“Mind The Gap!” – The life and times of a man on the move Episode 31

New IBs, partners and portfolio managers are within sailing reach of brokers, Leverage fears in Australia, Choose your provider wisely, and IG Groups brilliant resurgence in the US

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: Sailing on the Currensea

Maps and land masses are curious things. Google’s maps which calculate driving directions and train journeys are coded to give what its reference points consider to be the most efficient and fast routes to destinations, however they are not always appropriate.

This Monday, whilst arriving in Manchester from Liverpool, I began to plan my trip to Utrecht, a medium-sized industrial town in the western side of Holland, which has recently become a significant hub for technology, and with the technological development, a penchant for electronic trading.

Many FX brokerages have spent several years going to great extents to approach a good quality retail audience and to meet critically important introducing brokers and partners in offline seminar environments by crossing cultural and language barriers via long distance flights to the Far East, which in some cases has proven fruitful and in others has bloodied the nose of the host, however there is now a new and interesting means of doing so, that being to approach European partners and traders in one of the most sensibly run regions in the continent – Holland.

In two weeks’ time, on February 16, I will attend a retail FX event which hosts high net worth individuals, portfolio managers and introducing brokers, in Utrecht, Holland, where English is spoken at almost mother tongue level, and proximity to the world’s most important financial center of London is, well, as close as you can get.

I have made the decision to drive there, which involves an 84 mile drive from London to Harwich, which is in Essex on the east coast of England, and then take the overnight Stena Line ferry to the Hook of Holland, which allows me to exit the ship in the early morning, before making a very short 45 mile (60km) drive to Utrecht.

Despite Google’s estimate of a 329 mile journey, the way to do this is by night ferry, which is significantly shorter, and allows for a hotel room-style cabin which is not only ideal for traveling during the night which means time efficiency, but also provides a good environment for work, in an almost isolated position at a proper desk. Even the QANTAS Boeing 747 which conveys me in comfort across the Southern Hemisphere quite often does not have such office-like facilities despite its majestic presence and consummate abilities.

The event that I will attend is set to be the largest event of its type in Holland, and features speakers from across the FX industry including portfolio managers and traders. Many events of this nature take place in unregulated regions and therefore are less likely to bring a long standing and pragmatic client base to brokerages, however Holland is a strictly regulated environment and is subject to ESMA rulings, all brokers operating in the region have to adhere to the MiFID II rulings on infrastructure and product range specification, and the proximity to London is no different to that of a provincial town in another part of England.

I will report more on this as the week progresses, and will of course be reporting live from the event, as this paves the way for a means for UK brokers to approach a good quality and sustainable client base with a good regulatory framework and access to almost local facilities.

Now, where are my Stugeron tablets? …..

Tuesday: Leverage fear starting to take hold in Australia

As the snow falls on Manchester, the summer sun in Sydney is affording Australia’s professionals a sun drenched commute to their well organized and industry-leading offices.

The radiant summer conditions in the Antipodean financial and technology capital is not enough to stem concerns that Europe’s draconian restrictions on trading conditions may not come to Australia.

This Tuesday’s chuntering led me to discuss this whilst wrapped up in a fleece and scarf in Manchester’s fabulous and modern urban environment, the possibility of a change of structure in Australia with a colleague who was likely reclining in air conditioned comfort in the Sydney sun.

This particular industry executive’s opening gambit to our conversation was about the Antipode Forum, whose objective, according to my colleague, is to protect FX margin brokers from what he considers to be any odious regulations from ASIC.

The forum was held last week, and according to its official wording, its purpose is for AFS licensees in the industry to discuss the suggested provisions and agree on an industry accepted code, that being the industry code which will be submitted to ASIC for approval under section 1101A of the Corporations Act 2011.

The industry code was drafted in response to the measures outlined in IOSCO’s Report on Retail OTC Leveraged Products which identified the regulatory challenges and common concerns about OTC leveraged products offered and sold to retail investors.

According to my colleague, who has spent the last 20 years in the FX industry, there is of course an interesting back story here. He considers that it is worth questioning why this is happening now.

