How to make your brokerage visible to Chinese clients – Investigation

Full report: It is not just a case of avoiding being blocked. This is how to structure YOUR company when approaching an all important Chinese client base.

For quite some years, the retail FX powerhouse has been China, however unlike the three major financial centers which are synonymous with long-standing, highly regarded FX brokerages, those being London, New York and Sydney, China’s B2B environment is largely centered around the sheer size of the end users and their respective portfolio managers and introducing brokers.

Yes indeed, some domestic market brokerages have come to fruition recently, however, the vast majority of large introducing brokers, portfolio managers, which are the entities with the substantial client bases across the mainland’s first and second tier cities, prefer a B2B relationship with British or Australian FX firms.

This simply means that in terms of structure, China is completely a B2B environment in that it is the introducing brokers that are the tours du force, not the small, recently established Chinese retail FX brokerages, because the retail customers of introducing brokers are usually discerning, loyal investors – not traders, but investors – who entrust their portfolio to introducing brokerage houses that have proper commercial structure including portfolio management, most of which is conducted on MetaTrader 4 terminals, connected to automation software that is often developed in house, and transacted via MAM accounts.

A fantastic and very effective structure it is.

Brokerages with good credentials in the West can reduce their cost and increase their revenues tremendously by simply partnering with highly organized IBs, most of which are operated very similarly to a brokerage itself, and therefore the firm that business is being referred to simply needs to operate an omnibus account and perform the trade execution.

The entire client-facing side is handled by the IB, and if done correctly, as in the case of GKFX, FXCM, FXDD and what was FXSolutions and is now GAIN Capital, can form a vast proportion of a brokerage’s core business.

All four of those companies have the vast majority of their business in China, all of which is conducted via a large network of IBs across second tier development towns.

Indeed, in the case of FXCM, whose Chinese entity is still completely in tact and is going from strength to strength whilst its international operations are in tatters, as well as FXDD whose presence in its traditional markets has dwindled, marked by its exit from the US some years ago, would likely be in a very different commercial position if it were not for the efforts of former COO Lubomir Kaneti in establishing the firm as a household name across China.

For firms with more of a holistic approach, China has also been a major priority.

Saxo Bank’s direction in providing an entire technology solution to institutions, hedge funds and large IBs across China is evident in the level of B2B customer that engages with the firm, as is the firm’s address toward those companies, looking at the entire electronic financial services landscape from a technologically disruptive point of view.

This is where the future lies. Not so much with regard to how to garner clients, as that is relatively simple if the firm has a good reputation, is based in a center that is synonymous with the FX industry and is willing to put a great deal of effort into visiting B2B customers in China on a regular basis to evolve the relationship, but more in terms of how to structure the environment once a good degree of business has been garnered across the country.

On the retail side of the business, it is very easy to consider the evolution of the technological possibilities today to be a vehicle which can propel a firm forward, largely due to the ability to simply call a provider and ask them to connect a white label MetaTrader 4 system to a customer via an API, and subsequently to a liquidity source or price feed.

The difficulty here is that in some cases, within smaller MetaTrader 4/5 brokerages, the senior management are from the financial and trading industry, and are less au fait with technology, hence the propensity toward buying an off the shelf solution.

Concentrating on sales and relationship building is one thing, but without the correct visibility in China – that being whether nor not customers can see the website of a brokerage, whether its content is allowed to be advertised on Chinese media sites, and whether the trading topography can be used without being subject to blocking by the Chinese government.

First of all, connecting to an API feed is illegal in mainland China, largely because by doing so, it allows free movement of data via dedicated connectivity, to and from mainland China from outside of China, meaning that the government cannot supervise the data being transferred.

This means that an infrastructure-neutral brokerage with MetaTrader as its platform will never be able to connect said MetaTrader platform which is resident on a Chinese IB or brokerage’s infrastructure to its own hosted services outside China, as the government would block it within two minutes, and then de-list the company from Baidu, China’s national search engine, as well as block the payment channels and freeze bank accounts.

