NAGA obtains Seychelles license, launches crypto business in Brazil

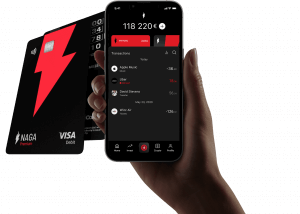

NAGA Group, a provider of brokerage services, cryptocurrency platform NAGAX and neo-banking app NAGA Pay, has received a financial license from the Seychelles regulator to accelerate its global business.

The company said the move reflects its commitment to continue on the trajectory of expansion and growth, and that the decision to acquire an FSA license comes in an effort to ensure even broader regulatory supervision in new markets.

NAGA has been operating under entities regulated by different financial supervisory authorities, including Germany’s Federal Financial Supervisory Authority (BaFin). In addition, the company is focused on expanding its regulatory map, having recently secured an Estonian crypto license for NAGAX. Further, two more crypto asset service provider licenses are in flight and expected to be granted in 2022, the company said.

“The Seychelles license provides a fully regulated environment for our business outside of Europe, will allow us to strengthen banking and payment relationships and unlock relevance for our B2B segment. In addition, customers are better protected. We have been working for several months on this license and are happy to have it operational in Q4,” says Benjamin Bilski, Founder and CEO of NAGA.

Meanwhile, NAGAX revealed that it has partnered with Guide Investimentos, one of the largest digital asset management platforms in Brazil. The collaboration aims to launch a joint venture to offer a cryptocurrency trading platform in Brazil using NAGAX’s capabilities for cryptocurrency spot and staking.

Earlier in July, NAGA appointed FX industry veteran Stelios Eleftheriou , who has a colorful career across the gaming industry, to head its cryptocurrency platform NAGAX and neo-banking app NAGA Pay.

“The Brazilian market for digital products is growing rapidly. Crypto is one of the fastest growing segments in the Brazilian online market. Guide is already established in Brazil and processes billions in trading volume from its brokerage business. NAGAX offers a strong crypto ecosystem for Guide and will enable Guide customers to gain immediate access to crypto services. Especially in the current market conditions, we are preparing for the next wave of cryptocurrency adoption, so we are very excited about this partnership,” the company said.

The Germany-based broker launched its brand-new social trading platform focused on cryptocurrencies back in March. NAGAX consists of a futures and derivatives exchange, crypto wallet, an inbuilt NFT platform, a staking platform, and a spot exchange with around 700 tradable assets. The platform also offers a unique Web3 social trading experience, whereby user-generated content on the platform is converted into NFTs that can be monetized.

NAGAX provides clients with quick access to NAGA native coin, the NAGA Coin. The exchange is also connected to its parent’s financial community and social investing network, bringing together more than half a million traders from all over the globe. The network is a digital space for newcomers and skilled traders to share their experiences, discuss focal issues and market conditions via personal, group, or public chats.