“Mind The Gap!” – The life and times of a man on the move Episode 46

A justified rant from London’s institutional sector, floating into the future, some new and important trading tools, and oneZero comes of age!

In this weekly series, I look back on what stood out, what was bemusing, amusing and interesting during my weekly travels, interesting findings within the FX industry and interaction with an ever-shrinking big wide world. This is purely observational and for your enjoyment.

Monday: Prime of prime of prime of prime… and so forth

There is and never has been any degree of ambiguity with regard to what constitutes Tier 1 liquidity, and these pages have been continually vocal in ensuring that the brokerage community has enough information with regard to how orders are managed and executed electronically that there should now be every reason why brokers should be able to have the right information to choose wisely.

This Monday, a rather unsurprising topic came up when discussing this with a colleague in London, who has been in the interbank prime brokerage business for over 30 years.

Whilst I remember this learned gentleman’s upright stature and neatly pressed white shirts as he sat at his immaculate desk at Goldman Sachs in the mid 90s whilst I carried Microsoft SDKs (remember those things called disks!?) around the campus and wheeled HP enterprise hardware in and out of hot and crowded server rooms whilst less elegantly dressed, the roles were reversed this time.

My colleague had developed a patina of rage at what has been occurring over the past year in the less well recognized regions for institutional liquidity, in this case the United Arab Emirates.

One particular firm that has been re-concentrating its efforts away from the major global financial centers and back into its Abu Dhabi heartlands has created some degree of despair among those who do their jobs diligently.

“One of hte owners of this particular firm that offers liquidity to retail brokers has a trading account in the name of his father that would trade over night on off market prices in the account’s favor so he has gone and they’re doing a clear out” is my colleagues perspective.

I iterated that brokers have to always consider that a non-genuine institutional provider that masquerades as a prime of prime liquidity distributor may on occasion put out information to their clients that they have a $100 million balance sheet or wealthy backer which is part of the criteria required to obtain increasingly difficult prime brokerage agreements with Tier 1 banks, when actually it is in many cases a wealthy relative putting money in a trading account therefore ultimately there is no prime brokerage agreement, no balance sheet and such a firm would be only able to offer a warehousing model.

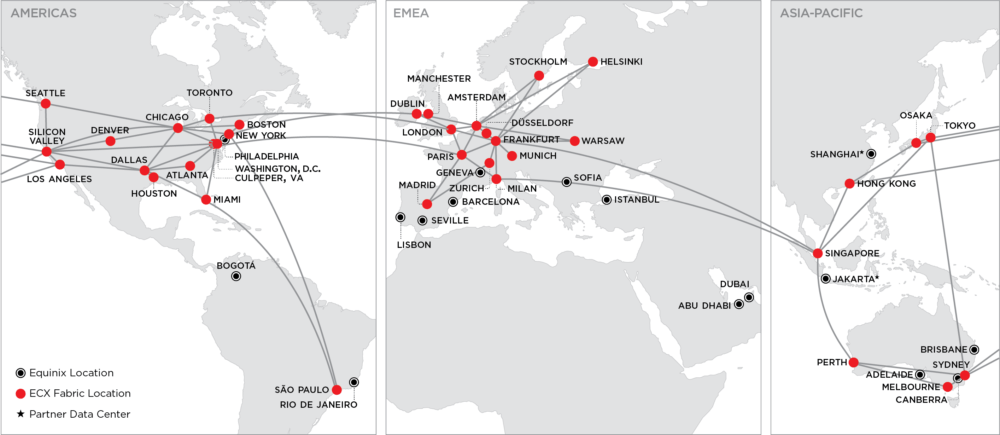

Then, consider the market connectivity of genuine prime of primes to Tier 1 banks.

Operating outside directly connected areas to Equinix datacenters is not that simple, as it would be impinged by approximately 8,000 miles of fiber optic cables which emerge from the seas in areas such as around the UK at locations such as Crooklets Beach and Sennen Cove in Cornwall, and Highbridge in Somerset.

These cables carry data not only across the UK but to its continental neighbors, and whilst the European Central Bank is correct in suggesting that the majority of Europe’s critical infrastructure for trading FX, as well as shares and derivatives, is clustered in a 30-mile radius around the City of London, and that regardless of the UK’s future, some of the industry’s biggest data center operators, which host banks and high-frequency traders’ IT equipment, have announced capacity increases this year to cope with rising demand from investors in both Asia and the US, the real reason is not just infrastructural, it is really around why that level of infrastructure exists only in Britain and not elsewhere in Europe.

