“Mind The Gap!” – The life and times of a man on the move Episode 32

Cyprus a victim of its own creation. Welcome to a new era in Sweden for our industry for transparency, skill, civility and technology, a brilliant idea for brokers and I’m off to Holland by boat

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: Death throes of the Cyprus chancers

Let’s get this clear and straight. There are probably four companies with their origins in Cyprus which have proven their mettle, those being FxPro, XM (whether you like them or not, they are a big company with over 12 MetaQuotes servers), easyMarkets and HotForex.

These are pure retail spot FX brokers with a third party platform that have expanded beyond the borders of the tarnished island and moved themselves forward.

What about the other 152 retail FX brokerages with CySec licenses? These are the fly in the ointment of the entire electronic trading business worldwide and are, along with lax regulators and the affiliate marketers and racketeers from Israel and the Middle East that operate them, responsible in many ways for a lot of negativity.

Rightly so. I do not understand why firms with good quality products and a proven background continue to look toward Cyprus brokers as potential takers of liquidity – most of them do not know what that is as they only care about leads, conversions and taking client deposits, hence they are not a proper financial services or technology firm – when they could all look toward proper jurisdictions with proper people and proper industrial capability.

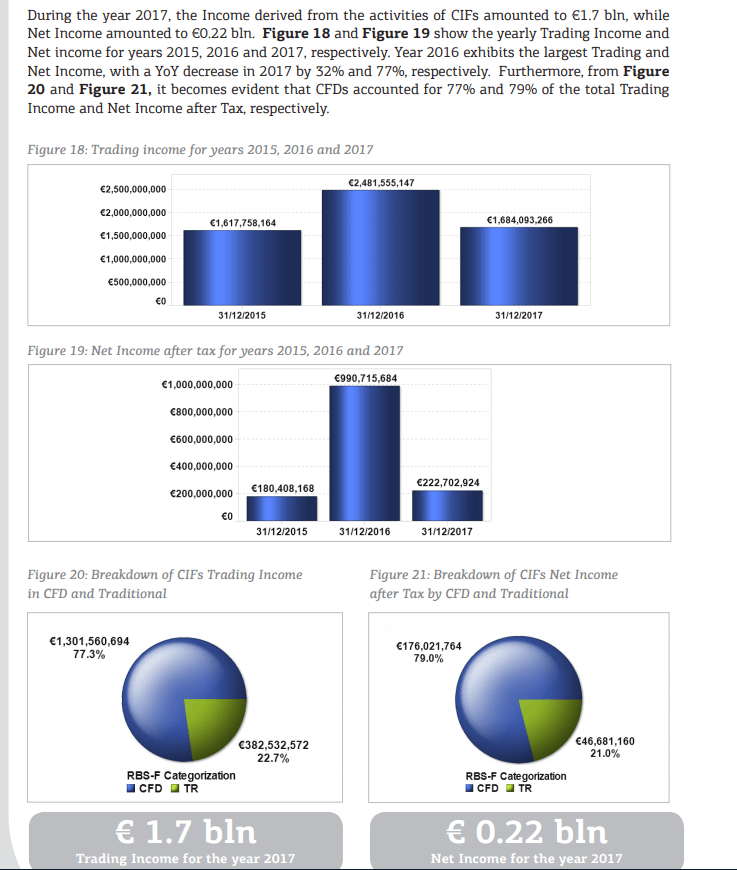

This week, another signal that the end is nigh for most of the small to medium Cyprus firms made its appearance, this time in the form of a publication from the European Parliament, specific to concerns that the government in Brussels has about how client assets are handled, and another alluding to the declining revenues and capitalization of most firms in Cyprus.

This infringement procedure is very serious. It seems that Cyprus is to be made responsible for not having declared the insolvency of some CIF’s, thus damaging investors.

Cysec may turn a blind eye to the flagrant layering of company structure that completely contravenes any regulatory law, largely because of brown envelopes that change hands between the Cyprus government and the small time gangs that operate in Cyprus, however it is not possible to adhere to MiFID II regulation and ESMA rulings when brokers onboard clients offshore, hold funds in third tier banks in Georgia and Armenia, and have their entire management team based outside Cyprus.

Now, ten years after the island became an aircraft carrier for small FX brands and white labels from non-aligned countries, the staff have done the rounds and furthered the cause of nothing by going from broker to broker, with no innovation having taken place, doing the same lead selling/lead churning activities, and have now nowhere else to go.

This leads to another issue, that being the decline in commercial income, meaning that the gravy train, which was always unsustainable, is coming to a stop.

What is surprising is that it lasted this long.

This week, I will be publishing some detailed research from on site in Scandinavia, the United Kingdom and Northern Europe regarding the more aligned, stable financial markets firms that our astute leaders should be looking toward as future partners. These being asset managers, hedge funds and application based trading platforms, all of which are electronically operated and totally aligned with the brokerage industry in terms of market connectivity and liquidity.

