“Mind The Gap!” – The life and times of a man on the move Episode 53

I reveal where all the retail traders are, a tip for secondhand equipment on eBay to save you a fortune, where to go for the best FX brokerage opportunities and let’s get them off the zero sum high street and into proper multi-asset trading

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: This is where all the traders are!

As my week began, a very interesting set of well researched information hit my desk, containing some very detailed metrics as to where retail traders are concentrated.

Rather reassuringly, the authors of the report who are very much au fait with the retail trading world, made an important allusion to something I have been championing for some time, that being the consideration that contrary to the common assumption that traders live luxurious city lifestyles when we uncovered that the majority of traders earn a modest household income of less than £35k per year.

In 2018, the stereotype continues to fall further from reality. In the last 12 months, the average household income of online traders has dropped even lower, and our data suggests that less than 5% of modern traders actually live in a major financial city.

As many of you know, my career has mainly consisted of B2B relationships with software companies in the banking sector, however I do personally know an equities trader in Tel Aviv who uses a bank platform for execution and has traded for over three decades, making significant profit and reinvesting it in property and as VC in businesses, but he actually lives very modestly himself, and exactly as the report states, far from the world’s financial cities.

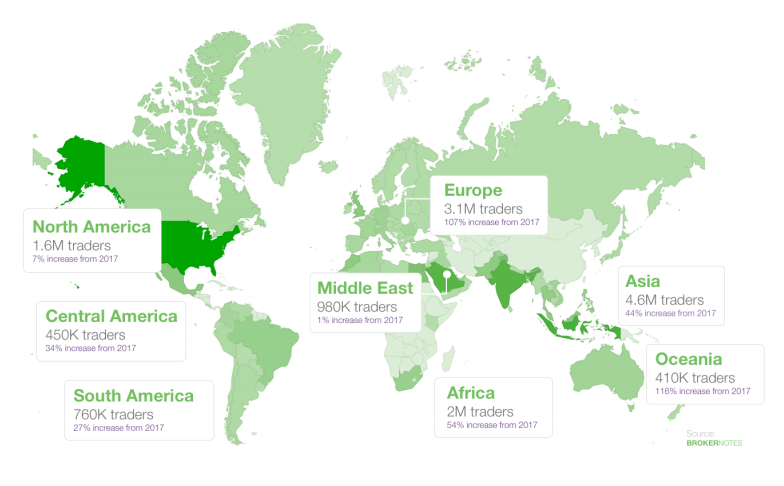

4.3 million people have started trading online since the end of 2017, bringing the total number of traders to 13.9 million worldwide. Globally, there are now 2.7 million female traders, which means that 1 in 7 online traders are women – an increase from 1 in 10 just last year.

Perhaps that would explain the banal and vacuous increase in barely clothed women standing next to Lamborghinis boasting about their (clearly false) trading expertise on LinkedIn. Let’s hope that the dignified ladies of trading do not stoop to the low level of the macho men. Women are more analytical and less egotistical, so the increase in the number of ladies who trade is a good thing. Let’s hope the marketing-led image orientated ne’erdowells do not tinge a great opportunity.

The report infers that many people would be forgiven for assuming that the majority of traders might live near a financial center like London, New York, or Hong Kong – but you’d be wrong.

The Internet has decentralised trading, empowering virtually anyone with an Internet connection to trade online. Today, over 95% of online traders live outside of a major financial center, with almost half of all traders being based in Asia or Africa.

We all know this, because many brokers approach the APAC region and parts of Africa from their bases in London or Hong Kong, however here is the interesting part.

13,613 traders were asked to specify how much money they deposit when opening a trading brokerage account. Over 50% of female respondents said that they deposit less than $500, compared to 42% of males.

The average deposit of a female trader is $1,821, which is $424 less than male traders. This is particularly surprising as the average household income of a female trader is more than $5,000 higher than that of a male trader. Yes. Female traders are more successful in their careers than men who trade, which points to the potential assumption that many low deposit male traders do it out of either addiction or desperation, whereas women do it for potential growth of capital.

Numerous studies have found that males trade more frequently than females, and that this hyperactive trading led to a 2.65% reduction in net returns per year, compared to 1.76% for women.

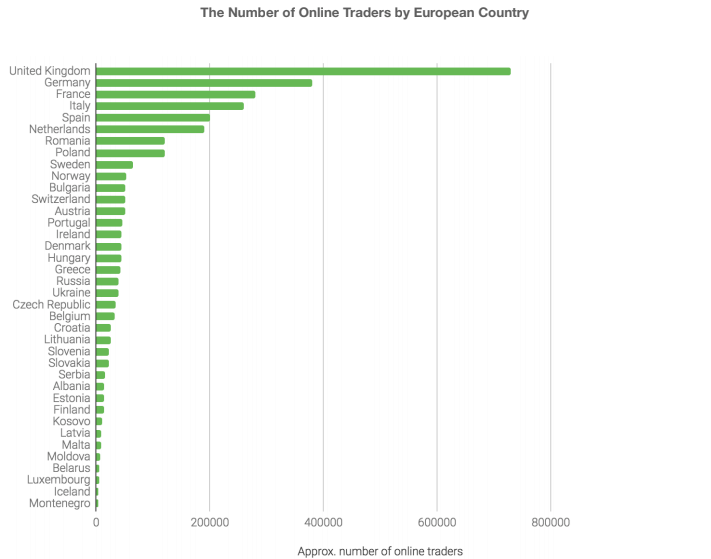

In England, the nation in Europe with by far the most retail traders, Manchester is the major center for retail traders. Yes, the CFD firms are based in London (IG Group, CMC Markets, ETX, and so forth) and Bristol (Hargreaves Lansdown) but the largest retail trader base is in Manchester, Britain’s fastest growing city where I have several times offered the opinion that brokers should establish there rather than Cyprus or offshore islands.

