M4Markets parts ways with marketing head Themis Christou

Seychelles-regulated brokerage firm M4Markets firm has parted ways with Themis Christou who held several marketing roles for nearly two years.

Mr Christou, whose career in the FX industry spans more than 13 years, has served most recently as Group Head of Marketing. Prior to M4Markets, he spent more than four years at London-based brokerage firm, Tickmill.

During this long stint, he worked his way up through several senior roles with the firm, culminating with the position of interim chief marketing officer (CMO). Christou’s career also encompasses other stops at forex broker Orbex where he served as the group’s senior marketing executive.

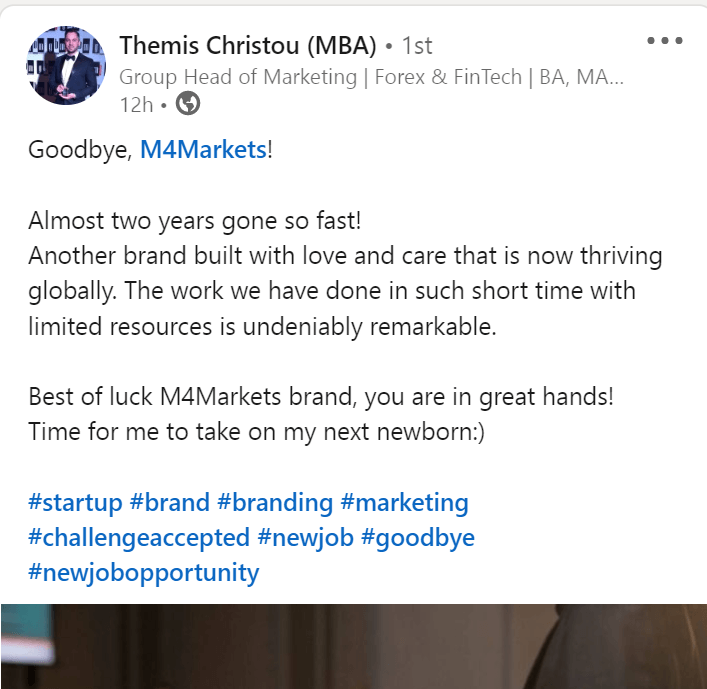

Without revealing his next destination, Themis confirmed in a Linkedin post that he is leaving M4Markets on good terms.

Established in 2019, M4Markets is the trading name of Trinota Markets Global Limited. The broker maintains its head office in the Seychelles and is licensed by the country’s Financial Services Authority (FSA).

The firm was in the news recently after it picked up some investment from Cyprus and Dubai based investors in a new funding round that it will be using to grow its business.

The lesser-known platform has not shared any details about the capital injection amount. M4Markets also didn’t disclose the identity of the investors participating in the financing round, though it says they acquired a significant stake.

The new funds will go towards product development and will allow M4Markets to continue its expansion plans by penetrating new markets. The company also intends to use the new capital to further develop its platform, accelerate growth and launch into new regions in line with its plans to become a global brokerage house.