Where is the Middle East?… Well……

In this case, our intrepid prime brokerage specialist in London stated a difference between that and what he witnessed this week. “In the case I saw” he said “it wasn’t his father putting money into an account, it was his father trading profitably on an account on off market rates to basically steal money from the owners. I know at least 2 people who were fired for asking questions about it.”

“As I see, the firm used to have sales people based who had companies set up in their names which would IB any of their accounts to this particular firm, get a kick back to the external company, and then pay a bribe to the client in return. I am tired of all these kickbacks that keep going round in the lower end of the institutional side of this industry, and the regulators need to stop it” he said.

Certainly there is a lot more enlightenment these days, and if previous examples are anything to use as indicators of future performance, one only has to look at the blotted copybooks of AFX whose profit sharing antics led to the demise of Galant Capital Markets, leaving many well meaning brokers to pick up the pieces of the inability to withdraw client capital from what they had been led to believe was a genuine prime of prime brokerage when actually it was far from that.

This week, some degree of moves in the right direction on that case were made but it’s better not to get into that situation in the first place. As I have always said, if it is not based in the UK, United States or Australia, then it will likely not be a genuine prime of prime brokerage.

Always ask for a clear document in writing explaining which Tier 1 prime brokers and non bank market makers or ECNs are being used to aggregate liquidity and process trades and bear in mind that there are about 5 prime of primes in the world. With this set of criteria clearly adhered to, you likely wont go far wrong.

Tuesday: Retail traders have never had it so good…

…as long as they use the right tools, data and information from good quality industry-specific software providers.

This Tuesday, I met Pavel Khizhnyak, a well known and highly committed professional whose consultative and R&D interests have been notable by their presence across three continents.

Pavel is an astute developer, and in these times during which information and data are as paramount as the way in which such information and data is automatically separated and delivered to traders, such specialism is necessary.

I will be meeting with Pavel this coming week to go through it all in detail and to be able to explain in detail how the four new systems that are being launched by the company that he founded, Tradefora, actually work, however I had a brief look.

TradeGuard, one of the interesting aspects, is designed so that traders can ensure the quality of execution that they are receiving from their broker.

It works by scoring each trade against the trade blotter to determine if it was executed within the acceptable market range, with this particular trade blotter being based on the Tradefora Composite Index (TCI), which uses

real-time pricing from 100+ brokers across 140 supported instruments in order to obtain an aggregated average market price.

This market price is used as a benchmark reference point to assess the quality of trade executionquality of execution that they receive from their broker.

During the FinanceFeeds Professional Trading Thought Leadership Conference in London on May 7, one of the most widely discussed aspects that traders consider important today is the ability to empower themselves by having accurate information at their terminals, to be able to trade well. This was raised by algo traders, system developers and institutional proprietary traders alike, and therefore the days of smaller brokerages in unrecognized regions of the world being able to warehouse trades at their own fabricated prices are thankfully long gone.

Looking closely at this, Pavel explained the new FeedGuard system which detects latencies in broker’s price feed and sends real-time alerts for a broker whenever a specified latency is detected on any of the broker instruments compared to Tradefora Composite Index. Widespread use of this type of system would avoid retail traders being slipped or intentionally tripped up by a less than reputable b booker.

I will be looking at this in full detail this week and making a full report about it alongside its developers and wholeheartedly advocate the availability of such systems.

Not only does this provide traders with vital information but it also plays a part in elevating the standard of the retail sector which is essential for sustainability.

Wednesday: When the balloon goes up

The electronic trading business is a global entity by its very nature, and therefore the vast majority of us are used to completing the equivalent of several laps of the world in one year, often on commercial airliners which are the current means of keeping the speed up and cost down.

As you know, I recently traveled to Utrecht in Holland for a conference, however I drove there from London, using the overnight ferry from Harwich. Yes, it is far more comfortable and convenient than flying, but it is a lot slower and not as cost effective.

The cost effectiveness of flights, and massive competition combined with the astronomical running cost of aircraft is an equation which will in the end seal the fate of the entire aviation business.

I am not sure who else has noticed, but this year, the lack of resources and low margins are evident in lots of delays, skeleton service, and when an incident such as the one involving the Boeing 737-8MAX aircraft that was turned round half way through its flight and dropped me off in Stockholm, placing me back where I had started 5 hours later, occurs, there is no back up.