Due to the government’s holding in all major entities in the mainland, the connection of an API would result in the entire presence of the company being removed from existence and not searchable by anyone, and its assets frozen.

FinanceFeeds is aware of several cases in which this has occurred.

An effective means of countering this is to use a liquidity integration solution that is owned by a Western firm and is an industry-specific standard, such as Gold-i which has an office in Shanghai and is operated as a WOFE there, hence is a Chinese company, or PrimeXM, which also has an office in Shanghai.

Both liquidity integration companies run their Chinese operations completely from within China, hence the government would be able to ‘see’ their infrastructure, hence sustainability is guaranteed.

oneZero, whose expertise is well recognized in this area, recently explained in an interview with FinanceFeeds “Having your trading system, connectivity solution and liquidity provider located in same venue is the best protection against many types of toxic flow. We also do our best to optimize the broker’s connection to their end clients, with dedicated connectivity into China and other key regions.”

Alternatively, Fortex has a significant presence in China, and, when onboarding its technology, brokerages would be able to operate their order flow in and out of China to connect to liquidity on a global scale without impedance, and Saxo Bank can provide an end to end solution from within China, its offices being within the bounds of the firewall.

Once this is considered, it is important to use a CRM, broker solutions and back office systems provider that has full functionality in China, and knows how to structure a brokerage system in the method preferred by Chinese users. An example of this is LEANWORK, which has an office in Cyprus, but is a Chinese company operated by Darren Qian, and hence the solution provided is specific to approaching a Chinese client base.

It is not viable to look toward operating from Hong Kong as a retail brokerage, as it is a misconception that this gives access to retail FX customers with no restrictions, as Hong Kong is, although a Special Administrative Region of China, still very much open to the global internet and therefore subject to blocking of data just as is any other part of the world.

Institutional providers with business on the mainland are able to operate their relationship-based business very well from Hong Kong, and this is preferable due to their vital connections with Tier 1 banks, Hong Kong being an institutional center for the APAC region, however retail firms that take liquidity from Hong Kong based suppliers, with a need to advertise on retail, market-related Chinese media and ensure that their presence on websites and compatibility with browsers that are subject to content scrutiny all the time by Chinese authorities would not be able to do so.

Websites themselves are critical.

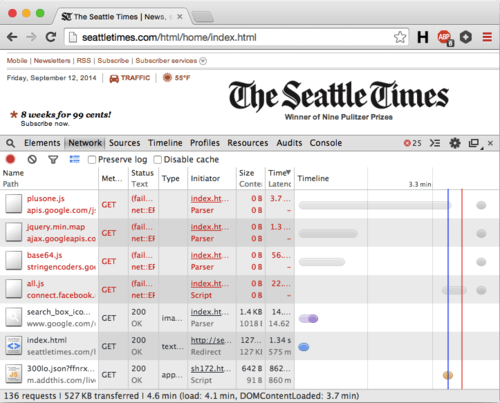

Let’s say you’re a Chinese citizen and internet user from within China – ie a potential or existing retail FX customer or IB, and want to look at any foreign website, for example, the Seattle Times. While some US media like the New York Times is blocked, the Seattle Times isn’t.

This, however, does not mean that as a brokerage, it is possible to just avoid any code or reference in websites to Google, the New York Times, or Facebook.

Many retail firms have been discussing the ‘liberalization’ of the Chinese government toward websites recently, but are basing this on business trips to China during which they have been able to access certain reportedly blocked websites, thinking that China is now not blocking sites, so they don’t need to consider that anymore.

This is a false sense of security, because what has actually happened is that China’s firewall technology and surveillance systems are just more and more sophisticated, allowing certain sites without ‘sensitive’ information, or that are not offering banned activities or products to Chinese citizens, to be read, however they are being passed through a monitoring system to start with.

Here is what happens if you try to load the Seattle Times when in China:

Google’s Content Delivery Network (CDN), which is very fast and is used as a benchmark measure of website performance and contributes to its indexing on Google in other regions, is incredibly slow in this case.

