The multi-asset rally is on! Share trading goes wild

54% of retail investors think big technology stocks such as Facebook, Tesla and Amazon currently represent some of the most exciting investment opportunities available

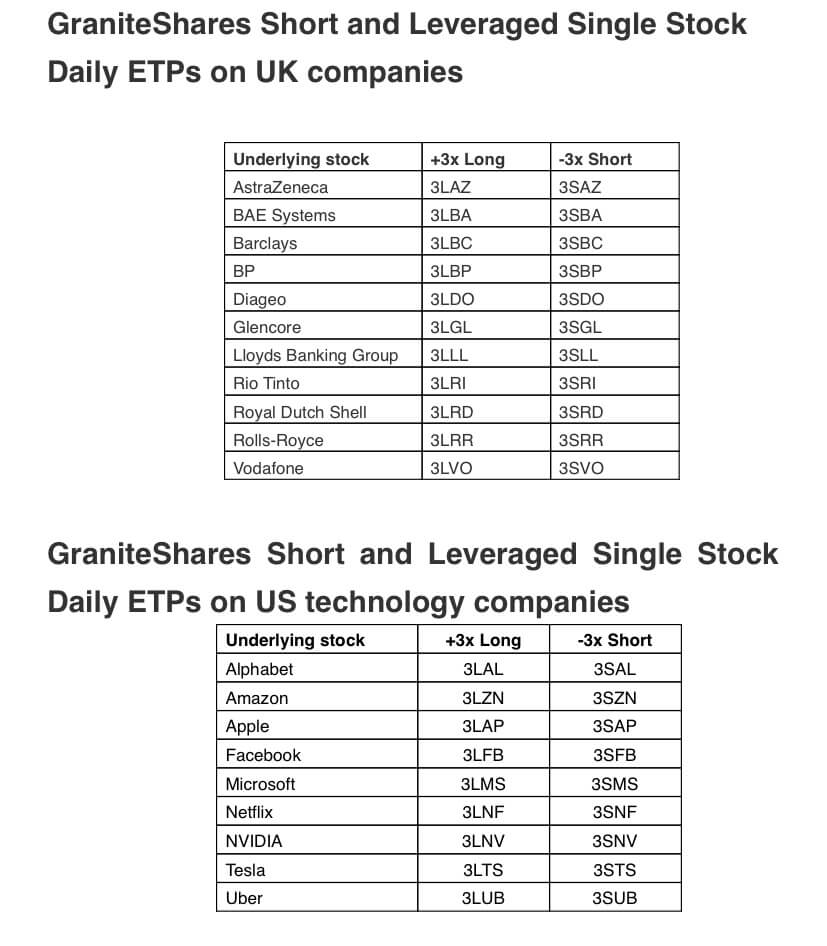

New research from ETF provider GraniteShares, which offers a range of 3x short and 3x leveraged ETPs on popular UK and US stocks, reveals that some 12.7% of the UK adult population has bought or sold shares since the Coronavirus crisis started, and 37% of these people expect to increase their level of activity here over the next six months. Just 16% expect it to fall.

A key reason for this planned increase in trading of shares is because 54% of retail investors think big technology stocks such as Facebook, Tesla and Amazon currently represent some of the most exciting investment opportunities available. Only 19% disagree with this view.

Similarly, 56% of retail investors believe you can find good investment opportunities in the FTSE 100, compared to 21% who disagree with this view.

However, worryingly, 10% of people who have bought shares since the pandemic started said they have used benefits such as unemployment payments and universal credit to do this, which might help explain why 26% have not told their partners about the amount of money they have invested.

When it comes to buying shares, 14% said it is essential that there are lots of analyst reports, media and market commentary on the stocks they are considering, and 56% said it is quite important to have access to these.

The findings also reveal that retail investors are becoming more confident in the strategies they consider for investing in shares. When asked about investment products that enable them to magnify returns through the use of leverage, with a view to profiting from either rising or falling prices 29% who have traded shares in the past six months said they would consider using them.

Will Rhind, Founder and CEO of GraniteShares, said: “There is little doubt that the Coronavirus crisis has helped fuel a significant uplift in share trading activity. Thanks to the internet and technology providing better access to company information and market data, many investors clearly feel that the current volatile environment, has created attractive opportunities to buy stocks, and, for sophisticated investors, also the possibility to short stocks in sectors, such as aerospace, hospitality and traditional retail, that are under particular pressure as a result of the pandemic. At GraniteShares, we have seen sophisticated investors use short and leveraged single stock ETPs to trade the volatility and also take exposure to some of new economy stocks such as Amazon and Microsoft that have seen significant growth in demand for their services.

“While investors appear broadly positive on the outlook, the imminent U.S. presidential election, rising cases of coronavirus across Europe and the uncertainty around the future UK-EU relationship are among many factors that suggest the coming months could see a rise in volatility in markets.

GraniteShares Short and Leveraged Single Stock Daily ETPs on UK companies