“Mind The Gap!” – The life and times of a man on the move Episode 55

A deluge of discourse about trade execution and B2B profit-sharing, the retail trader and a response to our insights this week, I examine the new FinTech that is booming in London’s Canary Wharf and let the train take the strain, as long as you are not Reginald Perrin

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: Caring is NOT sharing!

After all of the regulatory directives that have been implemented over the past two years which have required the entire OTC derivatives sector to review its structural methodology, it is somewhat astonishing that there are still some industry participants which are not concerned about the forced evolution that this has caused, and are treading a regressive path.

As this week began, I was approached by several senior level professionals in the institutional FX industry, one a proprietary trader with a dedicated Prime Brokerage give-up business agreement with two Tier 1 banks, denoting the size of his own balance sheet, others being board level management of institutional liquidity providers, one in London, the other in New York.

The subject which one shared was rather ironically echoing that of the other, regardless of the different requirements and business structures that these entities maintain, that being the continued attempts by some OTC firms which provide liquidity to brokerages masquerading as prime of prime, when they are indeed a retail brokerage themselves.

This phenomenon is of course not new, but it would be sensible to consider that following the catastrophic collapse of Gallant Capital Markets due to AFX Group’s semi-nefarious profit sharing arrangement which serves to defile two aspects of the correct modus operandi, the first being that it is infra dig to sell ‘liquidity’ and state to brokers that orders are being executed at bank level, when actually this is a b-book execution model with a profits share, which in the end created a house of cards.

In any other industry, that would be fraud. With the new rulings on trade reporting under MiFID II, whereby all OTC firms have to report every detail of their order flow including on what type of venue orders were executed and how their prices and execution methodology were attained, most of this is a thing of the past in regulated markets, however Monday’s discussions demonstrated a case of me being quite the venting option for disgruntled, good quality firms that are fed up with the market being encroached on by those who do not toe the line.

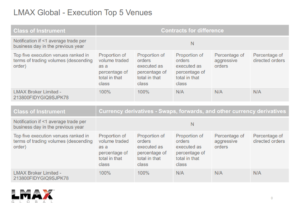

Back in January, London’s LMAX which purports to operate multiple institutional execution venues for electronic foreign exchange trading and has since inception marketed itself as the world’s only multilateral trading facility (MTF) for electronically traded FX, has established a b-book retail brokerage, offering 200:1 leverage, in New Zealand from which to directly approach retail clients in mainland China.

Indeed, diversification is vital in this rapidly evolving industry, and in order to offer a range of good quality products to a wider audience than the one that has become completely over-targeted by so many also-rans, however LMAX began its business as a highly-sophisticated provider of Tier 1 liquidity to brokerages and positions itself among prime of prime brokerages, meaning that its target audience is retail brokerages and its product range is marketed as a ‘no last look’ execution based MTF, and an ‘exchange’ from which brokerages can source Tier 1 liquidity.

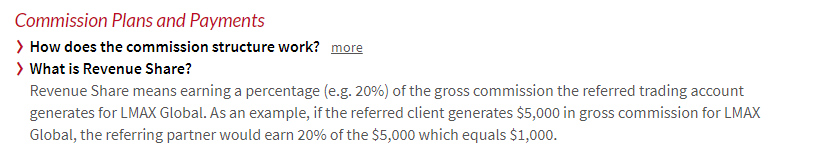

Now, the firm is, according to many sources in London, offering a revenue share arrangement and rebates, which is the method used by retail brokerages to onboard retail traders.

By operating a retail brokerage with 200:1 leverage and fixed trading terms set by LMAX, the company demonstrates that not only is this a b-book retail brokerage rather than an exchange model that provides directly sourced and aggregated tier 1 liquidity, but it also competes against LMAX’s broker clients, especially given that direct retail order flow is a core business activity of the company.

In the past, I have confronted companies at trade exhibitions in mainland China that use the words ‘prime’ or ‘exchange’ or even in some cases ‘venue’ in order to align themselves at a level that extends only as far as marketing materials with bona fide prime of primes and non-bank market makers, in some cases I have asked who their prime broker is, to be told Goldman Sachs, Societe Generale, Credit Suisse along with non-bank execution at XTX Markets or Hotspot, all of which has turned out to be far from reality, when actually the ‘prime’ is a MetaTrader 4 white label brokerage executing its trades on its own desk.

The regulators have gone absolutely over the top in many cases, creating a need to totally redefine the entire structure of the electronic markets, but what they have not done is address the usage of certain words such as ‘exchange’ or ‘prime’. I have actually approached senior regulatory figures – one of which was Demetra Kalogerou, Chairman of Cyprus’ financial markets regulator CySec, on this point and was met with a blank expression.

This matter is even more important now that brokers are required to publish RTS27 and RTS28 reports. Some regulated retail brokerages are marketing that their execution model is 100% STP but then ‘paper’ 90% of their business offshore, the Seychelles being a current island of choice for those wishing to dodge the regulator.

