Monex to offer equity trading services for young traders via ferci app

The app is designed to provide the younger generation with a new choice for asset formation.

Monex Inc, a part of Monex Group, Inc. (TYO:8698), today announces expansion to its offering for young traders, as the brokerage begins offering equity trading services via its smartphone app ferci. The launch is scheduled for 5:00 p.m. on December 26, 2019.

The smartphone app, as its name suggests, aims to provide younger generation with a new choice for asset formation, as younger people in Japan face future financial risks living in a super-aging society and have to deal with issues related to the pension system.

Monex has been offering the app ferci since June 2019 to give younger traders, who consider smartphones an integral part of their daily lives, friendly access to the investment community.

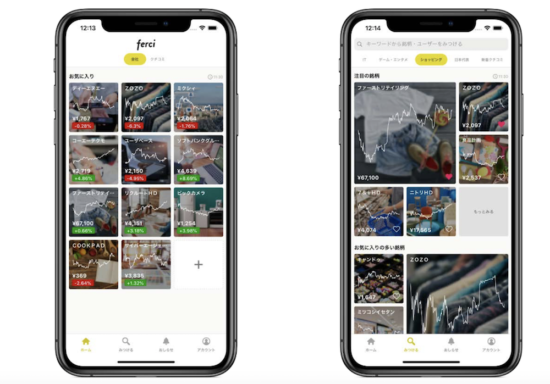

As part of the upgrade and in response to requests from a number of customers, ferci will have an equity trading function. The app’s simple user interface is designed to enable even those new to investing an easy way to buy and sell Japanese equities, including ETFs and REIT.

The app allows young traders to conduct everything on their smartphones from opening general accounts at Monex to depositing and trading equities. Users can deposit and trade all Japanese stocks available through Monex.

In addition, a community (social networking) function that allows traders to interact with each other makes it easier for beginner traders to start investing by referencing more experienced traders.

Monex will continue to upgrade the features and usability of ferci as the company receives feedback from individual traders.

Recently, the brokerage has been seeking to improve trading conditions. In November, for instance, Monex Inc said it would expand eligibility of Margin Trading Support Program and would extend the period of free equity trading on “TradeStation”, a Japanese equity trading tool for active traders. “TradeStation” will now have two frequencies, daily and monthly, for determining the eligibility of the program, as opposed to the single weekly basis up to present. Customers who meet one of the conditions are eligible for cash equity trading and margin trading free of charge for up to three months. Monex will also relax some of the other conditions.

Let’s recall that, in July 2019, Monex lowered the minimum fee for U.S. equities trading to US$0 (free of charge) for trades that are executed from Monday, July 22, 2019. The company explained that the change will enable its customers to benefit from its unique U.S. equities trading services with lower cost.