“Mind The Gap!” – The life and times of a man on the move Episode 6

Would your brokerage pay for the best R&D like the startups are? Michael’s epic bicycle ride, safaris and seminars, EU regulations, too much snow, and a lot of sun!

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: The long shrift for a short shift

Does the FX industry make enough of an effort to develop and support its systems?

In some respects, the FX business leads the entire financial services business in terms of technological advancement, and rather in a similar way that the premium-sponsored Formula 1 motor racing series has for several years paved the way forward for development and refinement of new systems which eventually find their way onto the standard equipment lists of even the most anodyne passenger cars whose natural habitat is the shopping mall parking lot rather than the paddock at Silverstone, systems developed to hone and refine the execution accuracy and efficiency within major banks often find their way into trading platforms which can be used at home by even the most amateur of part time traders.

This is certainly the case for non-bank market makers and long established retail FX firms with their own proprietary platforms, but what about those who do not place an emphasis on technological development and outsource the whole lot to third party platform firms?

The proliferation of similar firms has been a subject that has been debated many times and is now something of a moot point. With 85% of all retail FX now being traded on the MetaTrader platform, there is not only very little differentiation, but also an inability to scale, list (no IP exists in this model), and a constant nagging feeling that margins are being squeezed.

Concentrating on a low-cost model and outsourcing may well have become the dominant model outside the major centers of London, New York and Chicago where proprietary platforms are the norm among listed companies with a 30 year history, but Monday’s conversation with a former colleague of mine made for food for thought.

Sometimes, saving costs on development and support costs can be a false economy and lead to the firm doing so being an also-ran.

We worked together in 2001 for a few months, both as outsourced independent software consultants on a project which encrypted data for applications used by major banks so that users could not copy the software or databases, at Britain’s then burgeoning “Silicon Valley”, the Thames Valley Technology Park in Berkshire.

My pal, now a CTO for a major non-bank market maker in London, explained to me that R&D dominates their budget and that ensuring the recruitment of the right talent is the only way that sustainability can be achieved. He is indeed right.

His companny is looking for a Scala engineer to work on a project that the firm invested in recently, and is now one of the top 50 emerging fintech companies, having completed a Series B round of funding for £23 million. The firm provides a self-directed centralized investment and trading platform for retail customers, and is based in London’s Square Mile.

That in itself is interesting on the basis that I have never seen one medium sized or start-up FX firm actually go to the lengths of hiring in-house engineers. Many pass off their system as revolutionary and that it has a new means of attracting good quality clients and giving a unique service, but usually its just MetaTrader, dressed up with clever marketing, hence marketing spend still outstrips R&D in many areas of FX.

Thus, no firm would spend this amount on recruiting non-managerial engineers. In London, however, this is commonplace.

Whilst the world outside London complains about ESMA’s leverage restrictions, it is absolutely business as usual in the world’s major financial centers, and the furthering of new products is paramount.

The amount? £85,000 annual salary, unlimited vacation, early finish on a Friday, private healthcare, training/conference budget, and cycle to work scheme. For a non-managerial employee. Conversely, in MetaTrader-dominated areas such as Cyprus, senior management often complain of low salaries, zero investment and even abuse such as hiring key people, milking their lead database then letting them go.

Scala is a freeware software application with versions supporting Windows, OS X, and Linux. It allows users to create and archive musical scales, analyze and transform them with built-in theoretical tools, play them with an on-screen keyboard or from an external MIDI keyboard, and export them to hardware and software synthesizers, thus, this development is genuinely a ground-up build and not a simple marketing-over-function brush-over.

Hence, London is investing in its future whilst other parts of the retail sector are chasing the same heavily used methods whilst making little or no investment.

The way forward is to treat this business the way other technologically-led e-commerce sectors do, thus we will continue to lead the way and not only protect ourselves, but flourish.