“Is it because ESMA is getting to chase the dodgy brokers moving clients to offshore related broker houses to cut of the feed for Australian brokers or that ASIC, having the industry fund its regulatory review program, is on the prowl?” he asked.

“I really do wonder how they came to their findings which were based on reasoning and risk reward balance, given that the free-for-all out in Asia is effectively a totally ‘wild west’ environment, and I also wonder if they are trying to focus on shielding higher leverage to mug punters. Also, at a time Australian FX margin brokers are aiming to take advantage of the European rules and pick up retail traders migrating from the chills to the sunshine, this is perhaps an opportune time.”

“I really look forward to seeing what happens here” said my colleague, “However I expect ASIC will likely move on lower leverage to make it similar to that of European standards, require disclosure of win loss ratio as mandatory and negative balance protection as given, which is not quite the standard the Antipode Forum agreed to.”

“Then it shows the industry dependencies to create earnings which is that centering a business around high leverage to mug punters is critical and the rest is noise. The real balance/ tension is how ASIC deals with the definition of ‘retail’ and if the ‘retail’ can opt into higher leverage as this is where the retail margin brokers fish in both local and other countries waters. On this topic, you should read a book called ‘Cod’ by Martin Kurlansky. It is the evolution of the fishing of Cod and how it changed civilisations. Just change the word Cod and put in ‘retail margin traders'” he said.

“If Australia requires this ‘edge’ to survive, the higher leverage, for FX margin brokers to sustain or retain earnings, then it seems a limited shelf life for most brokers here, especially given global trends and the golden goose of China is now cut off more or less, ASIC will move fast and clean to remove bad apples as it is in the spotlight for being too close to the ‘industry’ – ASIC must do something or they die” he said.

“2019 will be the most interesting year for all concerned, in that the industry can get together and try and pull the wool over ASIC which is showing that the perceived threat is real, very real and in some cases fatal, at a time when market developments are already making life miserable for these predators.”

“My observation is that the evolution of the trading platforms that get reported in the media is amazing. It really lags behind the development in other technology sectors, despite us being a tech led business. I mean, the ability to draw more lines on the graph. Whooop de do!” he sarcastically exclaimed.

“Development seems to have given faster price feeds, lower spreads, A book risk management, more lines on a graph, more products, all on the backend to squeeze all the juice from the trade so I have to ask, where is the evolution in supporting traders ability to make money and if so, will the industry engage, which is a known answer, like God made little green apples, they wont support any such evolution in any form in my opinion”.

In conclusion, my pal said “I think very few brokerage systems will evolve to incorporate these traders tools platforms, the lack thereof is because their is no development other than digital mentor and the ‘education’ industry, even the algo trading programs for novice punters is basic and has inherent flaws, in that no algo system developed by a private trader will work hard enough for professionals.”

Interesting indeed, and of course encouraging that once again, this type of critical thought is coming from Australia, which at the moment is leading the retail sector in its generic form. I do think the future lies in the industry matching itself up with good quality new-age app based retail financial products – however as far as retail margin trading on traditional third party platforms like MT is concerned, Australia has it, and this type of critique is what keeps it good.

Thursday: Well done IG Group in the Windy City

We reported it first, and followed it during its development, and now once again we reported its fruition first. Yes, IG Group is now well and truly operational in the United States, with the 30-year established publicly listed British retail FX & CFD stalwart having brought itself into the most lucrative and well established market in the world by stating its wish to “turn Forex on its head”.

Opinions vary on the large, established firms and their might which is used to dominate the domestic market, however this is a step that must be celebrated because yes indeed, it is time to turn FX on its head, and the firms that are equipped to do so are those with large capital bases, their own in-house developed and supported trading systems, and a will to go their own way – a direction that IG Group has always taken.

IG Group has a long and illustrious history in North America, and I am personally good friends with some of the original senior management team that operated it last decade from its headquarters in Chicago. The company has been welcomed back to America, and as one particular listed derivatives executive put it late last year during a conversation I had in Chicago “IG are great, we welcome them back to Chicago with open arms, they’ll do well here and may take some of the multi-asset business from high street giants like Scottrade or Schwab.”

