NAGA Group in talks over merger with global broker

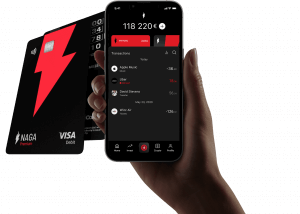

NAGA Group, a provider of brokerage services, cryptocurrency platform and neo-banking app, said it’s discussing a possible merger with an international brokerage firm.

The announcement suggests the two companies are hopeful of striking a deal by the end of the year, pending regulatory approval. Naga said it will maintain its current listing status following the consummation of any such transaction.

“The Naga Group AG is in discussions to pursue a potential strategic transaction with a multi-country brokerage firm, potentially in the form of a merger of the two companies. The transaction is subject to due diligence and is expected to be finalised subject to customary conditions precedent and regulatory approvals, and to close in Q4 2023,” the statement reads.

NAGA Group reported strong revenues, significant user growth in 2022, but it deepened its operational loss due to increased marketing and advertising expenses and the devaluation of crypto assets.

The group’s brokerage business revenue was reported at €35 million for the first half, up 51 percent from €23.2 million in the year earlier. In terms of its bottom-line metrics, the H1 EBITDA was -€2.7 million compared to €0.2 million in 2021.

In its latest annual report, the publicly traded fintech attributed the bulk of its solid performance to the copy-trading activity. In particular, NAGA saw over 4.8 million trades copied in the first quarter via its Auto Copy tool, that is almost tripling relative to the 1.7 million trades copied in 2021.

In terms of its trading volumes, the company reported a record €250 billion, up 107 percent from €121 billion in 2020. NAGA, which offers investment in stocks and crypto via its mobile app, reports that its trading platform onboarded over 277,000 new accounts in 2021, a 128% increase compared to last year.

NAGAX unveiled earlier this year a $100,000 creator fund to foster non-fungible token (NFT) development on its upcoming NFT marketplace while deepening its ecosystem.

NAGAX consists of a futures and derivatives exchange, crypto wallet, an inbuilt NFT platform, a staking platform, and a spot exchange with around 700 tradable assets. The platform also aims to offer a unique Web3 social trading experience, whereby user-generated content on the platform is converted into NFTs that can be monetized.