Tuesday: Kudos to Michael Davies

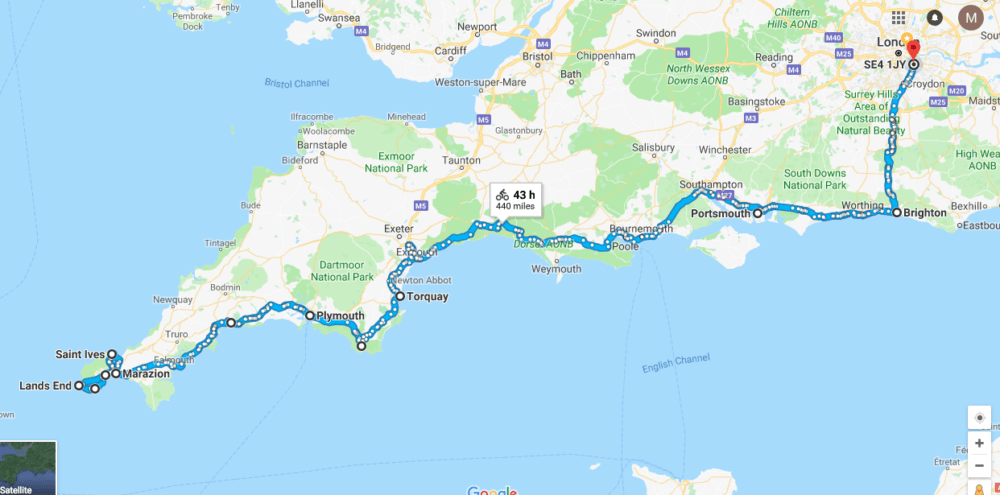

Michael Davies, a longstanding and highly respected figure in the eFX business, set off on a train journey this week from London to Land’s End, which is in the far South West corner of Cornwall, the most southwesterly point of the United Kingdom.

Michael’s usual appearance is that of a highly sophisticated professional. Composed, suitably attired, and equipped with vast FX industry knowledge that has earned him a very solid reputation among retail brokerages worldwide.

This week, however, Michael’s suit remains on its hanger, and has been temporarily replaced by sports equipment, a bicycle, some lightweight outdoor equipment and a train ticket.

Michael said “My EPIC charity hashtag#bicycle journey from Land’s End to London begins. I’m on my way by train to Land’s End with my girlfriend Lara Bates. Lara will be joining me from there over 4 days to St Austell in Cornwall before I continue back to London alone along the south coast covering around 450 miles. I will be roughing it by camping as much as I can, but don’t feel sorry for me, instead please donate to a worthy cause.”

“Im going to be raising money for the Big Cat Sanctuary as part of my mother’s memorial tree of life at the sanctuary. The fact I’ve never done much more than 60 miles in one go before and that I have dodgy knees means I will need your support in more ways than one!” he enthusiastically reported.

A beautiful, scenic journey across Britain’s south coast, in this glorious summer weather consists of a 440 mile (708 km) bicycle ride, mostly coastal before heading inland south of London.

This summer has thus far been spectacular, and as a former racing cyclist myself, I can vouch for both the challenge and the enjoyment.

Michael, I wish you great success in this undertaking, and remember – enjoy it!

Wednesday: Safari and Seminars

South Africa, a spectacular country with a massive opportunity for growth ahead of it, is becoming a region of great interest for electronic trading firms with a penchant for looking toward up and coming methods of business development.

Well regulated, English speaking and culturally and socially based on Western ideology with a background of British law, its lifestyle is among some of the best in the world, especially in major cities such as Cape Town and Johannesburg.

Thus, from substantial research conducted there, it is clear that South Africa is now a focus for many retail FX and alternative investment companies. Certainly seminars produced there by FinanceFeeds have borne this out, hosting highly enthusiastic professionals who see only opportunity, and have developed networks of very stable and analytical traders.

This Wednesday I began examining the viability of planning of a seminar which will attract a worldwide audience to South Africa. It would encompass over 30 global FinTech firms, all showcasing their developments to investors and commercial partners from Asia, the Middle East and Europe.

The most interesting aspect of this is that in South Africa, extensive lengths are being looked at, as firms are prepared to go the extra instead of simply host a one day conference in its traditional format.

Whereas the most standardized regions of the world have very corporate subject-based conferences, which certainly work well for those areas, South African event specialists that I spoke to this week are looking far beyond the well proven model.

In Cape Town, for example, one particular events management company with a remit to produce a conference for 30 sponsors from across the global FinTech space, is looking to extend the entire experience over the course of a week and include executive tours of the Western Cape Province, including five star accommodation on the world-famous convergence between the Atlantic and Indian Oceans, aerial travel to see Table Mountain via private air transport, and then a trip up to Johannesburg to visit some of the luxurious venues of Houghton, Sandton and Illovo before heading out to the National Parks such as Pilanesburg and Kruger for a safari experience and an evening at a lodge.

Somewhere in the middle, the conference itself would take place, however this is a very clear message that South Africa is ready for significant corporate presence and is extending more than a hand to the world’s executives in order to attempt to achieve it.

I will be in Johannesburg in November and will be certainly conducting more research in the area as to the viability for our industry.

Thursday: WOW, never again.

Incensed or filled with apathy? I had to spend a couple of minutes working out which response was appropriate when I learned this Thursday that incompetent budget airline WOW has just signed a three-year agreement with L3 Commercial Training Solutions (L3 CTS) for recurrent training across the airline’s A320 and A330 fleets. According to the Icelandic company, the agreement will cover the majority of WOW air’s training requirements by providing simulator services, type rating and Cross Crew Qualification (CCQ) training.

The L3 London Training Centre, the new headquarters for L3 CTS, is due to open in late 2018. It will be equipped with eight RealitySeven Full Flight Simulators, fixed-based simulators, briefing rooms and classrooms.