Yes indeed, they might. And they have very little competition too.

Currently, OANDA Corporation and GAIN Capital have the entire US market to themselves, and OANDA Corporation’s continual displays of disorganization ranging from white elephant social trading platforms to revolving door management which goes on until today, leave the most stable market, which encompasses the best quality of long term traders, a very stringent regulatory environment and a domestic market population which is used to having portfolios of investments to GAIN Capital alone.

IG Group will complement GAIN Capital, and hopefully pave the way for more well capitalized brokerages to enter the market. New CEO June Felix seems calmly confident as she continues to invest in company stock. I wish them well as this is a great direction for our industry.

Friday: Would you give your client base to a flaky provider?

For many retail brokerages, preserving their intellectual property is paramount, and in most cases, if the broker does not have its own trading system and is using MetaTrader, this is even more important.

MetaTrader is such a dominant force in the platform sector that nowadays some very large brokerages with revenues of over $500 million per month are maintaining their entire client base via MetaTrader servers and client platforms, which has the advantage of being able to easily onboard retail clients due to familiarity – especially in the Far East which is where most of the large MetaTrader-based brokerages conduct the lion’s share of their business, however there is a downside that is going unnoticed which I have seen many times, that once again raised my eyebrow on Friday.

This extremely important matter is the need to trust brokerage solutions providers with the entire trading infrastructure, including client bases and continuity.

There are only really a handful of firms that specialize in providing technology solutions to retail FX brokers in this industry that have genuinely demonstrated their abilities and commitment, those being oneZero, Gold-i, Integral, Saxo Bank, Fortex and for larger professional desks, DevExperts, all of which operate and serve brokers in top quality regions and have proved themselves to have sustainable development centers, and trustworthy management.

Firms which compete against their own client bases by founding retail brokerages of their own in Cyprus, and continue to chop and change their tack whilst micromanaging and bearing down on their own customers and providers as no staff stay more than a few months are pretty much moribund – and brokers should be aware of this because its their hard-earned client bases and ability to conduct business that is at stake.

Once again, Leverate has demonstrated its lack of regard for sustainability by changing its tack several times during the course of this year, and for the third time in my 10 years of knowing the firm, not adhering to a written contract, news of which hit my desk on Friday.

Cheapness, fickleness and a lack of corporate direction seems to plague the Middle East, hence brokers should judge the integrity and ability of the companies they entrust their entire business to by looking closely at corporate ethos, who represents and what approach is taken. I am sure that with good leadership this is a company that could flourish, but its fractious management, affiliate/gaming culture and lack of Western corporate values creates situations where chopping and changing is the norm.

It is probably better to host your own systems and then connect to Gold-i or oneZero for liquidity management, replication and trading platform integration to the market with your liquidity provider than to attempt to pay a large sum to a company that does not know whether it is coming or going.

Put simply, if the structure of your provide does not replicate that of established outsourcing firms with technological contracts with major institutions such as PriceWaterhouseCoopers, Fujitsu-Siemens or Capita IT Services yet dedicated to our industry, walk. If there is a hint of chewing gum or a head to one side, walk, and if, more importantly, you are being nickled-and-dimed and made to compete with your own provider, walk.

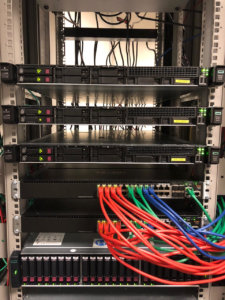

The system depicted here, however, was installed last week at a firm in the north of England and cost £93000. Now have a look at what you’d be charged by a non-aligned firm with its own brokerage for hosting and to hand over your entire client base, knowing they could cancel your contract at any time they like having had exposure to your entire IP.

On the other end of the spectrum, I am off to Sweden tomorrow to look closely at the newly established FX industry framework in the most democratic, transparent and socially advanced nation on earth. Watch this space!

Wishing you all a great week ahead!