Surely this is a regressive step and not the way to build for the future?

Basically, a retail brokerage which operates a b-book, yet is onboarding brokerages rather than retail clients and then b-booking their trades when the broker thinks that its clients are accessing a combination of tier 1 bank liquidity and non-bank ECNs.

Don’t get me wrong, there is absolutely no harm whatsoever in b-book execution if it is correctly marketed as a retail market making service, and there is nothing wrong with conducting risk management according to a price feed by b-booking trades as many top quality retail FX and CFD firms with public listings and 30 years in operation do.

The difference is that, as an example, IG Group is a retail firm, calls itself a retail firm, and openly onboards retail clients without approaching brokerages to attempt to sell them ‘institutional’ liquidity via their own retail b-book and then compete with their own customers.

I contacted the Asia Pacific division of LMAX to ask their opinion on this, my question having been received by a senior executive at the firm, who did not reply.

In the UK, many firms in all sectors are subject to rulings about misleading information, and the Advertising Standards Authority (ASA) in many cases has more teeth than the FCA in terms of banning firms from distributing certain material.

RTS27 and RTS28 explained.

With the new, and hugely capital-rich fintech sector in London absolutely mushrooming and becoming a major global force, surely it is best to emulate them, rather than regress to affiliate-orientated lead churning and treading a path has been sullied by now defunct firms that have damaged the reputation of what is a fantastic, innovative and downright interesting business.

Tuesday: Richard, you are right!

Firstly, before I allude to the brilliant response that this triggered, I hope you enjoyed the video interviews that were published on FinanceFeeds this week, we will of course be continuing to do many more of those.

Interestingly, the response was tremendous, so I thought I would share a very interesting dialog I had with a colleague that I respect tremendously, Richard Goers, owner of institutional trading software company ManagedLeverage in Sydney. Well, just outside Sydney, but Australia is a big place!

Richard, who was this time not able to make it to the FinanceFeeds London Thought Leadership Conference in May, said of the video interviews “Great! Amazing discussion here, and brilliant presentations by some of the industry’s best people. I wish I had been there!”

Next time, Richard, you are always welcome!

Briefly, ManagedLeverage produces a professional system called ML^2 which is a next generation trading platform and technology ecosystem for active traders which has a set of predictive analytical tools called CSi^ that provide advanced warning on changes in the directional price movement on financial instruments within 1 minute 15 minute 30 minute 60 minute 24 hours time windows.

“My observation is that the whole market really is still all about the traders experience and therefore very much aimed at improving the retail experience. As rightly presented, professionals have the knowledge, they just need a great platform which really means price spreads, no slippage, and an instrument universe because at that level leverage is not a selection criteria” said Richard.

“I think that the new tools to be offered on platforms really fall into a few categories, and it should be considered that professionals have their own programs and rules already figured out” he said.

“Because of this, they progress within their own ecosystem of knowns and unknowns, hence retail brokers getting hedge funds, prop houses and professional traders is the new landscape and the evolution of the platform is also a known to accommodate this client base, so this professional client universe is fine for ‘trading experience’ as discussed in many of the videos and the broker has to be straight and not bent!” said Richard.

“So the business model is mainly STP [A Book] and commission based, and we can pretty much wait for this fee structure to fall from the current mixed $3.00 – $5.00 per Lot based on turnover and some rebate paid back” he said. Exactly Richard! That is what I had a conversation about on Monday (see above!).

“So we again get into turnover model, which is fine, but Darwinian in structure. This business model is understood, professional traders already understand the markets because these people were trading in a forgotten space for B Book retail brokers, now sought after because the B Book brokers aggressively over-fished” he said.

“I think the IB model will still remain retail because this is where it gets interesting in terms of the tools needed to provide their retail clients to progress and become long term clients trading in a sustainable manner. The main question I think is how to get the retail traders at the smaller margin size end to get off the leverage teat” said Richard.

“So maybe the evolution in retail focused platforms [+ business models] will still be in this space. the tools need to be more like those that professional traders use [but, that is a forbidden garden] and I suggest, and this is general, in the aggregate and opinion – so depends on who you talk to, but hedge funds, prop houses into algorithmic trading do not really depend on retail level technical analysis. It is there, but not the answer, just an input to wider inputs, outside specific volume – latency trade rules” he said.

“Realistically I would say that the attractor is to more ‘experienced’ traders therefore the action is a change in the retail broker business model from B Book + ‘extreme’ marketing and my opinion is that most retail margin brokers will not survive using an older strategy, but there will be a market that supplies the manipulative drugs that some traders seek which is high leverage” he said.