That is all very well, but once qualified, who will these pilots be flying if the aircraft are empty?

WOW had an interesting mantra when it first went into service, in that it would fly passengers on an (admittedly very small) Airbus A320 from certain destinations in Europe to Chicago O’Hare airport.

Indeed, a small A320 is a strange choice for a trans-Atlantic flight, however one of the bizzarre attractions of WOW is that it would leave, for example, London’s Heathrow or Dublin’s Shannon airport, land at Reykyavik, where there would be a requirement for passengers to transfer to another, identical A320 before proceeding to Chicago. Thus, it consists of two five hour flights, which are similar to an A320 flying from London to Tel Aviv.

The appeal is the unusual route, via Reykyavik, a small city in the frozen depths of the north, however judging by my own experiences earlier this year, and several other publicly-available forums directed at lambasting the airline, it is not one worth repeating.

WOW not only canceled my flight in February from Chicago to Dublin via Reykavik, citing a highly amusing reason – too much snow (my sides are splitting!) but they then also canceled the second flight which I had to pay for because my schedule did not fit theirs (!) and they never refunded either, and there is no method of contacting by telephone.

Judging by several forums, this is common practice at WOW, hence the customer experience and likely expression of astonishment echoes the name of the airline.

Too much snow? Imagine if Emirates, one of the world’s most respected airlines announced to passengers that it would be unable to schedule a whole week’s flights from Dubai due to too much sun, or if SWISS suddenly announced to a line of passengers in a departure lounge in Zurich, boarding passes in hand, that there are too many mountains and lakes to travel over.

This constitutes the same banality as an Icelandic airline complaining for a week about snow, and then keeping customer money. There is a phrase for telling porkies about reasons for not delivering service and then keeping client deposits in the trading business. That phrase is ‘bucket shop’.

Friday: The sun is gold, but not as Golders Green

Here I am in Golders Green, one of London’s northern inner suburbs, during my annual London-based summer. The sun is shining and it has been for several weeks, however here in London, the most that can be complained about is having to water the garden.

The rest of the world’s financial markets center is fixated on how to navigate new bureaucracy, whereas London’s executives have simply accepted it as normal and moved on. I have not even heard a word about the FCA’s plans to attempt to impose similar restrictions to those implemented by ESMA this week onto products that appear similar to CFDs, in an attempt that has been perceived by some institutional traders that I have spoken to this week as an attempt to prevent firms from hiding leverage inside CFDs and issuing them with what appears to be zero leverage, when actually the product itself contains leverage and is called, for example, something along the lines of EURUSD50.

Nobody in London that I have seen since arriving here is remotely bothered about the changes and most firms are focusing on improving their product range and increasing client experience. Even the radio advertisement breaks on London-based radio stations such as Magic or Smooth are littered with Received-Pronounciation Queen’s English tones promoting new retail investment platforms ranging from self-directed funds to single, non-bank finance services which host everything from current accounts to investment platforms in one application.

This is the way forward. Hence if we innovate, we have a great future and the regulations will be a benefit and not a bugbear.

Four hours of travel on Wizzair’s A320 with no reclining seats (come on, this is 2018!) was worth it.

The future of air travel is the same as that of electronic trading. It is not about racing the other firms and attempting to offer similar services, or promising to there faster by 0.001 millisecond which is often a promise that cannot be kept (execution on retail platforms that is dependent on a third party such as another B-book dealing desk that won’t allow any differentiation and therefore slips customers, or delays at an airport due to prioritization of flag carriers that pay extra ground fees or are sponsored by the same government as the host airport).

It is about doing something cheaper and more sustainable.

Ever since the lamentable demise of the most significant engineering achievement this century – Concorde – there has been no drive toward re-engineering an SST (SuperSonic Transport) with new technology so that it addresses Concorde’s attributes that made such an incredible engineering feat eventually non-viable financially.

Those would be to reduce the astronomical fuel costs that blighted the Rolls-Royce-SNECMA Olympus 593 engines, and increase passenger capacity from 100 to 500.

In today’s world of business travel, cost matters. Hence getting from New York to London or vice versa in 7 hours and back for $450 in an age of full internet access and conference calling via VOIP at any destination is preferable to getting there in under 3 hours and paying $10,000 for a return ticket.

There are hybrid Mach 2 aircraft in development, but no real push to build them for commercial travel, yet electric and hybrid short-distance aircraft are imminent.

That is the future – low cost, low fuel usage and a concentration on short distances whilst the long distance travel will continue to be served by Boeing’s 787 and Airbus’ A380, both of which, although very modern and up to date, are traditional aircraft and do not differ from the 1960s 747 very much at all in their basic design.

We could do well to study this and work out how to power the future of delivering financial products to a retail and corporate audience.

Wishing you all a super week ahead!