MtGox’s trustee establishes Trust with SMBC to protect interests of bankruptcy creditors

The trust assets exceed JPY 15.8 billion as of the date of its establishment.

Nobuaki Kobayashi, the civil rehabilitation and bankruptcy trustee of ill-fated Bitcoin exchange MtGox, has earlier today announced a set of measures aiming to secure the interests of bankruptcy creditors.

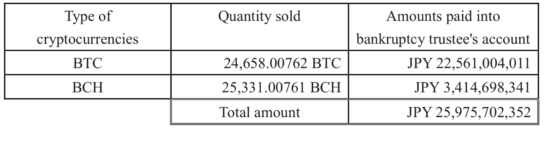

The bankruptcy trustee said he had sold a certain amount of bitcoin (BTC) and bitcoin cash (BCH) that belonged to the bankruptcy estate, during the period from the 10th creditors’ meeting in the Bankruptcy Proceedings (it took place on March 7, 2018) to the commencement of Civil Rehabilitation Proceedings, and secured a certain amount of money for the bankruptcy estate.

As a result of the Sale, the balance in the bankrupt trustee’s account reached approximately JPY 70,059 million.

In addition, the bankruptcy trustee created a trust by entering into an agreement with Sumitomo Mitsui Banking Corporation (SMBC) as a measure to secure interests expected to have already been obtained by the monetary creditors who filed proofs of bankruptcy claims in the Bankruptcy Proceedings. SMBC will act as a trustee of the Trust.

The Trust assets amount to JPY 15,894,530,915 as of the date of its establishment.

The agreement was entered into after the bankruptcy trustee determined that it is necessary and appropriate to establish a trust for the principal and delay damages of the monetary claims filed in the Bankruptcy Proceedings, the total amount of which is about JPY 17,864,000,000, with the Trust Assets being a suitable amount of money for the interests creditors were expected to have obtained in the Bankruptcy Proceedings. Also, such an agreement provides, among other things, guarantees for obligations regarding the monetary claims for which proofs of bankruptcy claims have been filed, which are only paid out of the Trust Assets.

There is about a month left for submitting proofs of rehabilitation claim to MtGox’s trustee, and the tensions among clients of the ill-fated Bitcoin exchange are on the rise. Some of them – those who have chosen the offline method to file their rehabilitation claims rather than the online method, are now worried that they may be put at disadvantage over the other claimants. Last week, the Q&A section on MtGox’s website was updated, with the trustee providing more explanations about procedural specificities, and stressing that the Office of the Rehabilitation Trustee in the Civil Rehabilitation Proceedings is receiving a large volume of proofs of rehabilitation claim forms, and it will take some time to process the paperwork.