Monex seeks APAC expansion, Australian online securities business launch scheduled for FY2018

The launch of Monex’s Australian online securities business operations is scheduled for the first half of the year to March 31, 2018.

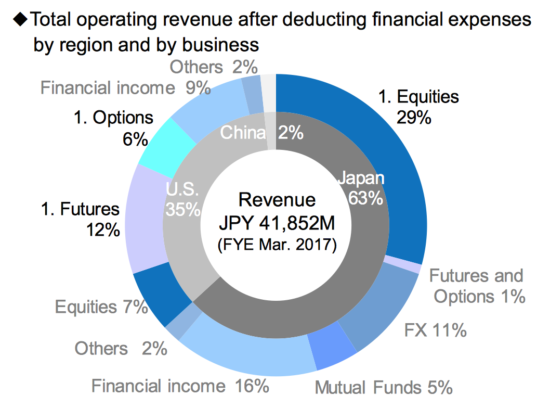

Monex Group, Inc. (TYO:8698), the online trading services provider with key operations in Japan, the US and Hong Kong, has earlier today provided more details on its financial performance during the year to March 31, 2017, with FinanceFeeds being interested in the business strategy of the group.

Unlike its previous report, which underlined Monex’s efforts to expand its customer base in Japan, the FY2017 report stressed the group’s plans to build further its Asia-Pacific business segment.

Currently, Monex’s APAC business involves Monex BOOM Group Online (based in Hong Kong), Monex’s representative office in Beijing, Cherry Technology Co., Ltd (which provides technical support in China), as well as Monex Securities Australia Pty Ltd.

The report for the fiscal year to the end of March 2017 outlined Monex’s plans to grow its B2B business in China. Marketing activities there will enjoy a boost in order to increase the number of B2B customers. Monex adds that negotiations are currently in progress with additional prospective brokers.

Monex has presented some ambitious plans for the Australian market too, with the launch online securities business operations by Monex Securities Australia Pty Ltd scheduled for the first half of full year to March 31, 2018.

As per ASIC Connect, Monex Securities Australia Pty Ltd has an Australian Financial Services License #363972. The License authorization conditions as of March 2014, permit the company to: provide general financial product advice for derivatives, Forex, and securities; deal in a financial products (including FX and derivatives); make a market for Forex and derivatives to retail and wholesale clients.

Australia is crucial market for the Forex industry, as underscored by the success of the FinanceFeeds Sydney Cup. Leading online trading companies, like CMC Markets, are seeking to further build their presence and expand their product offering and client base in Australia.

Back to Monex, let’s mention that its Asia-Pacific business saw a rise in trading volumes in the January-March 2017 quarter but that could not offset the weak trading activity during the rest of the year and for the full year, the segment recorded a loss as a result of decreased volumes.