“I would say that the retail division of the business will play in a space where they win:loss ratio remains around 80% losers – for all the same reasons as it seems a natural law and is needed for the market to be some waht sustaining in supplying liquidity – the rewards go to the risk takers, so if that is the case, what does this new retail platform look like beyond the current program – and what comes first? Will it be a broker who finds the ‘holy grail’ and will attract the new clients?” he said.

“Currently there is no current holy grail – just a strong emotional need for it, to get it (think Monty Python and the Holy Grail as the journey by these marketing based retail brokers) but the holy grail cannot be ‘open’, it can only survive in limited form which means that dilution kills it hence my thought that in the retail space the win:loss metrics wont change much, no matter the broker model” he said.

“As far as professionals are concerned, this is not an issue as they know that their programs work for a time, then do not, and they know how to manage these processes, so for IBs – they are between the rock and the hard place. Some are making a robust sustainable business model out of education and finding the required retail platform and if it exists, do they get access because any great trading idea will die in the open market and traders wont make money without an edge and the edge disappears” concluded Richard.

Wednesday: My old stomping ground is everybody’s new stomping ground!

Anyone my age will remember the construction of Canary Wharf and the subsequent massive influx of global financial institutions into what was once one of the poorest neighborhoods in the whole of Great Britain but is now the global epicenter for the entire financial markets business representing tens of trillions of dollars daily.

This Wednesday, a flashback to my software consulting time at One Canada Square engulfed my cognitive resources as I remembered the structured, highly institutionalized in-house technology divisions of bank trading divisions that I worked in for 18 out of my 29 year career in this industry.

Today, things are more than somewhat different and One Canada Square, although still maintaining its appearance as an unmistakable obelisk which dominates the docklands area with its flashing operations beacon sending signals to aircraft approaching and leaving at City Airport, the occupancy is going totally modern.

No more 10 year development cycles and Steria/Captia/Fujitsu outsourcing for 5 year bank server migration and solutions architecture projects, because not only is the FinTech sector absolutely burgeoning among the youth of Shoreditch whose huge venture capital investments are outstripping any sector in Europe, but it is now massively ensconced within the same building as the institutions.

My conversation with Level39 at Canary Wharf’s most iconic building showed me how to get involved in what it self-describes as ‘the world’s most connected tech community’.

Level39, unlike the traditional institutions, is more like a combination of Google Campus and a VC community in that it supports fast-growth tech companies in three clear ways giving access to world-class customers, talent and infrastructure.

Through expert mentors, access to Canary Wharf’s dynamic workspace, a packed events calendar and best-in-class facilities we help businesses achieve scale.

Interestingly, this is no trendy fly-by-night and there is not a hipster or a weird beard in sight because Level39 is owned wholly by the Canary Wharf Group and therefore on the same plane as global law firms and major institutions in terms of presence at Canary Wharf.

It now 80,000 square foot community space occupying the 39th, 24th and 42nd floors of One Canada Square, so I am going there this week to interview their senior executives and produce a video about how this sector is burgeoning in Canary Wharf.

This should, by all accounts, help our industry’s leaders to assess the landscape should they wish to reinvest capital to compete with some of the ‘challenger’ fintech firms that are now the focus of massive investment. I’ll keep you all posted!

Friday: GWR – Great Wonders of Rail

It is a British pastime to complain about the ineffectiveness of public transport, however those who know me well are familiar with my absolute affinity to train travel. I simply love it.

Yes, I am a car enthusiast and love to drive, but with a sensible head on my middle-aged shoulders, train travel is much quicker, much more efficient, affords the ability to work, and is quiet, smooth and relaxing.

The latest Hitachi rolling stock is excellent and I have always, even in the days of the HS125 whose 45 year lifespan as InterCity transport is testimony to its excellence, liked the environment of work in which a large desk is available and the passing patchwork quilt English countryside viewed from a large window replaces the fixed view of an office.

This Friday, however, an allusion to a regular excuse by 1970s comedian Leonard Rossiter portraying his most notable character Reginald Perrin arose, as the announcer stated “Points Failure at Chippenham”.

GWR, which stands for Great Western Railway, became the subject of very polite British derision by its passengers. Once the announcement was made, the subdued clamor of “oh this is a catastrophe” and “it will take over half an hour longer to do this journey” was uttered from fellow travelers in nearby seats.

GWR, which was established in the pre-industrial revolution period by incredibly talented engineer Isambard Kingdom Brunel as the land-based section of the world’s very first method of passenger travel from London to New York, is a remarkable entity.

I was able to carry on working, and GWR’s announcer maintained calm and nicely delivered prose to update passengers as the train re-routed with no inconvenience to anyone.

What does this tell you? Life in England is so well organized and people are used to such excellence, that a points failure which was quickly solved by a rerouting which meant nobody had to leave their seats, is a ‘catastrophe’.

This can be viewed as a great success for industry and the public transport sector. Now where is my Volvo? ……

Wishing you all a super week ahead!