There’s a huge difference between UK and US traders, as we have always known.

The typical American trader is in his forties, drives a Chevrolet Impala, and enjoys catching up on the latest business & economic news. In contrast, Britain’s average trader is a Vauxhall Corsa driving 27-year old Mancunian, who enjoys watching football and learning about digital currencies & the latest gadgets.

Ergo, the American trader has a portfolio, a high deposit amount and is very analytical, whereas the British trader is speculative, young and wants to ‘give it a go’ rather than be very structured as per his Transatlantic counterpart.

Outside of London, Greater Manchester has the highest number of traders with over 27,000 people trading online. Bristol, meanwhile, has the highest density of traders in the UK and the highest proportion of its population trading with 262 traders per square mile* and 24 out of every 1,000 people being a trader.

Outside of the UK, things are interesting indeed. Look at South Africa with its 2 million traders, and by how much the number of traders has increased recently.

We are committed to helping the development of business in South Africa and if you look at this chart, our IB events in Johannesburg are well worth participating in. For information on how to participate in our event in November, all you have to do is drop me an email or give me a call.

Tuesday: eBay, you win again.

Over the course of several years, a source of amusement among those who know me well is how short a time a laptop computer will last between the moment that I purchase it, and the time that it resembles something out of Dark Metropolis.

On average, a brand new laptop computer lasts me eight months before it is completely falling to pieces, the casework broken and the ability to boot up and actually use the keyboard completely impaired.

This week, my 2018 Dell Inspiron finally met its maker, and I vowed never to buy a new laptop ever again. It is just not worth the outlay.

Once the ritual DBAN procedure was complete, I booted up my recent acquisition which is a 17 inch HP effort that cost just $150 on eBay and arrived in its original box, with all documentation as a factory reconditioned unit.

This is the way to do it. Today’s topography in enterprise environments is hardware light, whereas 20 years ago it was hardware dependant, therefore I think it is more efficient for companies to buy cheap hardware for users and then connect it to cloud hosted infrastructure.

Just thought I would share that because the saving was over $700. Multiply that by the average number of people who work in an FX firm and that is considerable saving.

Wednesday: Lifestyle traders and opportunities

I have a lifelong aversion to television and tabloid newspapers to the extent that when I purchased my television set, I asked the salesman to turn it off so that I could see what it would look like when not in use, as that is how it would appear for 95% of the time when installed in my living room.

Tabloid press has a similar place reserved in my mind, however this week’s Liverpool Echo depicted something quite interesting in the form of a magnificent house for sale for £299,000 in a very nice suburb of the city just across the Mersey from Pier Head.

Bearing in mind that I have been championing the cause of establishing brokerages and FinTech firms in the North of England, the availability of a very good lifestyle at a reasonable price should be an incentive for firms to take that opportunity seriously.

In Cyprus, there is no way that such a lifestyle could be achieved, and overall ex-patriot British employees based there tend to have higher overall expenses due to the lack of supply of important products and services that are readily available in Liverpool and Manchester, and due to the complete absence of any aligned customer base, which is often based in non-English speaking, non culturally aligned areas of complete one-off, small deposit opportunism in the Far East.

As we now know, the North West of England is full of traders, all of whom are British and understand the rules and structure well, and is in the same country as the largest and most well developed trading infrastructure from Equinix hosting to dedicated fiber optic cabling to the Tier 1 banks of Canary Wharf and major ECNs and non bank market makers.

Essentially, for a small to medium sized retail broker, a holistic and high quality approach can be taken without having to seek overseas traders or get involved in low end activities.

Gaining the right staff would also be easy, as there would not be the turnover that is experienced on the islands. Many sales people on the islands go from one to another until there are literally no career opportunities left, whereas in Liverpool that would not happen. The universities are among the best in the world, and the UK is home to one of the most diversified and comprehensive economies in the world.

If I had an FCA license and was a retail broker, I’d be packing my bags now.

Thursday: Move over gambling, make way for proper trading

During a drive from Manchester to London, I made a diversion from my usual Spotify-centric listening to the DAB radio, on which the excellent music choices were occasionally interrupted by short news headline broadcasts.

One of such broadcasts reported that William Hill, the British sports betting and online gambling giant, was about to close 700 retail high street outlets and make 4500 staff redundant.

Quite how gambling is even legal is beyond my comprehension (it is totally illegal in most countries) but whilst the news report was melancholy, I see this as a good thing.

Perhaps British people who would have traditionally participated in the futile folly of gambling are no longer prepared to punish themselves routinely to this end, or maybe the level of education and spirit of entrepreneurism among young British people is such that gambling is viewed by most of the disposable income-rich population as exactly what it is – a zero sum road to ruin.

Overall, it is a good thing that this is happening, and it may well be worth good quality A-book brokerages approaching some of the senior managers of the retail outlets that are closing in order to attempt to operate seminars about trading so that those customers who did submit to being customers of William Hill could actually empower themselves by being customers of a good quality, regulated A-book multi-asset trading firm and have the right guidance to make some profit whilst generating commissions for the broker.

Isn’t this how progress is achieved?

Wishing you all a super week ahead!