Surely the qualified and well structured firms in good regions who mean well and have genuine product offerings provide us all with a far better standing in the financial sector, that being a standing that we all deserve for leading the development of OTC retail technology and liquidity to such a high level.

Tuesday: Gothenburg and a look behind the scenes

Arriving in the highly industrious and artistic coastal city of Gothenburg, Sweden, my interest in seeing a part of the world which is renowned for neutrality, high quality, good business ethic and equality become involved in the retail FX industry became more tuned.

Sweden, the world’s most socially advanced country, is ready to bring its own home-grown brokerages with their own in-house technology and infrastructure into the realms of the retail trader, which can only be excellent news.

Nicely away from the high decibel boorishness and corner-cutting of the Mediterranean, Sweden represents a complete dichotomy, and is more representative of the genuine technology led, highly educated and detail conscious civility that the financial markets industry has required for many years.

Sweden’s famous exports include cut crystal glass, jewelry, luxury and stylish furnishings, Husqvarna precision engineering equipment, Volvo, Spotify and of course modular homeware firm IKEA.

These are just a few, but they all are long established and are at the very top of the industries that they compete in, and all have a customer focused culture which is totally transparent, hence the unfaltering brand loyalty.

Unlike the non-transparent environment which the affiliate marketing driven, testosterone and ego-saturated and largely uneducated loud mouths seen and heard strutting around various trade shows in Cyprus have created, Sweden’s corporate structure is based on totally available public information, and a societal culture in which every citizen is looked after from cradle to grave by a completely non-corrupt government which supports its highly educated population in a right and proper way.

The result? High standards of living, high standards of education, skilled workforce and a massively enviable global reputation. Go to a totally independent individual, such as an accountant, lawyer or bank manager, and then to a small business owner looking for potential partners and contract deals, and mention the words “Cyprus” “Israel” and then “Sweden” and watch the different reactions.

Swedish developers, marketers, account managers and customer facing executives have by and large got a good degree, a good upbringing and a good career background behind them. Can the same be said of those who hawk leads through a smoke filled room in warmer climes?

On Tuesday, I spent the day at Volvo Cars headquarters in Torslanda, suburban Gothenburg, and had a detailed insight into the quality and planning that is prevalent in Swedish companies.

The research and development ethos at Volvo is such that they expend four times the resources on product planning, development and external research than any other automotive company, extending from car design, to safety, to active electronics to actually sending teams out to road accidents to collect data in order to work out what causes accidents in order to develop systems that help prevent them.

The company invites its customers into the factory to see exactly what goes into making the cars from the ground up, and what a factory. I am a lifelong car enthusiast and a qualified professional electronics and software engineer, however, I have never seen such a facility. The whole factory is designed to be modular, with every assembly process taking place in one unit, avoiding logistical considerations of moving panels, engine and transmission components and electronics from unit to unit.

Every robot, produced by Sweden’s ABB company, performs efficient and near silent operations to piece together the new SPA (Sustainable Platform Architecture) Volvo car range whilst smartly dressed, and often young, engineers calmly operate machinery and take a clear pride in their product.

There is no noise, no raising of voices, no disorder, and a tranquility that is unheard of in heavy manufacturing.

The company has its own University, which accepts post-graduate automotive engineers to internship programs and the average career length of a Volvo employee is 20 years, whilst the average ownership timeframe for a Volvo car owner is a remarkable 17 years and has been since 1985. The average ownership time frame for any other motor vehicle is 3 years.

This is the ethos that can easily be applied to retail FX. We have the technology and in many regions we have the skilled and educated workforce. Leveraging it is very simple. Ask yourselves how long anyone stays at a Middle East-based FX firm, how many times contracts have not been honored, how much stress and noise there is, and how much fighting with potential competitors expends useful energy.

Sweden welcomes competitors. The corporations there see that as a compliment to the national business environment, and a method of keeping quality high. Consider the threatening nature of some of the bandits in the lower end of the retail sector in other places.

I welcome the new look toward Sweden and advise liquidity providers, technology firms and strategic partners to look toward them, as well as the obviously necessary London-based application based firms and hedge funds. I know a few if anyone is interested and will be reporting in detail this week regarding the pioneers of this industry, including in-depth interviews.

Wednesday: Talking of hedge funds and new broker services….

Wednesday morning consisted of me navigating through Gothenburg’s pure white streets in order to meet with a very interesting and highly experienced member of the FX industry.

A Swedish national whose origins in Gothenburg date back several centuries, the mild-mannered professional explained something which appears to be exactly what brokerages need, that being a stable and risk-free method of maximizing their operating capital.

Today’s highly competitive market has made margins lower and product offerings very closely related, so my enlightening friend explained a solution.

He has established a banking license in Switzerland, developed a set of in-house algorithms, gained a relationship with several hedge fund managers and professional traders in Switzerland, London and Gothenburg, as well as a payment channel protected by a randomized code such as those used by bank payment dongles, and will offer this to brokerages in order that they can hedge and invest their operating capital (note, NOT client assets).

