NAGA Group deepens loss as crypto winter bites

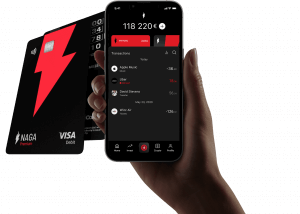

NAGA Group, a provider of brokerage services, cryptocurrency platform NAGAX and neo-banking app NAGA Pay, announced the financial results the first half of 2022 ending 30 June 2022.

Looking at the figures, NAGA Group reported strong revenues, significant user growth, but it deepened its net loss due to increased marketing and advertising expenses and the devaluation of crypto assets.

The group’s brokerage business revenue was reported at €35 million, up 51 percent from €23.2 million in the year earlier. In terms of its bottom-line metrics, the H1 EBITDA was -€2.7 million compared to €0.2 million in 2021.

In its latest annual report, the publicly traded fintech attributed the bulk of its solid performance to the copy-trading activity. In particular, NAGA saw over 4.8 million trades copied in the first quarter via its Auto Copy tool, that is almost tripling relative to the 1.7 million trades copied in 2020.

In terms of its trading volumes, the company reported a record €250 billion, up 107 percent from €121 billion in 2020. NAGA, which offers investment in stocks and crypto via its mobile app, reports that its trading platform onboarded over 277,000 new accounts in 2021, a 128% increase compared to last year.

NAGAX continues its product rollout

NAGAX unveiled earlier this year a $100,000 creator fund to foster non-fungible token (NFT) development on its upcoming NFT marketplace while deepening its ecosystem.

NAGAX asserts the future will be tokenized and it doesn’t intend on missing out on the NFT frenzy that has dominated crypto space over the last two years. It has the ambition of becoming a “premier platform” for NFT creation, minting, and management with zero fees.

NAGAX consists of a futures and derivatives exchange, crypto wallet, an inbuilt NFT platform, a staking platform, and a spot exchange with around 700 tradable assets. The platform also aims to offer a unique Web3 social trading experience, whereby user-generated content on the platform is converted into NFTs that can be monetized.

NAGAX provides clients with quick access to NAGA native coin, the NAGA Coin. The exchange is also connected to its parent’s financial community and social investing network, bringing together more than half a million traders from all over the globe. The network is a digital space for newcomers and skilled traders to share their experiences, discuss focal issues and market conditions via personal, group, or public chats.