Marshall Gittler: “Widening cross currency basis suggests continued support for dollar rally”

By Marshall Gittler, Head of Investment Research, FXPRIMUS There are lots of reasons to expect the dollar to continue to rise in 2016. For example, many observers expect that “monetary policy divergence” – the widening interest rate differential between the US and other countries – will underpin the US currency as the Fed starts hiking […]

By Marshall Gittler, Head of Investment Research, FXPRIMUS

There are lots of reasons to expect the dollar to continue to rise in 2016. For example, many observers expect that “monetary policy divergence” – the widening interest rate differential between the US and other countries – will underpin the US currency as the Fed starts hiking rates while other countries look for ways to ease policy further. Falling oil prices and increased US production should narrow the US trade deficit. And rising geopolitical tensions around the world means more demand for assets in the largest, most liquid and safest market of all.

In addition, there’s one other reason that’s not widely known: the widening of the cross currency basis.

What is the cross currency basis?

When a bank that doesn’t have much in the way of dollars – for example, a Japanese bank whose deposits are mostly in yen – wants to make an international loan in dollars, it has to raise the dollars somehow. It could borrow the money from the market and then lend it out again to the customer. However if it does that, it could never compete with US banks, which can always raise dollars more cheaply from their own depositors.

A cheaper way for non-US banks to raise dollars is through the FX market. A bank can take its own currency and sell it for dollars with an agreement to buy it back at a certain time in the future at the same exchange rate. This is called a cross-currency swap.

In theory, the cost of this arrangement should be determined by the interest differential between the two currencies. The Japanese bank has to pay its depositors interest in yen. On the other hand, it would earn interest in dollars while it was holding the dollars during the transaction. The difference between what it pays to borrow yen and what it earns from holding dollars should determine the cost of the swap.

That’s because if the price gets too far away from this rate, other investors will see an opportunity and do the transaction in the opposite direction (borrowing dollars, switching them into yen and putting them on deposit), thereby pushing the cost back into line with its theoretical price.

However, sometimes the actual price does get out of line with the theoretical price. That’s because sometimes the market is largely one-way – there are so many more people who want to put on the transaction in one direction than there are people willing to take the other side that the price has to move far away from the theoretical price to entice people into the other side of the trade. That difference is called the basis.

“The cross-currency basis – the difference between the theoretical price to borrow a currency and swap it into another currency and the actual price – indicates the supply/demand balance of a currency by showing how much people are willing to pay to borrow dollars using their currency. The more negative it is, the more people are paying to swap their currency into dollars.” – Marshall Gittler

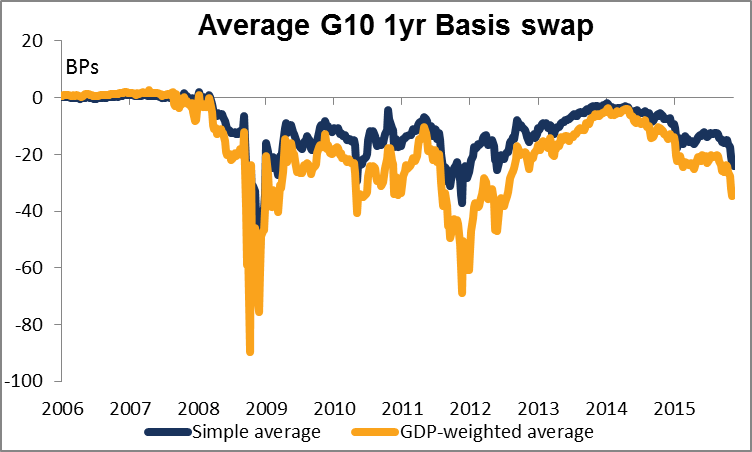

And the basis is widening out, and sharply. As the first graph shows, it’s nowhere near where it was back in the traumatic days of 2008, before the Fed instituted various swap arrangements with other central banks to alleviate this funding pressure. Nor is it back to where it was when the markets were worried about the health of the European banking system back in 2012. But it is widening out again.

