Monex declares year-end dividend of 2.70 yen per share

The brokerage declared dividend per share of 2.70 yen, resulting in total dividends of 717 million yen.

Online trading services provider Monex Group, Inc. (TYO:8698) has earlier today published a notice of its year-end dividend for the fiscal year ending March 31, 2019.

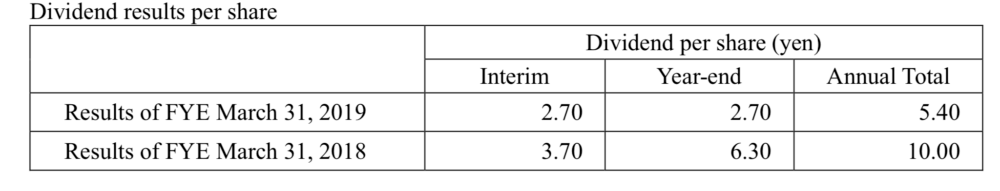

The brokerage declared dividend per share of 2.70 yen, resulting in total dividends of 717 million yen. This is markedly down from 6.30 yen per share (or a total of 1,695 million yen) distributed a year earlier.

The Company has calculated the year-end dividends for its full year to March 31, 2019 in consideration of share buyback and interim dividend during this fiscal year, with a target of a 75% total return ratio as a percentage of net income attributable to owners of the company on a multi-year basis. The lower limit of the dividend is an annual 2% DOE (dividend on equity). As a result, the total return ratio of this fiscal year is 291%.

Total return ratio = (total dividends paid + total amount of share buyback) /net income attributable to owners of the Company

In April this year, Monex published its financial results for FY19. In Japan, low trading volumes in equity market caused a decrease in revenue. The profit of the Japanese segment was ¥ 1.2 billion.

The brokerage also noted that ¥1.8 billion of impairment loss on fixed assets related to Japanese Equities trading tool “TradeStation” was recorded, which resulted in ¥ 1.7 billion of net loss due to reevaluation of book value based on the actual performance, while the service continues to be provided. The impairment and the revision of future amortization for other fixed assets will result in a decrease in depreciation and amortization cost in FYE Mar. 2020 by ¥ 1.6 billion per year.

In the United States, the net financial income increased due to a hike in interest rate and brokerage commissions increase driven by higher trading volume. Segment profit was ¥ 2 billion, at record high.

The Asia Pacific business saw revenue drop due to a decline in trading volume in Hong Kong market. The segment incurred a loss of ¥ 50 million.

Monex’s cryptoasset business saw unfavorable market trading volume. An increase in expense to strengthen internal control led to a segment loss of ¥1.7 billion.