Mizuho’s J-Coin Pay app adds participating financial institutions

In total, 57 financial institutions now allow linking accounts to J-Coin Pay.

QR code-based smartphone payment service app J-Coin Pay continues to gain wider adoption. The app, which was launched by Mizuho Bank, a subsidiary of Mizuho Financial Group, Inc (TYO:8411), in March this year, has gotten seven more partners, Mizuho announces.

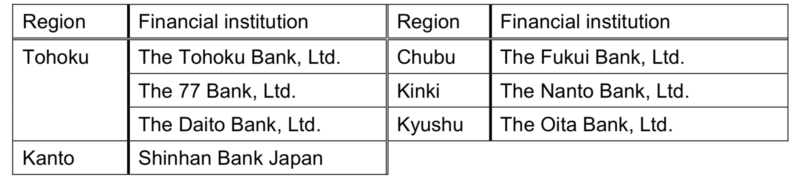

Beginning today, customers can also link accounts from 7 more financial institutions, listed below.

In total, 57 financial institutions now allow for linking accounts to J-Coin Pay. In May this year, Mizuho announced that 10 institutions were added to the list of businesses which allow linking accounts to J–Coin Pay.

J-Coin Pay allows customers to make payments, send and receive transfers, and perform other financial transactions all on their smartphones. Customers are also able to use the smartphone app to move funds between their J-Coin Pay accounts and their deposit accounts at their financial institutions for free, anytime and anywhere.

The features of the app include:

- Moving funds: move funds between J–Coin Pay and your deposit accounts. Move money to and from your registered deposit accounts anytime, anywhere, for free.

- Making transfers: sending and receiving money. Send and receive money with friends and family anytime, anywhere, with a phone number or QR code.

- Paying at stores: Pay with just a smartphone at both large retailers and small regional shops.