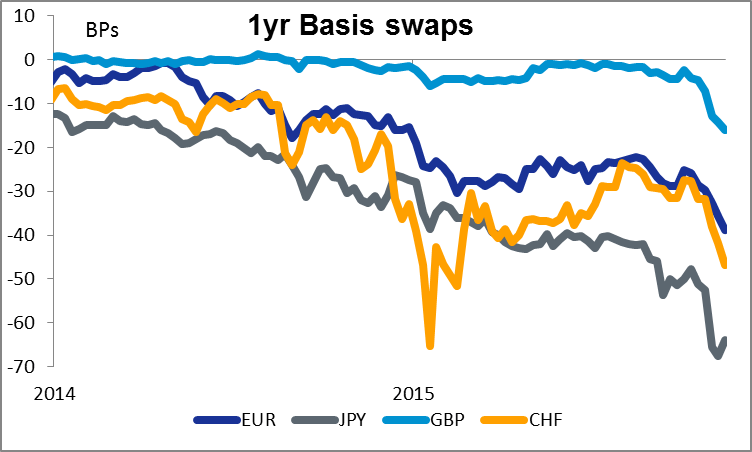

This move is not restricted to any one currency, unlike previous bouts, when it happened largely to the yen or the euro. It’s happening across the board in various currencies. Even GBP, a currency that investors rarely use for funding trades, is seeing its basis widen out.

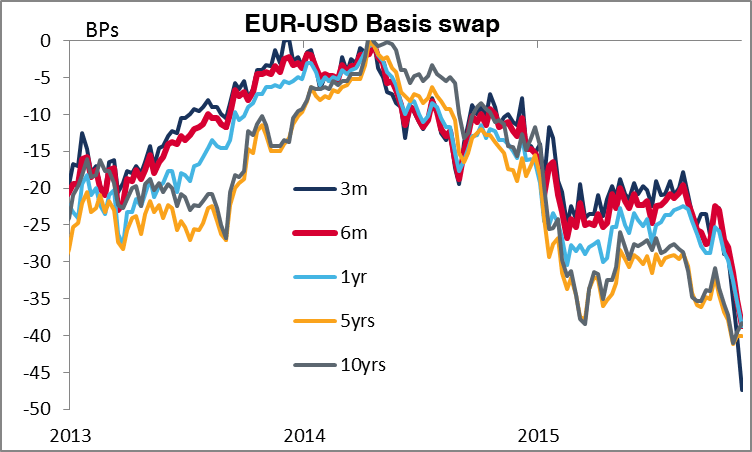

Nor is this just a temporary crunch caused by the approach of the year-end. The phenomenon is happening across maturities.

My guess is that this widening out comes largely from two sources:

Companies in EM countries increased their dollar-denominated debt dramatically over the last few years. Now, with their currencies weakening, global trade slowing and US interest rates rising, they are having problems rolling over these debts.

The Fed is becoming less accommodative in supplying dollars. At the same time, other central banks, notably the ECB, the BoJ and the SNB, are becoming more accommodative. Banks and traders alike may be switching their funding into these currencies and using to finance everything from trade credit and loans (see above) to equity investments and carry trades.

Other sources of pressure have been mooted, such as changes in regulatory requirements.

In any event, what the widening basis signals is this: demand for dollars is increasing while the supply of other currencies is increasing. The widening basis is an indication that the supply/demand balance for dollars is shifting. The causes of the widening are not likely to go away any time soon; the EM debt is here for years, while the monetary policy divergence between the US and the rest of the world is just getting started. I expect the basis to widen further and for the imbalance that it reflects to manifest itself in a further rise in the dollar in 2016.

Marshall Gittler is a renowned expert in the field of fundamental analysis, with over 30 years’ experience undertaking top level research of the financial markets. His career spans a range of elite investment banks and international securities firms including UBS, Merrill Lynch, Bank of America and Deutsche Bank. Marshall has most recently established himself as global thought leader for clients of FXPRIMUS – a global provider of online forex trading – educating and delivering insightful FX research, helping traders to make the best trading decisions.