Even just five years ago, another plane of a different model would have been waiting, luggage and passengers would be transferred and off we go.

Not these days though. With landing fees at airports at an all time high, air fares at an all time low and the environmental lobby knocking at the door of the kerosene-hungry, fuel-efficiency obsessed and expensively regulated airline industry, something has to modernize.

I actually think that we may see the reintroduction of airships.

If we had all been sitting at a table discussing how we would arrive at customer meetings or conferences ten years ago, it would have been a hedonistic talk of the new Boeing SuperSonic Transport (SST) which had been cited to travel at Mach 4 (four times the speed of sound) and carry 800 passengers.

This, however, is not the future. We can see this in other industries such as utilities and the car industry. High performance public transport with massive fuel use and expensive maintenance to get people from London to New York in 2 hours is not a priority, and in these days of smartphone apps such as Zoom, Google Hangouts and in-flight internet, it never will be.

Concorde, one of my favorite engineering masterpieces of all time and a groundbreaking milestone of the entire 20th century, was developed in the nation I grew up in, and flew overhead every day at 11.00am with majesty and poise. It carried 100 passengers from London to New York in just under three hours, at twice the speed of sound, and is as old as me!

However, it used over 25,000 liters of kerosene per hour, whereas a basic Boeing 777 which carries over 400 passengers, uses only 7,300 liters per hour.

Yes, it only does 840 km/h but so what? It has internet, beds and a ticket is $500 to New York and back, whereas on Concorde it was $15,000 over fifteen years ago which is when it was grounded for good.

At the time, I thought Concorde’s grounding was a tragedy and placed the blame on envious European political wrangling, trying to put an end to Britain’s incredible engineering superiority. Whilst that is the case in many other areas of technology, sadly it was a combination of inefficiency, cost and environmental conscience that killed it.

This Wednesday, I decided to look at how we will all be traveling in another 10 years from now, and I think we may see the return of airships.

Airships vanished from the skies in the 1930s when connotations with German use against the Allies, and some unpublished yet horrific explosions had been silenced by the non-free German press came to light after the Hindenburg disaster.

Seeing Pathe news’ late 1930s exposee of the giant Hindenburg airship – itself eight times the size of the largest airliner in the world – the 747 – combust and be totally consumed within thirty seconds due to the volatility of the reaction between the hydrogen lifting gas and the atmosphere would be enough to ensure that these gigantic floating vessels would never see use again.

Because the incident happened on American soil, freedom of press put it everywhere, and previous incidents that had been covered up in Europe were enough ammunition to put it away.. until now.

Here we are, more than 80 years later, and the environment, cost and space are major issues. There is now a modern airship, this time engineered in Britain, which I think could well be our future method of traveling for business.

It has electric fan motors for propulsion, and is filled with inert Helium gas instead of Hydrogen which ignites when compressed and combusts with the atmosphere.

The new airship, called the Airlander 10, was developed at Cardington in England by Hybrid Air Vehicles and has begun to be showcased just last month. These aircraft use both aerodynamics and lighter-than-air (LTA) technology to generate lift, potentially allowing the vehicle to stay aloft for several weeks.

There is a luxury interior that can carry several hundred passengers, accommodate a restaurant, a lounge and hotel style cabins, and the noise and fuel usage are absolute zero.

This would allow short runways, avoiding any NIMBY orientated grumblings at airport runway extensions, and would allow airports to be closer into cities.

Yes, it is slower than a conventional plane, however wouldn’t you rather travel overnight in comfort and silence, whilst using no fuel, knowing that airlines and operators are not squeezed to the point of skimping maintenance, or have a room with a desk in which a whole day’s work can be done? I would. Roll on the balloon revolution.

Friday: Happy birthday oneZero!

oneZero Financial Systems, one of the FX industry’s most recognized trading system integration and software companies has reached an important milestone, that being its tenth anniversary since establishment.

A highly consistent entity, oneZero was established in Cambridge, Massachusetts by astute computer scientist Andrew Ralich, and has grown tremendously over recent years with Mr Ralich still well and truly ensconced in his leadership of the company.

On Friday, I spoke to the company about the firm’s achievements over ten years, and what direction we will see over the coming years, which is always well worth documenting when analyzed by a sector of this industry which innovates and develops the exact technology that will power the electronic financial markets into the future.

I will be at oneZero this coming week, and will report in full. Meanwhile congratulations to Andrew and his devoted team.

Wishing you all a super week ahead!