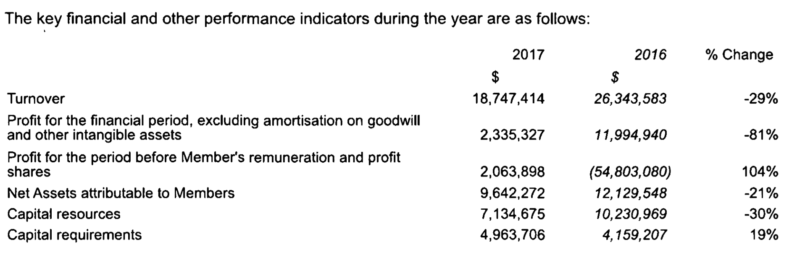

Let’s mention some performance numbers now.

The profit for the year to December 31, 2017, fell 81% from the preceding year to $2.34 million. Turnover was down 29%, whereas capital resources were down 30%.

Lucid Markets was among the businesses in the “FXCM family”, which the broker has actively marketed for sale. In May last year, FXCM announced the sale of its stake in FastMatch to Euronext. FXCM Group has said that it will receive approximately $55.6 million for its interest in FastMatch, with a portion held in escrow and subject to certain future adjustments including a share of a $10 million earnout if certain performance targets of FastMatch are met.

A SEC filing has shown that in August 2017, V3 Markets, LLC (V3), another of the businesses that FXCM has actively marketed for sale, sold certain intellectual property and fixed assets. An unnamed buyer paid $0.3 million in cash. Also, as part of the transaction, the buyer agreed to reimburse V3 for certain liabilities and contract costs incurred by V3 for a prescribed period of time before and after closing amounting to $0.2 million. In conjunction with the sale, V3 ceased its remaining operations.