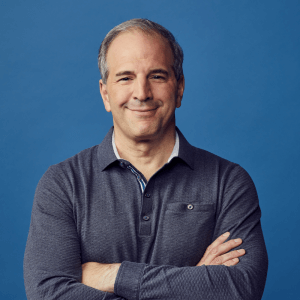

MX appoints ex-PayPal Jim Magats as CEO

“Financial data is the lifeblood of a connected economy, and nobody helps organizations access and act on financial data better than MX.”

MX has announced the appointment of Jim Magats as Chief Executive Officer, joining the fintech from Paypal, where he was most recently Senior Vice President for Omni Payments Solutions.

Jim Magats, who also joins the MX Board of Directors, spent 18 years as a senior executive at PayPal Inc., helping spearhead the firm’s transformation into one of the most valuable and innovative fintech companies in the world.

He was a member of PayPal’s 12-person Operating Group charged with ensuring that the organization met its strategic and financial targets.

Magats oversaw Paypal’s open banking strategy and solutions

As Senior Vice President for Omni Payments Solutions he oversaw PayPal’s open banking strategy and solutions, as well as a partnership network of more than 150 financial institutions and networks.

Jim Magatsfirst joined PayPal in 2004 and, while based in Europe, he partnered with regulators on the creation of the Payment Services Directive 2 (PSD2) banking standards for banks and fintechs. Then, he helped build open, secure API capabilities.

Most recently, his scope included leading the product and technology teams responsible for PayPal’s merchant-facing products, including Braintree and Zettle, as well as the payment platforms that power PayPal Check Out and Venmo, processing over $1.2 trillion per year.

Jim Magats’s new challenge at MX

Ryan Caldwell, Founder and Executive Chairman of the Board of Directors at MX, said: “Jim Magats brings a wealth of experience and knowledge about how to deliver high-impact financial solutions and products for consumers, merchants, and financial organizations, along with a vast network of partners and customers at the world’s leading financial institutions and fintechs. We have tremendous confidence in Jim’s ability to lead the organization through the next phase of our growth in establishing our leadership in the open finance economy, helping organizations of all sizes access and act on financial data to improve customer outcomes and grow their businesses.”

Jim Magats, Chief Executive Officer at MX, said: “Financial data is the lifeblood of a connected economy, and nobody helps organizations access and act on financial data better than MX. Our opportunity to make financial data accessible and actionable is global, extends across verticals, and has the potential to make a positive difference in the lives of billions of people. After 18 amazing years at PayPal, I’m incredibly excited to join MX, a company on a mission to build the open finance economy and empower the world to be financially strong. We are going to deepen and extend our partnerships with financial institutions and fintechs to fuel the next wave of innovation while fostering greater participation in the global economy through new products, use cases, and services.”