In this example by Edward Jiang, Google Chrome reports that the DOM took 3.7 minutes to load! The majority of the time, Chrome was waiting for jQuery, Google+, and Facebook’s APIs to timeout. In addition, the site is partially broken, because jQuery is missing.

This would happen to most retail FX brokerages, even if the site has been translated in a rudimentary fashion into Chinese language from outside of China, because ultimately the same code and APIs are present as they would be in the domestic market site.

On the mobile app side of things, you’ll also face an interesting challenge when distributing your apps. Yes, there is Android and iOS, but the Google Play store is not accessible in China, so you’ll have to rely on many-many specialized app stores instead. There are 500+ app stores, and you need to target at least the top ones to get a decent reach.

Instead of attempting to engage traders via apps, most of which are blocked or have reduced functionality in China, all data and customer engagement should be done via WeChat, ensuring that the brokerage account (WeChat offers commercial channels with full functionality) with WeChat is pushing information to IBs on a regular basis. Not to customers, but to IBs.

So let’s assume that a system can be hosted locally in China, and that the right connectivity to deliver the content has been established, in this scenario, it is important to look at how it will be accessed by a broker’s target audience – usually IBs – also has local challenges.

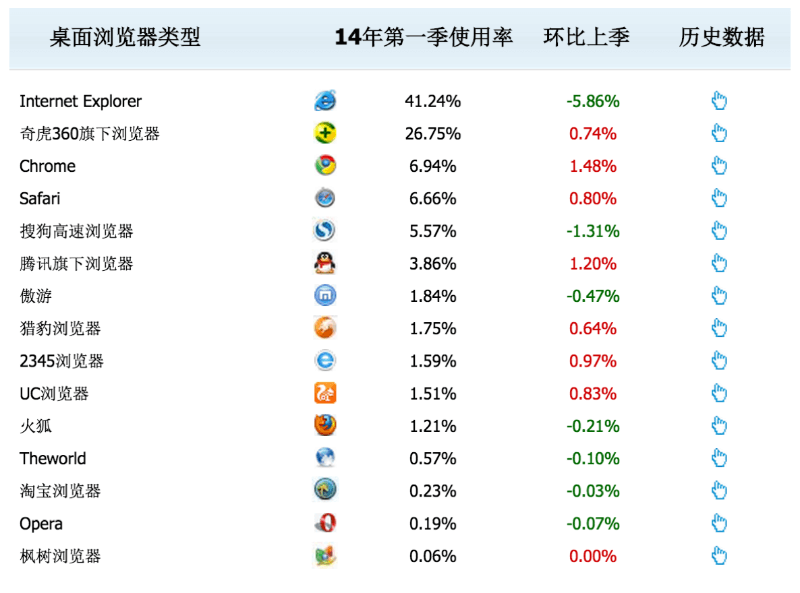

If building websites, it is likely that a broker already has a matrix of mainstream browsers to support – but it is critical to be prepared for some more. First of all, there are just more Windows XP-legacy devices out there, running old-old versions of Internet Explorer.

Then there are local market-leading browsers many brokerages have either never heard of, nor tested their hosting and site content/coding on and are unable to do so from outside of China. Examples of these include the 360 security suite that is so widely spread on desktop and mobile devices, its built-in browser is the second most popular browser in China. There are also browsers specialized for online gaming, or built into other social apps that are used in many domestic households and with which IBs are familiar, as this is what their end users are operating.

Leverate’s Itai Damti explained to FinanceFeeds last year exactly this. “In the West we have a well recognized landscape in terms of operating systems across mobile and desktop platforms and browsers. The situation in China is very very different. In South East Asia, it is usually mobile and it is easy because it is all based around Android and Apple devices, but in China it is very different” he said.

“When we distribute apps in the West, we do it via Apple Appstore or Google Play, but Google Play is blocked in China. Some have hacked versions of Apple or Google apps available but are fake. Some vendors suddenly find that they have hundreds of users that they didn’t know about!” – Itai Damti, Leverate

“In terms of web, there is a browser called 360 which is the second most popular browser in China, after Internet Explorer 6 so the platforms are very old” said Mr. Damti.