This gives a low risk professionally traded environment for brokers to make more from their funds, hence turning their operating capital divisions into proprietary trading houses in their own right, and reducing the reliance on retail traders.

There will be more to say on this over the next few months, but it is a very good idea, and it comes from a professional who is well positioned within banks and global technology giants to bring this to our industry, which he also knows well.

Thursday: Culinary and lifestyle delights. What are you waiting for?

The transient nature of Cyprus as an island of ex-patriots has so many disadvantages for business and personal life, however there is one advantage, that being that it is easy to pick up the holdall that you arrived with and go elsewhere. We have recently seen the out-of-the-frying-pan-and-into-the-fire technique of many brokerage employees who think that moving to Vietnam to become a ‘consultant’ is a good idea, however why not take the knowledge that has been garnered and apply it to a better environment?

London’s lifestyle is one of the best in the world, however unless you are either a start-up with a few million in seed capital and a good development team that will create a massively popular application, or you are at C-level in a publicly listed company, progress is hard indeed. Worth it, but hard. It will not, for example, be possible to simply grab a few deposits and then disappear to the beach or a poolside bar for the rest of the day (thankfully…).

However, Thursday took me to Stockholm, Sweden’s capital city. Looking at corporate culture in Stockholm, B2B clients are often treated to an afternoon’s spa relaxation – a Swedish tradition – in the world famous Centralbadet facility which was founded in 1904 and is, not to put too fine a point on it, absolutely magnificent. Herbal saunas, refreshing and relaxing treatments and health-improving quiet areas are abound and are part of corporate entertainment.

Why not make your commercial partners happy and focused, rather than stressed and angry? Surely that’s what business relationships are about? Many former employees of retail FX firms in the middle east have experienced severe stress-related issues, and in many cases for no real financial gain, and zero security.

Sweden’s ultra-secure society and proper treatment in the work place speaks volumes. I was told by one particular FX brokerage in Stockholm that it invites its portfolio managers, partners, white labels, investors and retail traders to Stockholm and pays for their hospitality, just to show them the inside of the company – rather in a similar vein to Volvo with its Overseas Delivery Program which includes the factory tour that I took, along with a full insight into the company’s ethos which eventually leads to the personal collection of your own car from Volvo’s management team.

The spa ideology is remarkable. This is a popular corporate entertainment method and allows people to speak with a clear mind, whilst feeling well and not distracted. Additionally, the culinary experience is outstanding. Fine dining and accessibility to incredibly modern spaces for meetings and business facilitation over fantastic lunches cooked by famous chefs such as Marcus Samuelsson are abound.

In essence, Stockholm offers the highest level of London’s City, but affords it to everyone, not just those at the very top. This is a great environment for development of business. Would I start a brokerage or tech firm there? Yes, in a heartbeat.

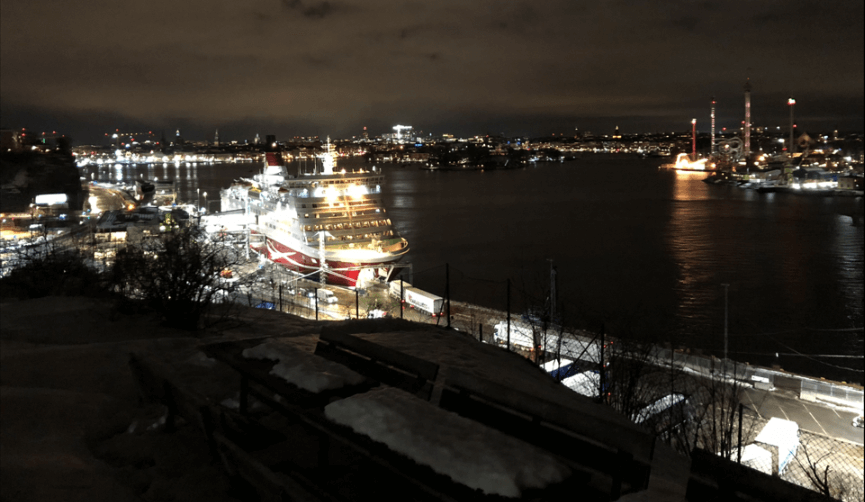

Friday: Holland, here we come

My flight home from Stockholm gave me a short window in order to do some logistical planning. Instead of flying to Utrecht for next weekend’s FX event in which over 150 traders will be present, I will drive there, and take an overnight ferry from Harwich to the Hook of Holland. I think it is important to have some thinking time and in this methodology, I will be able to do so, with the car on auto pilot, and Spotify providing my favorite playlists from readily available cloud based music of all types.

Air travel is the quickest and cheapest method of getting around, but let’s be fair, it is still public transport and is not always ideal. I will be able to report on what Holland has to offer in terms of retail trading. We know already that it is home to several proprietary trading houses and has a pragmatic, conservative and sensible investing population – both excellent components for the good brokerages of this industry.

Modern cars are effective thinking capsules, especially if they have self-driving technology… and yes, it’s a Volvo.

Wishing you all a great week ahead!