MercerFX: Who really ran away with the client funds? – FinanceFeeds investigates

MercerFX investigation: we speak to Mr. Ashok Kumar whom is claimed to have purchased the MercerFX book to hear his side of the story.

Last week, FinanceFeeds reported that retail FX brokerage Mercer FX had taken its website offline, opting for a loading screen that had been coded and installed server side which made users think that there was a difficulty in loading, when in actual fact it was nothing to do with the quality of internet connection, and everything to do with a company that has run away and closed its operations down.

This comes three months after FinanceFeeds reported that the company had been the subject of a series of complaints to the New Zealand FMA containing allegations of fraudulent practices which date back to 2014.

Following our contact with former CEO Jake Amar, who maintained that he is no longer connected with the company by stating when questioned by FinanceFeeds “this is not related to me anymore” Mr. Amar maintained that he sold the company to an individual who goes by the name of Ashok Ashok (pictured below, real name Matthew Ashok Kumar).

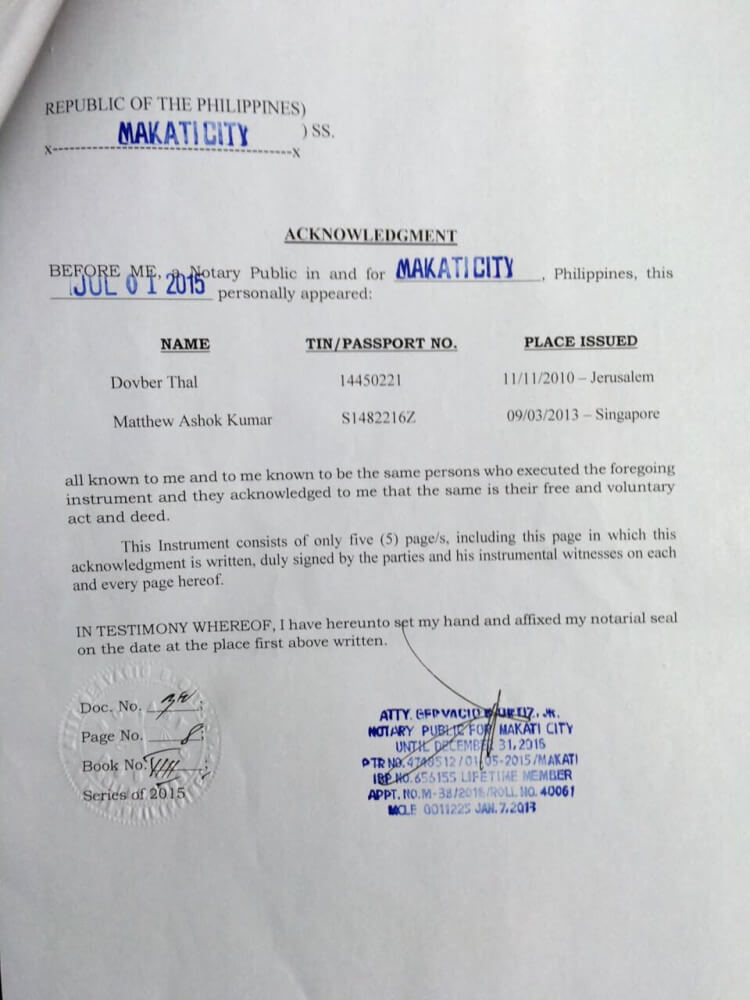

Mr. Amar presented documents to FinanceFeeds showing that the company had been sold, and that Mr. Ashok Kumar had bought the client book.

In the quest to investigate this matter fully, FinanceFeeds today spoke to Mr. Ashok Kumar, who denies that he bought the company or any of its client assets from Mercer FX, and when shown the document that states that the document, signed by Dovber Thal (known as Dubi, Mercer FX’s Operations Manager and not a shareholer) and Matthew Ashok Kumar, is a forgery, and that he did not purchase any aspect of Mercer FX.

Mr. Ashok Kumar claims that he has never seen this document before, and that the signature is incorrect, and that the city (Makati, Phillippines) is somewhere he has no knowledge of.

Mr. Ashok Kumar explained that he was employed as Head of Education, and was encouraged to bring his client base from the Asia Pacific region to Mercer FX, which he subsequently began to do.

“Mercer FX cheated all the traders in the Asia Pacific region that I brought to the company” he said this morning. “I was the head of education, I was not a shareholder and I do not own any part of this company” continued Mr. Ashok Kumar.

When asked by FinanceFeeds what aspects of the company were sold, why its website is offline and who closed it down, Mr. Ashok Kumar said “Three executives in the company owned the company until the end.

“They are the only people with access to the bank accounts, and they took the money” said Mr. Ashok Kumar.

This does not match what was explained to FinanceFeeds by Mr Amar when he was contacted by us last week when the site went offline.

Mercer FX continues to maintain that it sold the entire operations to Ashok Ashok, however a contract which details the transaction states that Mercer FX sold the client book for Asia, UK, Netherlands and New Zealand.

When this was pointed out, the company provided a statement to FinanceFeeds stating “As you can see, it is also mentioned there that all the managed accounts and EA users have now been transferred to Mr. Ashok Kumar.”

Mercer FX maintains that the net assets of the combined client list was $600,000, and that according to Mr. Amar, $400,000 was paid out to customers. “I guess the rest didn’t get anything” he said.

“Mr. Ashok Kumar killed the company” alleged Mr. Amar, “There are no regulations of course, and absolutely no recourse.”

However, Mr. Ashok Kumar’s version of events differ significantly from this.

“My traders were all cheated” said Mr. Ashok Kumar.

“The total amount was about USD$1.2 million, all from clients in the Asia Pacific region. The company owners are liars and scammers, and there are several complaints on various internet portals” he said.

“I brought all those clients to Mercer FX and now they are coming to me with their frustrations, and there is nothing much I can do. When it came to withdrawals, Jake made big problems, all customers cannot withdraw their funds.”

Mr. Ashok Kumar considers Mr. Amar to be a ‘mastermind’ and believes that he profited substantially from this in order to purchase his home and car from client funds.

Investigations by FinanceFeeds last week unveiled sources which understand that Mr. Amar is still involved with Mercer FX, and has simply started up a new website, and closed the previous one down. Some allege that it is unlikely that Mr. Ashok Kumar made any form of payment for any clients, and that the client book purchase contract probably has no value or standing.

A quick look at the website of integrafx.com shows that it is registered in the island of St Vincent, and the contact phone number is in Poland, however FinanceFeeds can confirm that the executive team are in fact based in Israel, and are common to the executive team of the formerly unregulated Mercer FX which has now vanished, giving very little recourse to clients.

Mr. Amar maintains that he has left the FX industry and now operates an insurance referral agency, with four staff, that operates on the basis of referring insurance business to large insurance companies from retail clients.

Upon asking Mr. Ashok Kumar what it was that finally made Mr. Amar and his colleagues close the company down and run, he did not wish to comment further.