Morgan Stanley sees best use for Blockchain in securities rather than payments

“Global Insight: Blockchain in Banking: Disruptive Threat or Tool?”, published by Morgan Stanley to share its thoughts on distributed ledger technology and its place in the world, is a paper that suggests several misconceptions and identifies 10 hurdles to overcome to make blockchain a reality in banking. “The opportunity is clear but the blue sky […]

“Global Insight: Blockchain in Banking: Disruptive Threat or Tool?”, published by Morgan Stanley to share its thoughts on distributed ledger technology and its place in the world, is a paper that suggests several misconceptions and identifies 10 hurdles to overcome to make blockchain a reality in banking. “The opportunity is clear but the blue sky is too far off to impact our 2017/2018e.

The higher efficiencies that DLT bring won’t just change the Financial Services’ IT architecture, but also might change accessible profit pools, depending on how quickly incumbents move, and that explains early experimentations of Linux Hyperledger and R3 sponsored by JPM, BK and STT. Banks and custodians have a clear advantage as policymakers are unwilling to allow ‘unpermissioned’ DLTs, but the market doesn’t seem aware of that.

DLTs, however, could also pose a risk to them as well: “For custodians such as BNY Mellon, State Street, Northern Trust, Citi, JPM, which generate profits from ensuring securities are accurately measured and moved and which benefit from the carry fromT+2/3, blockchain technology threatens their value add and shorter settlement periods could cut into revenues more than they could free up capital for buybacks – but that’s why the custodians are at the leading edge of distributed ledger work to ensure that they can deliver the most efficient blockchain solutions to their clients”.

Morgan Stanley argues both bullish and bearish cases. The first being the reduction in post-trade activity costs, especially in investment banks, with potential savings between $15 billion and $20 billion a year for the banking industry. Savings from current utility-like structures is potentially one of the most compelling reasons, among speed and transparency, to develop the technology: “And we’re not talking five, ten, 15% cuts in costs. We’re talking 30/40/50% and there’s only one way to do that and that is to share a mutualized common infrastructure that previously was kept separately and run independently by every market participant.”, said Blythe Masters, CEO at Digital Asset Holdings, LLC.

However, higher IT spend at the same time as dramatic reduction in margins is destabilizing and disruptive, also risking profit pools leaking to other players.

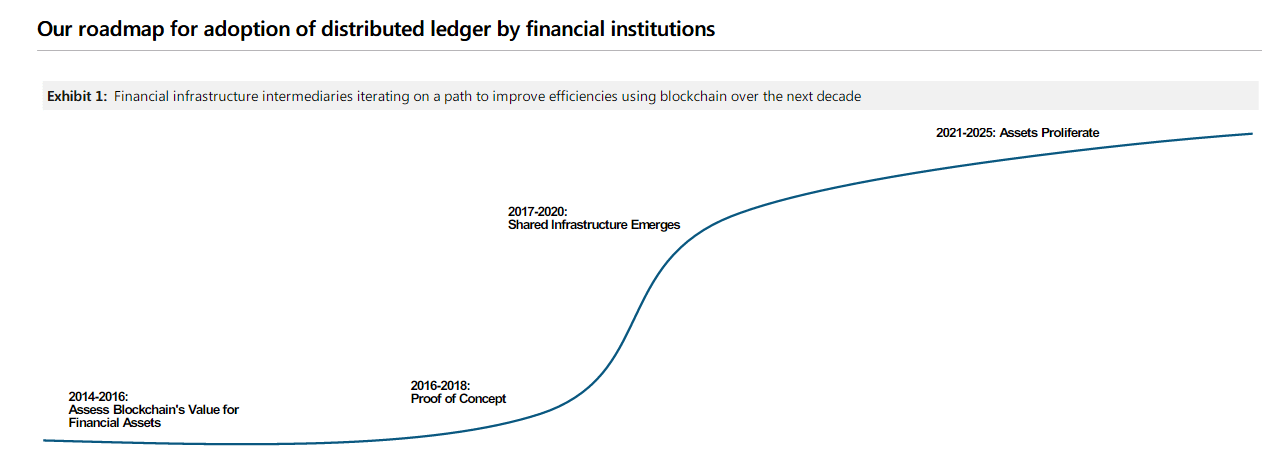

According to the opinion of Morgan Stanley’s report authors headed by Huw Van Steenis, shared utilities are likely to have a bigger impact on bank earnings in 2017-2019 than blockchain implementation. But DLTs’ post-trade effiencies, particularly with loans, CDS and securities in general, should be the best use for the technology, rather than payments: “Financial institutions are required to allow regulators to review transactions. Financial institutions have to ensure that all the customers on their platform are reviewed under the know your customer (KYC) and anti-money laundering (AML) guidelines, which a permissionless blockchain like Bitcoin would not allow. That said, there could be some payments mechanisms between trusted, authenticated parties, in particular cross-border, which seems inefficient today”, said the report.