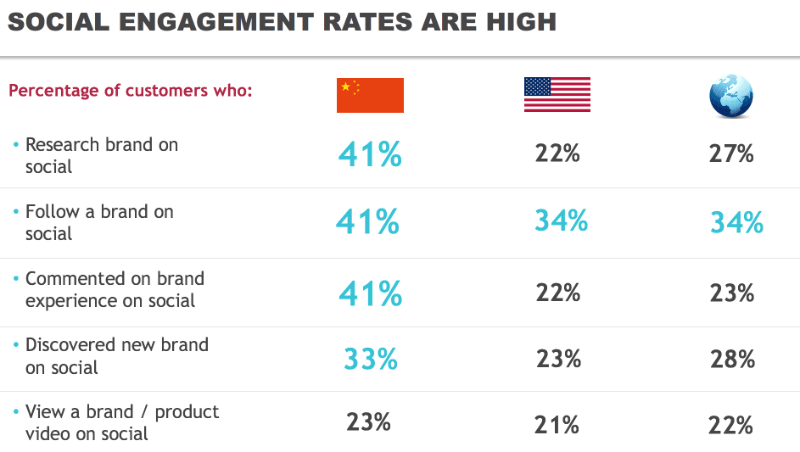

Indeed, whilst the browser and internet access structure is completely different, so is social engagement.

In China, social media, and to be specific, domestic social media, dominates business.

Media, whether televised or internet based, online or offline, is a major tour de force in China. Companies that have succeeded in this sector within the mainland have often poured marketing budgets into mainstream television advertisements, billboard posters, radio and internet campaigns.

This stresses the importance of being inside China, and not on the outside.

China may well indeed be a land of opportunity, however its internet is domestic, its payment solutions systems and banking infrastructure is domestic, and the entire environment in which the country which powers the entire world’s industrial, commercial, intellectual and financial world is impenetrable to the outside world, and vice versa.

Joining FinanceFeeds at a discussion in Guangzhou in January this year was a senior executive from Chinese cross-platform mobile messaging firm WeChat, which is very similar to WhatsApp in its functionality, however is for the domestic Chinese audience.

WeChat has become a vital tool in use among all introducing brokers. FinanceFeeds has met with introducing brokers across the country which have portfolios of over $250 million onder management, all of whom use WeChat as the main source of media as well as connection with their customers.

WeChat themselves highlighted to FinanceFeeds that introducing brokers are reliant on developing massive WeChat networks in order to scale and expand their business as well as using it as the sole means of contact for clients, regardless of size or amount of assets under management.

This, in itself is another indicator that having presence in China in terms of full operational capacity is the only way ahead.

Some accelerators may be needed, such as Mobile China which is a WeChat strategy for retail brands, or the B2C eCommerce Accelerator for WeChat, both of which are heavily supervised by the government.

Working with media firms that are experienced in the Chinese business environment and have vast connections in China is vital, and from a Western firm’s perspective, FinanceFeeds offers just that, as our Chinese entity, FinanceFeeds China, under the site www.financefeeds.cn is a completely Chinese entity and is operated, hosted and resident within China’s mainland.

This way, connecting Western firms to all important Chinese IBs is sustainable and all content, articles, editorials and news from and about companies, as well as their advertising banners will always be displayed correctly and will reach an entire audience.

Finally, the Chinese government blocks websites owned by individuals, even if the individual is Chinese and has applied for a Beian (Chinese website operator) license for a top level .cn domain.

The government will never allow any individual to hold a Beian licence for a commercial website, hence a Chinese company needs to be established, owned by Chinese executives and have a Chinese government stake and supervision element, in order to be granted a Beian license.

For further information on the range of services that FinanceFeeds can uniquely offer your brokerage to better maximize client acquisition and streamline commercial operations in China, contact [email protected]